How Envista Holdings' Return to Profitability and Raised Guidance May Impact NVST Investors

- Envista Holdings Corporation recently reported a return to profitability for the second quarter, with sales rising to US$682.1 million and net income reaching US$26.4 million, alongside raising its full-year 2025 sales growth outlook to 3%–4%.

- This shift was supported by the completion of a US$100.45 million share buyback and a shelf registration for an ESOP-related offering, highlighting the company's ongoing capital management initiatives.

- We’ll examine how Envista’s improved earnings and raised guidance may affect its investment narrative and growth story.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Envista Holdings Investment Narrative Recap

To be a shareholder in Envista Holdings today, you need to believe the company can capitalize on global dental market growth, boost digital innovation, and deliver margin improvements despite rising competition and external headwinds. The company’s return to profitability and raised sales guidance may bolster near-term confidence, but do not materially alter the sharpest short-term catalyst: accelerating adoption of digital workflows and clear aligners. Biggest risk remains: intensifying pricing pressures from China’s VBP reforms, which could continue to drag on revenue and margin recovery.

Among Envista’s recent announcements, the completion of a US$100.45 million share buyback stands out as particularly relevant. While this move reinforces the capital allocation discipline cited by management, it does not directly resolve the uncertainties around margin impacts from cost headwinds and segment-specific competition, both of which are closely tied to the company’s core growth narrative.

By contrast, investors should remain aware that visibility around China’s ongoing VBP reforms and their potential effect on revenues is...

Read the full narrative on Envista Holdings (it's free!)

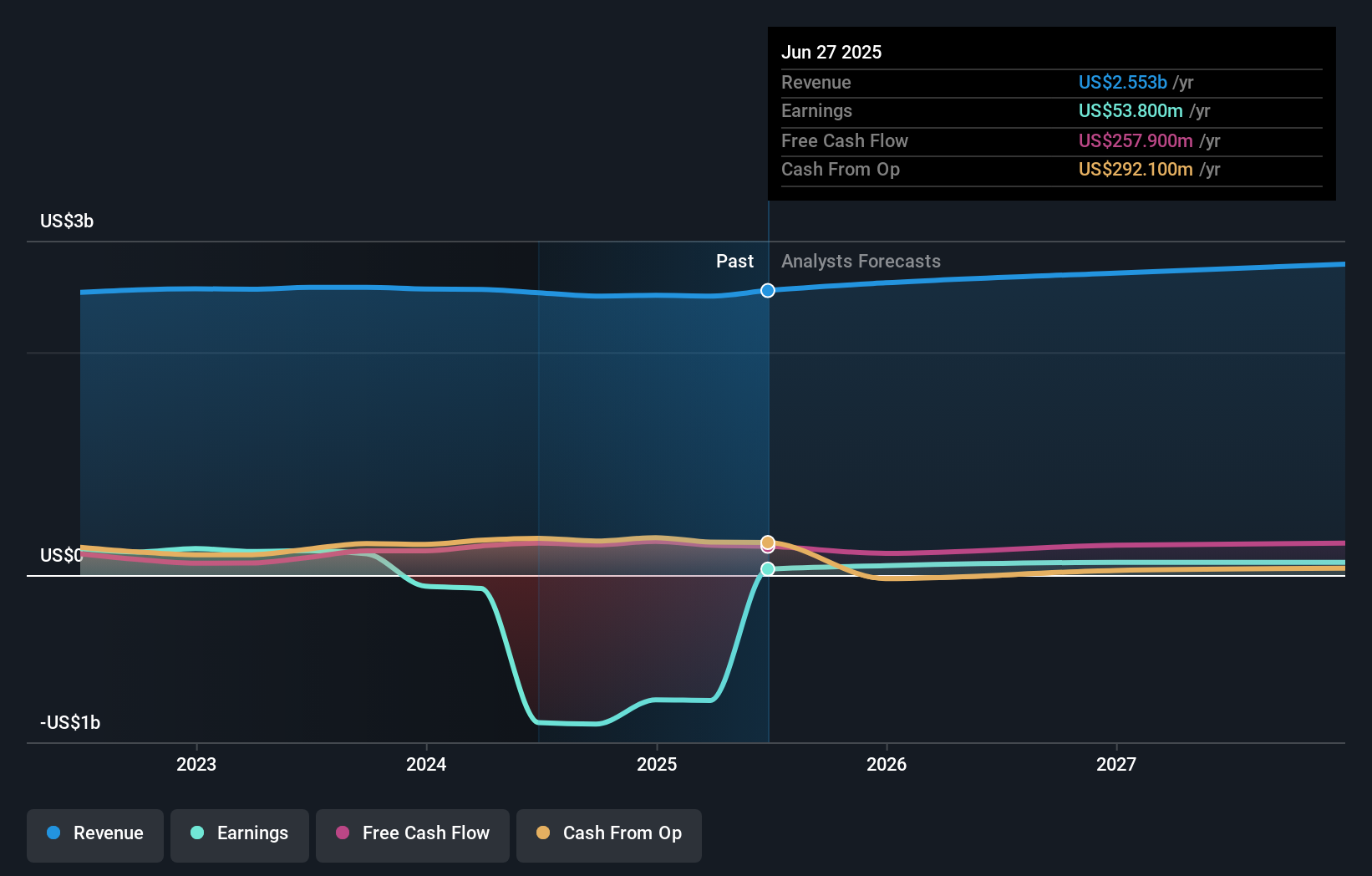

Envista Holdings’ outlook anticipates $2.8 billion in revenue and $144.7 million in earnings by 2028. This is based on forecast annual revenue growth of 3.6% and an earnings increase of $90.9 million from the current $53.8 million.

Uncover how Envista Holdings' forecasts yield a $21.42 fair value, a 6% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided two fair value estimates for Envista Holdings, ranging from US$21.42 to US$25.91 per share. As opinions sharply differ, consider how China’s tariff and reimbursement risks could influence the business beyond what’s already reflected, and explore several alternative viewpoints to inform your decisions.

Explore 2 other fair value estimates on Envista Holdings - why the stock might be worth as much as 28% more than the current price!

Build Your Own Envista Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Envista Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Envista Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Envista Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Envista Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10