Owens & Minor, Inc. (NYSE:OMI) will release earnings results for the second quarter before the opening bell on Monday, Aug. 11.

Analysts expect the Glen Allen, Virginia-based company to report quarterly earnings at 28 cents per share, down from 36 cents per share in the year-ago period. Owens & Minor projects to report quarterly revenue at $2.73 billion, compared to $2.67 billion a year earlier, according to data from Benzinga Pro.

On June 5, Owens & Minor announced it terminated its Rotech Healthcare acquisition.

Owens & Minor shares rose 12.4% to close at $7.09 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Baird analyst Eric Coldwell maintained a Neutral rating and boosted the price target from $9 to $10 on June 6, 2025. This analyst has an accuracy rate of 61%.

- JP Morgan analyst Michael Minchak maintained an Underweight rating and cut the price target from $14 to $10 on March 10, 2025. This analyst has an accuracy rate of 68%.

- UBS analyst Kevin Caliendo maintained a Buy rating rating and cut the price target from $25 to $13 on Feb. 13, 2025. This analyst has an accuracy rate of 66%.

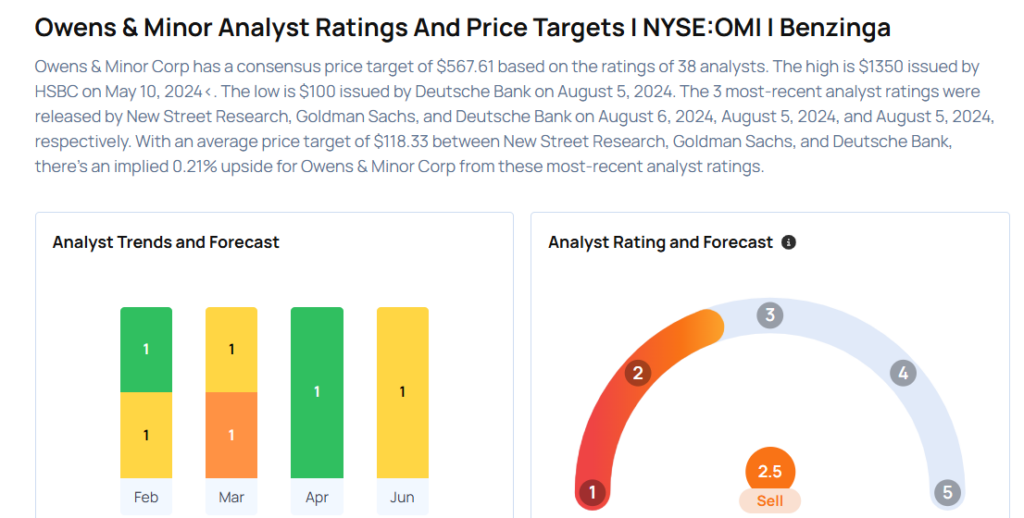

Considering buying OMI stock? Here’s what analysts think:

Read This Next:

- Should You Buy Boeing? Jim Cramer Weighs In

Photo via Shutterstock