- Academy Sports + Outdoors recently appointed Brandy Treadway as Executive Vice President, Chief Legal Officer, and Corporate Secretary, where she will oversee all legal, compliance, and risk management functions for the company.

- This move expands Academy's leadership bench with experience from large retailers and may reinforce corporate governance and operational oversight.

- We'll examine how this addition to the executive team could strengthen Academy Sports and Outdoors' investment outlook and risk management framework.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Academy Sports and Outdoors Investment Narrative Recap

To own shares of Academy Sports and Outdoors, an investor typically needs to believe in the company’s potential to revive sales momentum and improve margins despite recent pressures on earnings and comparable sales. The appointment of Brandy Treadway as Chief Legal Officer may boost organizational oversight, but it is unlikely to immediately influence the most pressing short-term catalyst, accelerating revenue growth through new store openings and brand partnerships, or address the primary risk of continued soft consumer demand. Among recent announcements, the rollout of new stores across multiple states is most relevant here, as it aligns closely with Academy’s key growth catalyst. While executive appointments enhance corporate governance, the long-term impact on profitability and sales trends will be more directly affected by the company’s ability to execute its expansion and drive shopper engagement in a challenged retail backdrop. In contrast, there are ongoing margin risks linked to rising costs and tariffs which investors should be aware of, especially if...

Read the full narrative on Academy Sports and Outdoors (it's free!)

Academy Sports and Outdoors' outlook projects $7.2 billion in revenue and $450.8 million in earnings by 2028. This is based on an expected 6.8% annual revenue growth rate and a $62.7 million increase in earnings from the current $388.1 million.

Uncover how Academy Sports and Outdoors' forecasts yield a $54.94 fair value, a 6% upside to its current price.

Exploring Other Perspectives

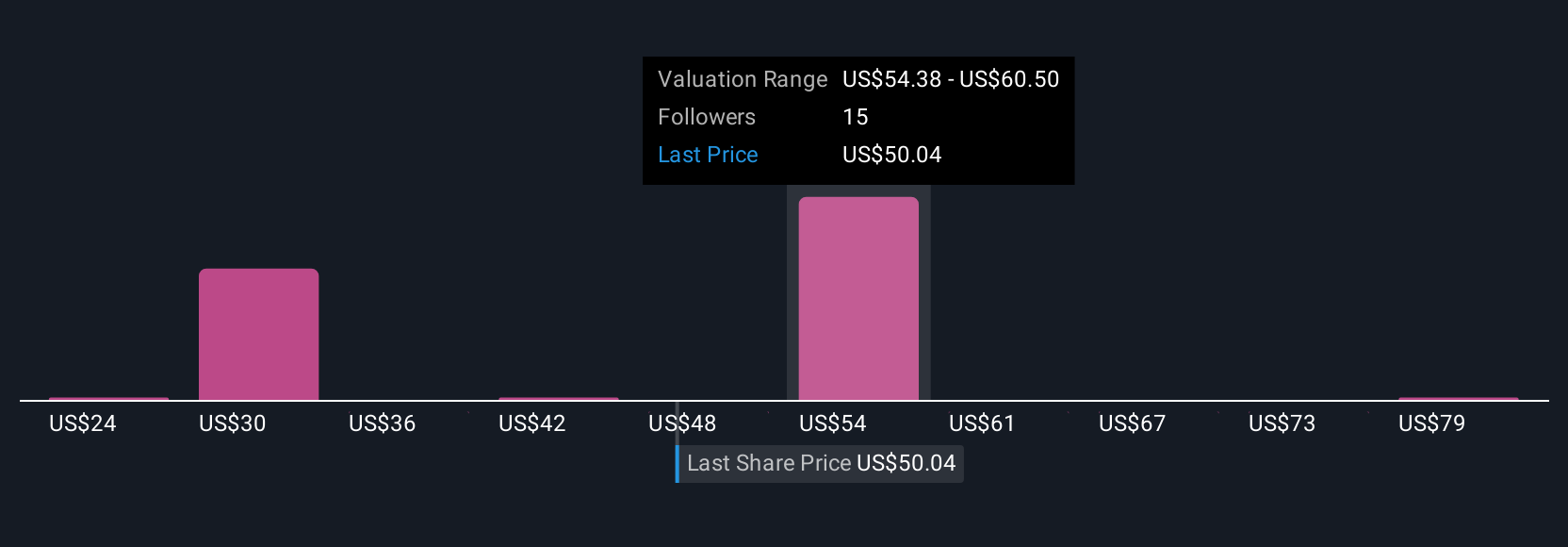

Simply Wall St Community fair value estimates for ASO range widely from US$23.75 to US$85, reflecting 5 unique viewpoints. With sales growth from store openings front of mind, make sure you consider how these widely differing opinions could affect your investment expectations.

Explore 5 other fair value estimates on Academy Sports and Outdoors - why the stock might be worth as much as 64% more than the current price!

Build Your Own Academy Sports and Outdoors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Academy Sports and Outdoors research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Academy Sports and Outdoors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Academy Sports and Outdoors' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com