US Undiscovered Gems To Watch In August 2025

As the U.S. market navigates through a flurry of earnings reports and tariff news, major indices like the Dow Jones and S&P 500 are experiencing volatility, reflecting investor concerns about economic health and trade policies. In such a dynamic environment, identifying promising small-cap stocks can be crucial for investors seeking growth opportunities amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Preformed Line Products | 7.86% | 6.57% | 8.22% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Click here to see the full list of 293 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Underneath we present a selection of stocks filtered out by our screen.

Citizens Financial Services (CZFS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Citizens Financial Services, Inc. is a bank holding company that offers a range of banking products and services to individual, business, governmental, and institutional customers with a market capitalization of $257.61 million.

Operations: Citizens Financial Services generates revenue primarily through its community banking segment, contributing $103.86 million. The company's market capitalization stands at approximately $257.61 million.

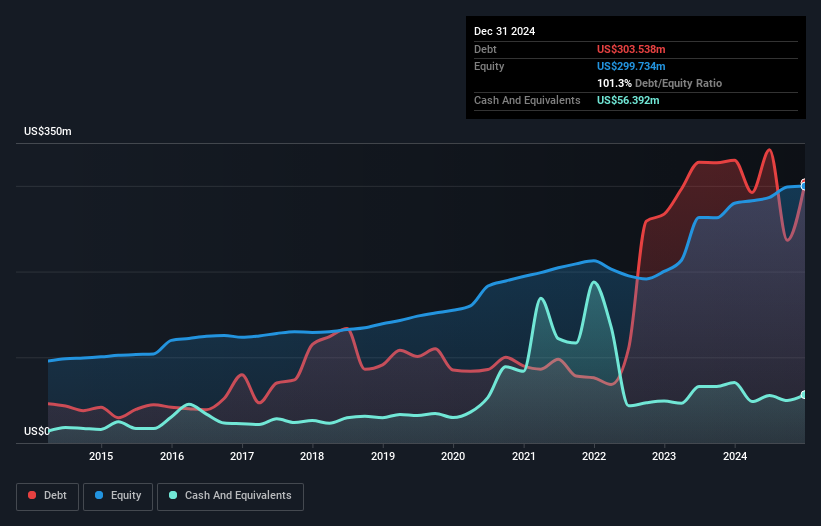

Citizens Financial Services, with total assets of US$3.0 billion and equity at US$313.7 million, shows a promising profile in the banking sector. Total deposits stand at US$2.3 billion, supporting its primarily low-risk funding strategy, while loans amount to US$2.2 billion with an appropriate 1.1% bad loan ratio. The bank's earnings growth of 15.4% over the past year outpaces the industry average of 11.5%, highlighting its strong performance relative to peers and trading at a significant discount to estimated fair value by 36%. Recent buybacks include repurchasing shares worth $0.06 million this year, adding value for shareholders.

- Delve into the full analysis health report here for a deeper understanding of Citizens Financial Services.

Learn about Citizens Financial Services' historical performance.

West Bancorporation (WTBA)

Simply Wall St Value Rating: ★★★★★★

Overview: West Bancorporation, Inc. is a financial holding company that offers community banking and trust services to individuals and small- to medium-sized businesses in the United States, with a market capitalization of $310.86 million.

