Asian Penny Stocks To Watch In August 2025

As global markets navigate a challenging landscape marked by trade tensions and economic uncertainties, the Asian market remains a focal point for investors seeking opportunities. Penny stocks, often seen as relics of past trading eras, continue to captivate interest due to their potential for growth when backed by strong financials. These smaller or newer companies offer a unique blend of affordability and potential returns, making them intriguing prospects for those looking to uncover hidden value in quality investments.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.20 | THB4.15B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.44 | HK$908.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.12 | HK$3.66B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.42 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.54 | SGD218.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.84 | SGD11.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB1.01 | THB1.49B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.88 | THB9.86B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.63 | SGD995.89M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 980 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Fenbi (SEHK:2469)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fenbi Ltd. is an investment holding company that offers non-formal vocational education and training services in the People's Republic of China, with a market cap of HK$7.77 billion.

Operations: The company's revenue is primarily generated from tutoring services at CN¥2.34 billion and sales of books totaling CN¥600.78 million.

Market Cap: HK$7.77B

Fenbi Ltd., a company with a market cap of HK$7.77 billion, has shown consistent profitability growth over the past five years, with earnings increasing by 23.6% annually. Despite facing intense competition in China's recruitment examination tutoring industry, Fenbi remains debt-free and maintains strong short-term asset coverage for liabilities. Recent guidance indicates a projected revenue decrease to RMB 1.47 billion for H1 2025 due to declining tutoring sales, alongside an expected net profit decline to RMB215 million. The board's limited experience and recent director resignation might impact strategic direction amidst these challenges.

- Dive into the specifics of Fenbi here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Fenbi's future.

Greentown Service Group (SEHK:2869)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greentown Service Group Co. Ltd., along with its subsidiaries, offers residential property management services in the People's Republic of China and internationally, with a market cap of HK$15.34 billion.

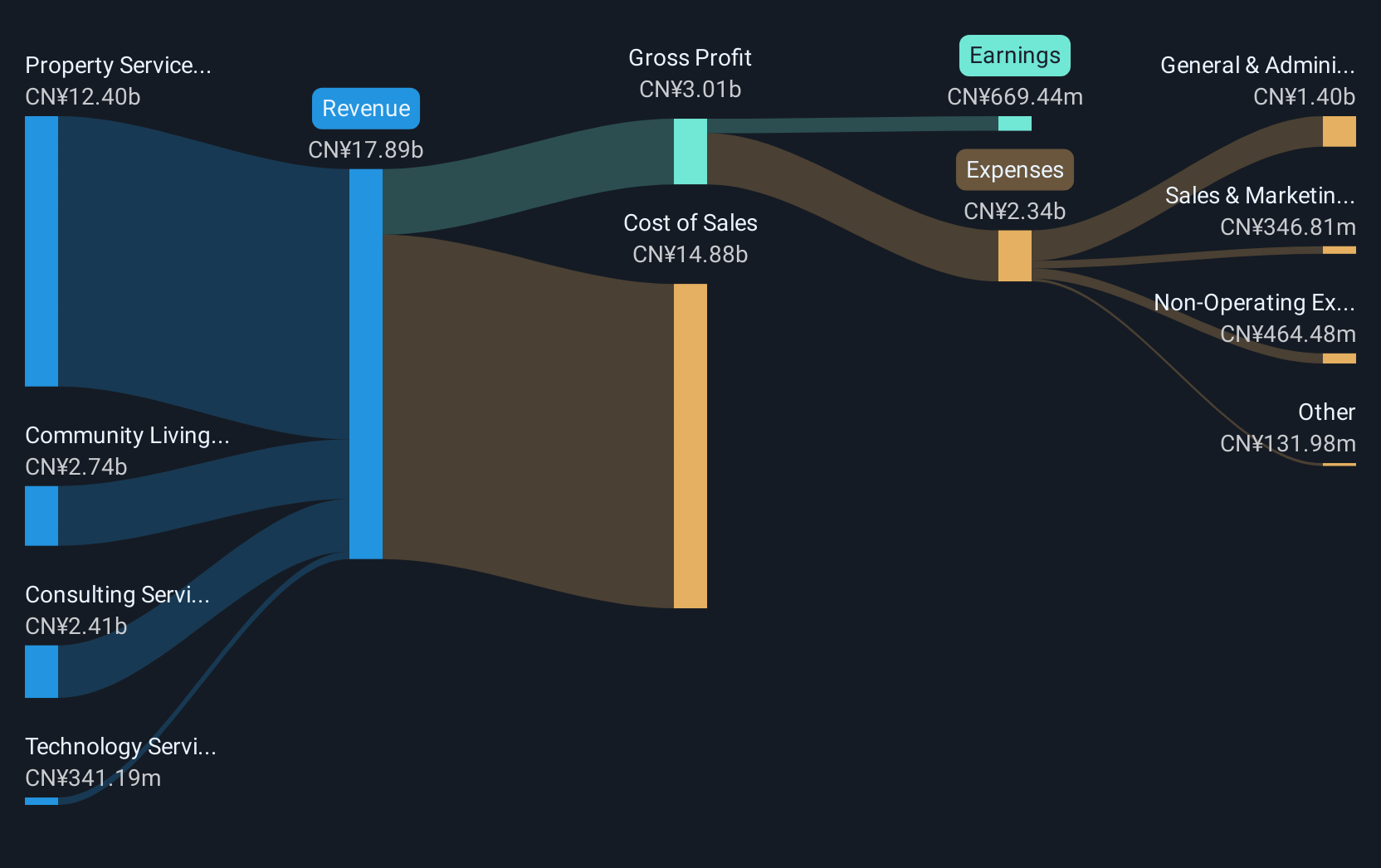

Operations: The company generates revenue through several segments, including Property Services (CN¥12.40 billion), Consulting Services (CN¥2.41 billion), Technology Services (CN¥341.19 million), and Community Living Services excluding Technology (CN¥2.74 billion).

