CVR Energy (CVI) Is Down 5.5% After Earnings Miss, CEO Retirement and Shelf Offering News

- CVR Energy recently reported a net loss of US$114 million for the second quarter of 2025, as sales and production volumes decreased compared to the prior year, and also filed a shelf registration statement for a US$70.68 million employee stock offering.

- Alongside these financial results, the company announced upcoming leadership changes, with Mr. Dave Lamp set to retire as CEO and President at the end of 2025 and Mark A. Pytosh expected to assume both roles.

- We'll examine how weaker earnings and reduced operating output may reshape analyst expectations for CVR Energy's future earnings outlook.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CVR Energy Investment Narrative Recap

To own shares in CVR Energy, you need to believe in a sustained recovery in petroleum and fertilizer demand, alongside the company's ability to expand capacity and manage costs through ongoing operational challenges. The latest net loss and production drop reinforce short-term uncertainty, but given management's reaffirmed third-quarter throughput guidance, the immediate impact to the company's core catalysts appears limited, while execution risk and margin compression remain the biggest watchpoints.

Among the recent developments, the leadership transition set for early 2026 stands out. With Mark A. Pytosh poised to take over as CEO and President, investors may look for continuity in strategy as the company attempts to stabilize earnings and navigate the effects of commodity cycles and regulatory costs.

On the other hand, investors should keep in mind the risk that persistent profit declines and board turnover could...

Read the full narrative on CVR Energy (it's free!)

CVR Energy's narrative projects $7.7 billion in revenue and $152.7 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $485.7 million earnings increase from current earnings of -$333.0 million.

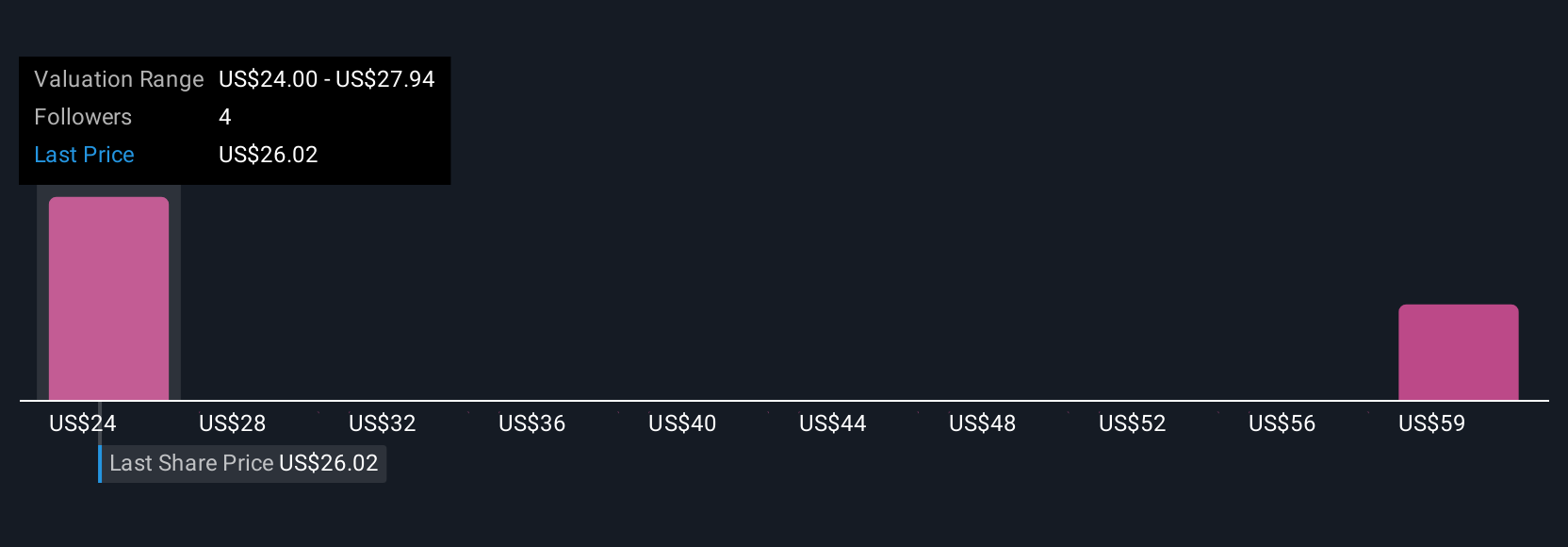

Uncover how CVR Energy's forecasts yield a $24.00 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have valued CVR Energy between US$24 and US$63, reflecting just two varied perspectives. Amid these divergent forecasts, ongoing margin pressure from regulatory costs could challenge even optimistic recovery scenarios for the business.

Explore 2 other fair value estimates on CVR Energy - why the stock might be worth 10% less than the current price!

Build Your Own CVR Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVR Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CVR Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVR Energy's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10