Sensata Technologies Holding (NYSE:ST) Will Pay A Dividend Of $0.12

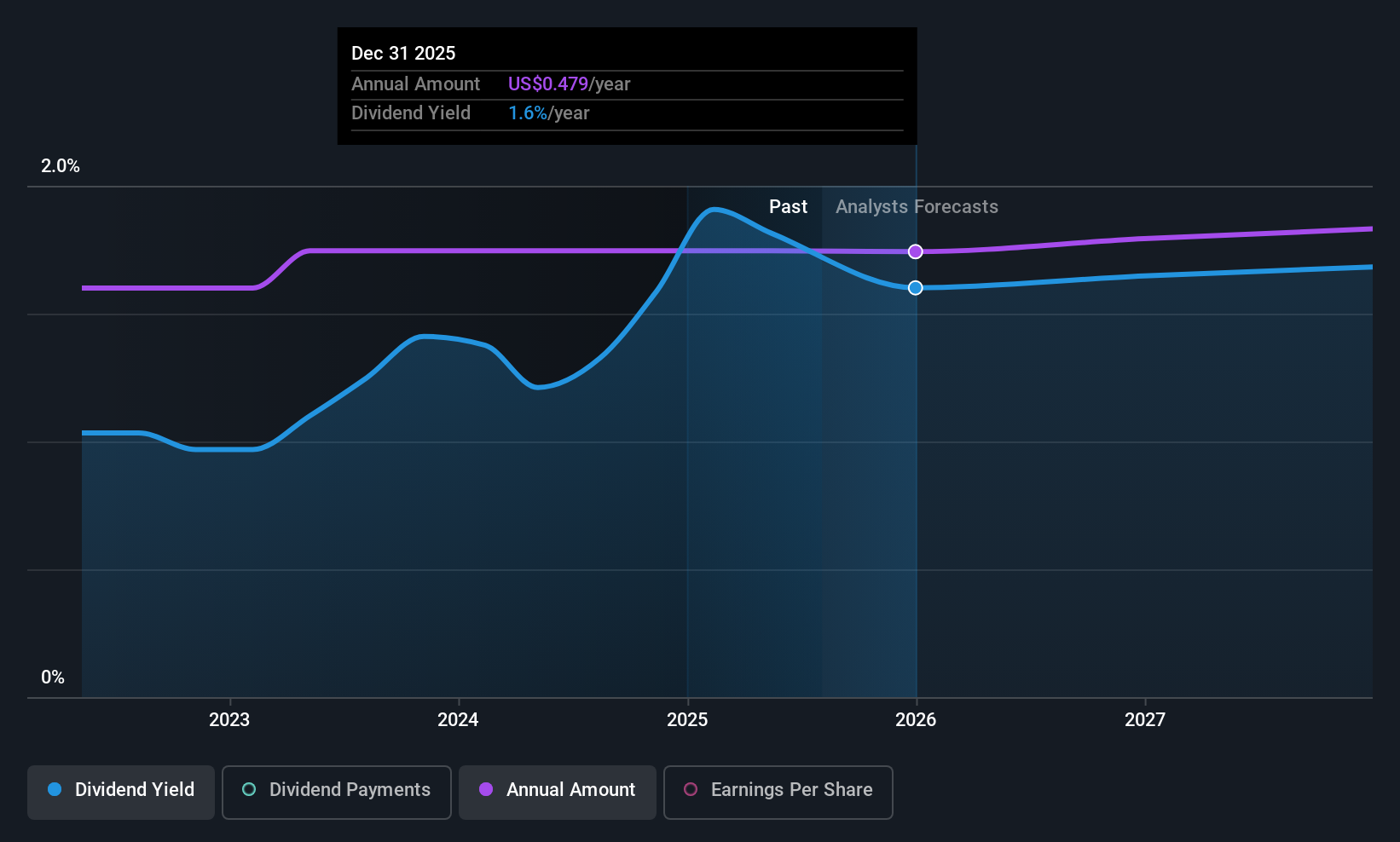

Sensata Technologies Holding plc's (NYSE:ST) investors are due to receive a payment of $0.12 per share on 27th of August. This payment means the dividend yield will be 1.6%, which is below the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Sensata Technologies Holding's stock price has increased by 38% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sensata Technologies Holding's Payment Could Potentially Have Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. Based on the last payment, Sensata Technologies Holding was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

According to analysts, EPS should be several times higher next year. If the dividend extends its recent trend, estimates say the dividend could reach 13%, which we would be comfortable to see continuing.

View our latest analysis for Sensata Technologies Holding

Sensata Technologies Holding Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The dividend has gone from an annual total of $0.44 in 2022 to the most recent total annual payment of $0.48. This means that it has been growing its distributions at 2.9% per annum over that time. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

We Could See Sensata Technologies Holding's Dividend Growing

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Sensata Technologies Holding has seen EPS rising for the last five years, at 6.1% per annum. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

Our Thoughts On Sensata Technologies Holding's Dividend

Overall, we think Sensata Technologies Holding is a solid choice as a dividend stock, even though the dividend wasn't raised this year. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. To that end, Sensata Technologies Holding has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10