Market Cap: HK$15.34B

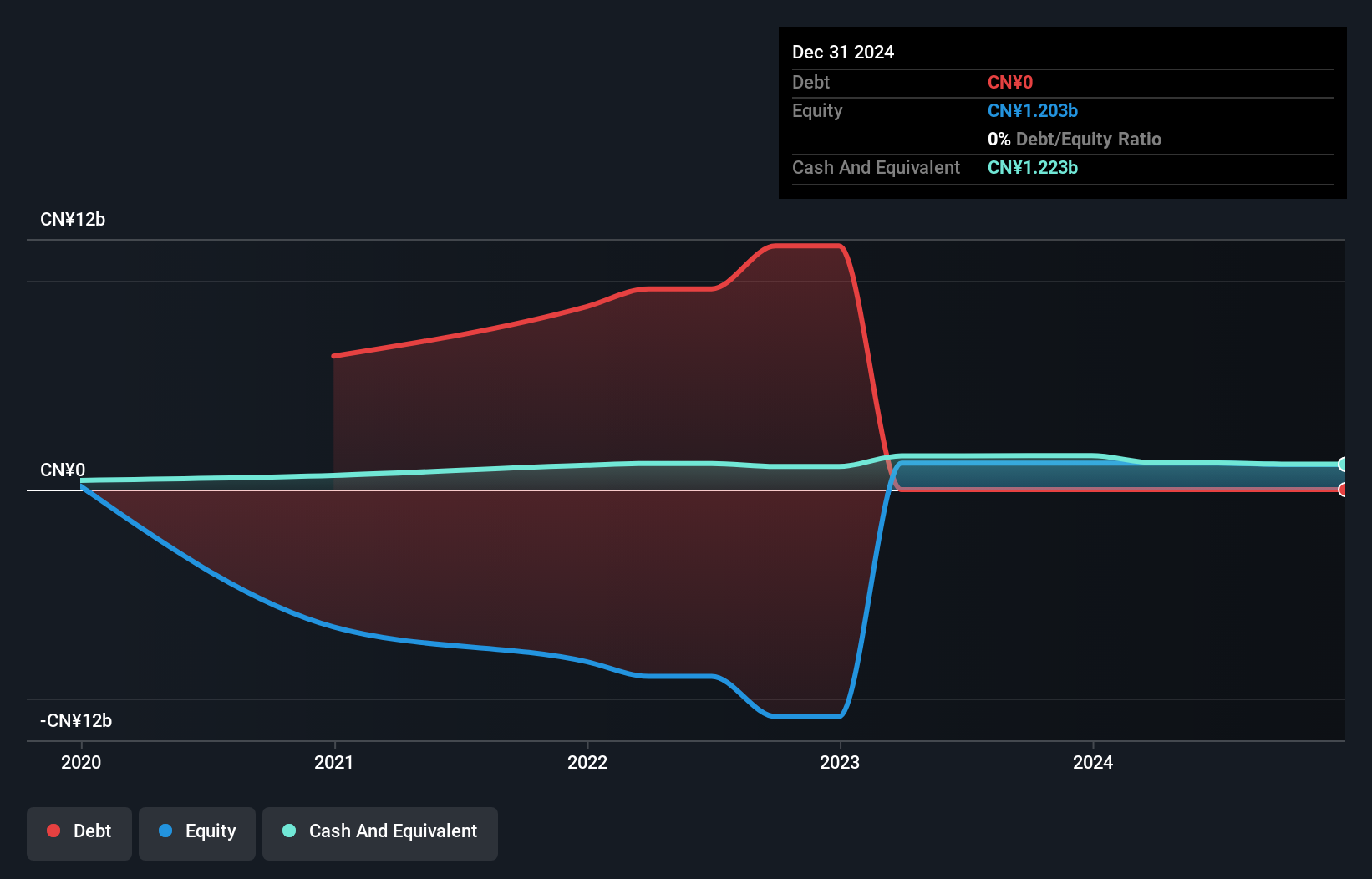

Greentown Service Group, with a market cap of HK$15.34 billion, is trading significantly below its estimated fair value and demonstrates stable financial health with short-term assets exceeding both short- and long-term liabilities. The company's earnings growth of 13.3% over the past year outpaces the real estate industry decline, although its return on equity remains low at 8.8%. Debt management appears robust as operating cash flow covers debt well, and interest payments are not a concern. However, an unstable dividend history may raise caution for income-focused investors despite strong asset coverage and reduced debt levels over time.

- Click to explore a detailed breakdown of our findings in Greentown Service Group's financial health report.

- Learn about Greentown Service Group's future growth trajectory here.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China, with a market capitalization of approximately HK$26.11 billion.

Operations: Dongguan Rural Commercial Bank Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$26.11B

Dongguan Rural Commercial Bank, with a market cap of HK$26.11 billion, trades significantly below its fair value estimate while maintaining stable financial health. The bank's Return on Equity is low at 7.3%, but its Loans to Assets ratio of 52% indicates prudent lending practices. Despite declining earnings over the past five years and negative growth last year, the bank benefits from primarily low-risk funding sources and an appropriate bad loans ratio of 1.8%. Recent dividend adjustments may concern income-focused investors, yet the experienced board and management team provide strategic stability amidst earnings challenges.

- Click here to discover the nuances of Dongguan Rural Commercial Bank with our detailed analytical financial health report.

- Understand Dongguan Rural Commercial Bank's track record by examining our performance history report.

Summing It All Up

- Access the full spectrum of 980 Asian Penny Stocks by clicking on this link.

- Contemplating Other Strategies? Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10