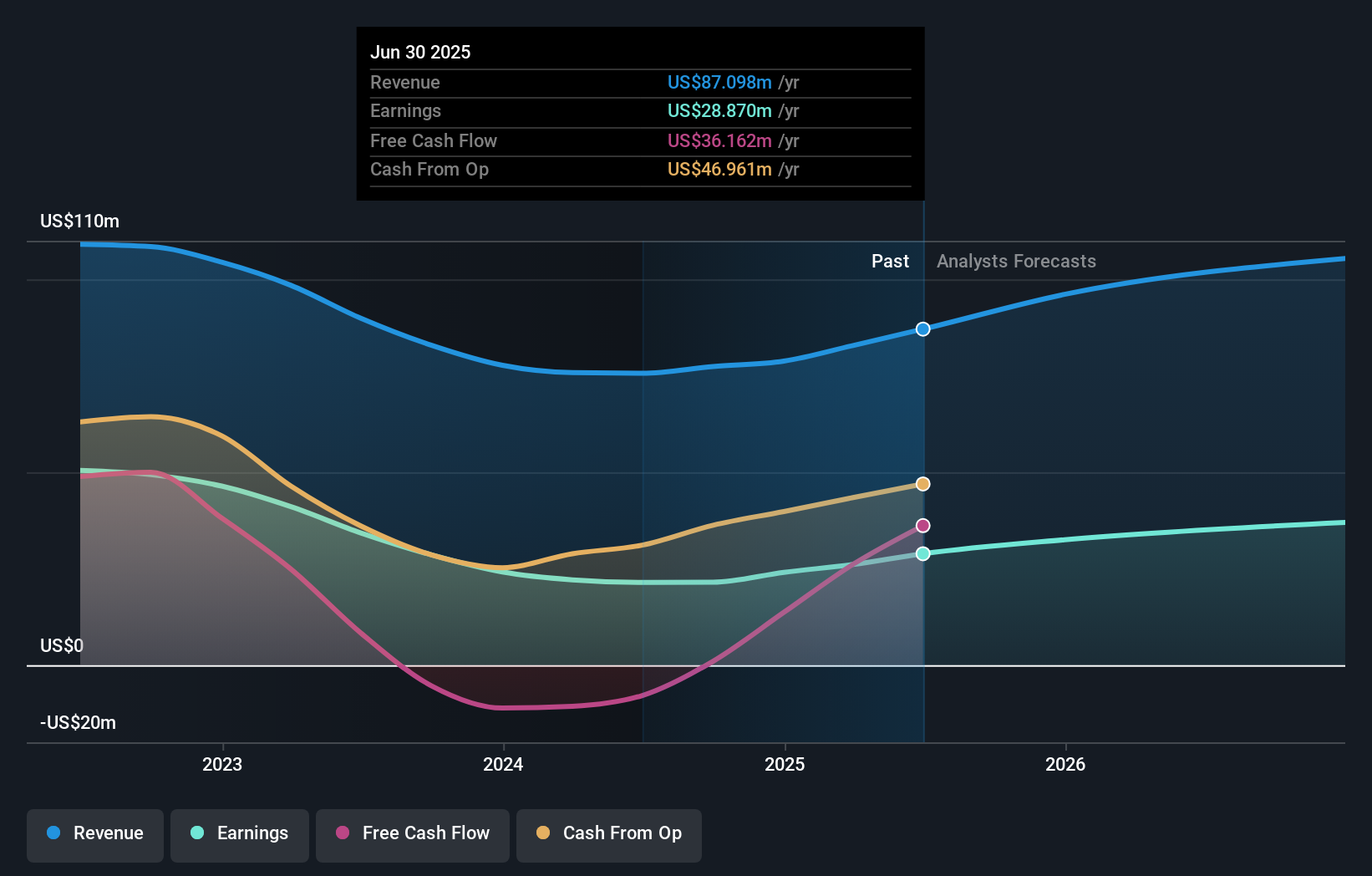

Operations: West Bancorporation generates revenue primarily from its community banking segment, which accounts for $87.10 million. The company has a market capitalization of $310.86 million.

West Bancorporation is making strides with its strategic Midwest expansion and digital banking investments, aiming to enhance client acquisition and operational efficiency. With total assets of US$4.1 billion and equity at US$240.9 million, the bank's financial health seems solid. Total deposits stand at US$3.4 billion against loans of US$2.9 billion, supported by a net interest margin of 1.9%. The allowance for bad loans is robust at 0.01% of total loans, indicating prudent risk management practices that align with its high-quality earnings history and low-risk funding structure dominated by customer deposits (89%).

- West Bancorporation's strategic expansion and digital investments drive growth and profitability. Click here to explore the full narrative on West Bancorporation's investment thesis.

Flotek Industries (FTK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flotek Industries, Inc. is a technology-driven green chemistry and data company serving industrial and commercial markets globally, with a market cap of $347.26 million.

Operations: Flotek Industries generates revenue primarily through its Chemistry Technologies segment, which accounts for $192.20 million, and its Data Analytics segment contributing $9.81 million.

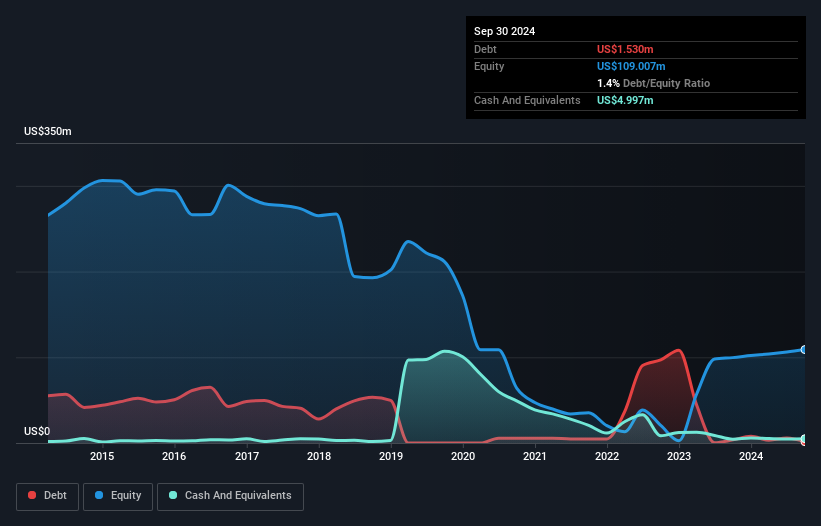

Flotek Industries, a nimble player in the chemicals sector, has shown impressive earnings growth of 190% over the past year, outpacing its industry peers. Trading at 68% below estimated fair value, it seems undervalued despite its solid financial footing with more cash than total debt and high-quality earnings. The company's EBIT covers interest payments 14.8 times over, indicating strong financial health. Recent additions to multiple Russell indices highlight its growing market presence. However, volatility in share price and reliance on international markets introduce risks that investors should weigh against potential rewards from forecasted revenue growth of 10% annually through 2028.

- Flotek Industries' growth is driven by its expanding international chemistry business and innovative technologies in Saudi Arabia. Click here to explore the full narrative on Flotek Industries.

Seize The Opportunity

- Embark on your investment journey to our 293 US Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10