Is StepStone’s Rising Revenue but Swing to Loss Reshaping the Investment Case for STEP?

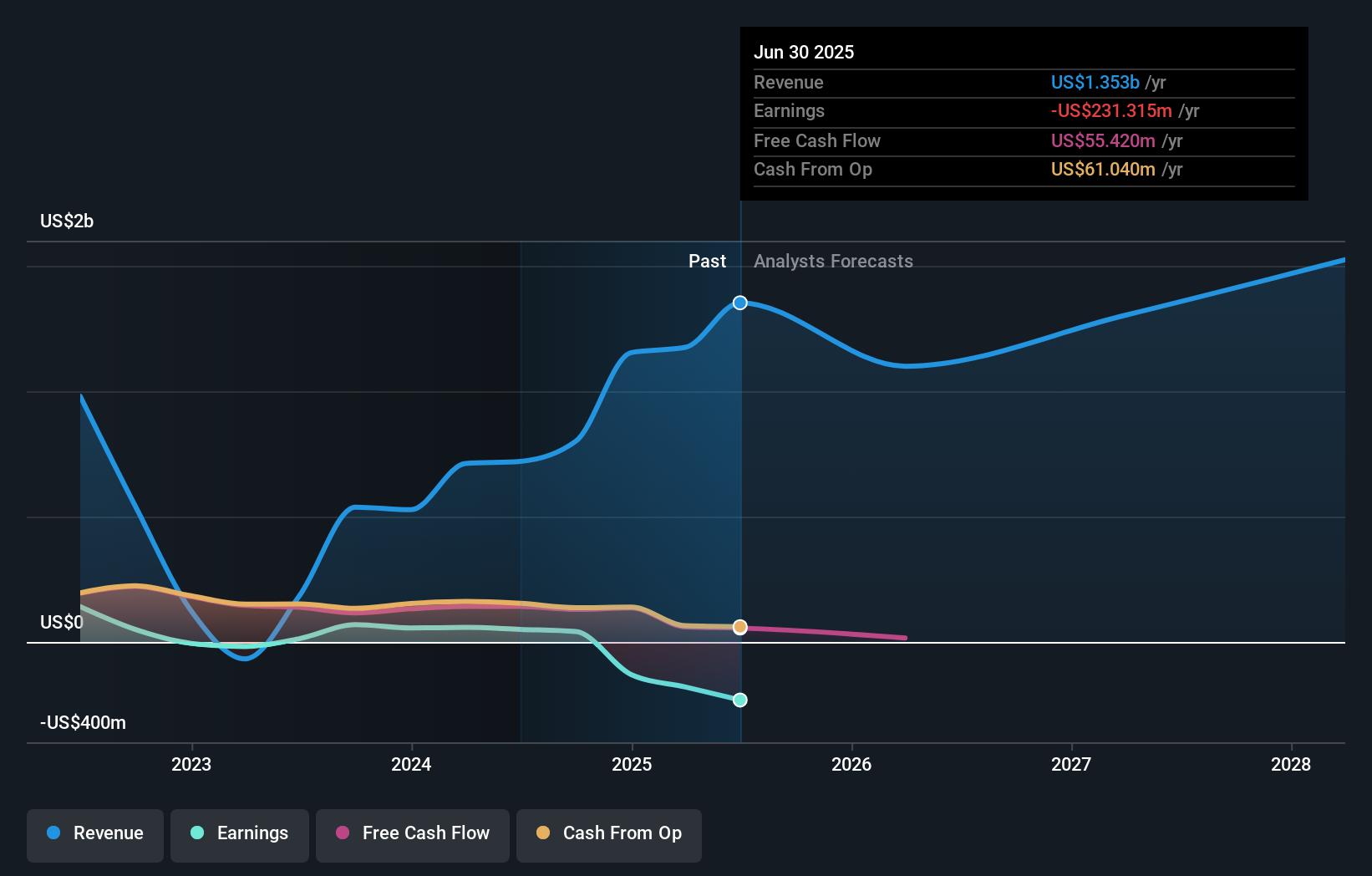

- StepStone Group recently reported first quarter results with revenue rising to US$364.29 million, up from US$186.4 million in the previous year, but posting a net loss of US$38.42 million after having achieved net income a year earlier.

- The company also declared a quarterly cash dividend of US$0.28 per share, juxtaposing increased top-line figures with negative earnings performance.

- We’ll explore how StepStone Group’s swing from profit to loss despite higher revenue could affect its investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is StepStone Group's Investment Narrative?

To invest in StepStone Group right now, you’d have to believe that top-line expansion can eventually drive consistent profitability, even as the shift from profit to a US$38.42 million quarterly loss clouds the earnings outlook. The recent revenue jump is impressive, but the drop into the red re-frames the business’s biggest short-term catalyst: a sustained turnaround in net income. While news of a maintained dividend may offer some reassurance about capital return, increased losses now raise the stakes for delivery on any cost controls or margin improvement initiatives. The market’s positive price reaction following the results suggests the news won’t materially dampen sentiment in the very near term, but it does highlight risks tied to continued unprofitability and the sustainability of the dividend if losses persist. Investors should also keep in mind the company’s exposure to pressures from recent equity offerings and index removals, which may influence both liquidity and perception in the coming quarters.

But despite healthy revenue, questions about whether the dividend can be sustained are worth noting. StepStone Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on StepStone Group - why the stock might be worth less than half the current price!

Build Your Own StepStone Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StepStone Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free StepStone Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StepStone Group's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10