Uber Technologies (UBER) Partners with Dollar General for On-Demand Delivery Expansion

Uber Technologies (UBER) has recently entered into a partnership with Dollar General to integrate over 14,000 stores into the Uber Eats platform, offering customers delivery of affordable essentials. This consumer-focused initiative coincides with Uber's overall strategic expansion through multiple partnerships and announcements, including a significant collaboration with Serve Robotics and Little Caesars, as well as the introduction of Robotaxi services with WeRide. While the company’s share price increased by 8% over the last quarter, these developments likely complemented the broader market trends. Major indexes, notably the Nasdaq, reached record highs, benefiting from a strong tech sector rally.

Every company has risks, and we've spotted 3 weaknesses for Uber Technologies (of which 1 can't be ignored!) you should know about.

Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Uber's recent partnerships with Dollar General and others highlight its ongoing efforts to integrate diverse services and innovate within its platform. These collaborations have the potential to attract more users and drive additional revenue streams, reinforcing Uber's strategy of enhancing customer engagement and expanding its service offerings. The partnership with Dollar General, in particular, could provide further penetration into the delivery of everyday essentials, possibly boosting Uber's Delivery segment, and thus supporting revenue forecasts. While the introduction of Robotaxi services and autonomous ventures with Serve Robotics may not immediately impact earnings, they are crucial for long-term growth, aligning with Uber’s efforts in the autonomous vehicle space.

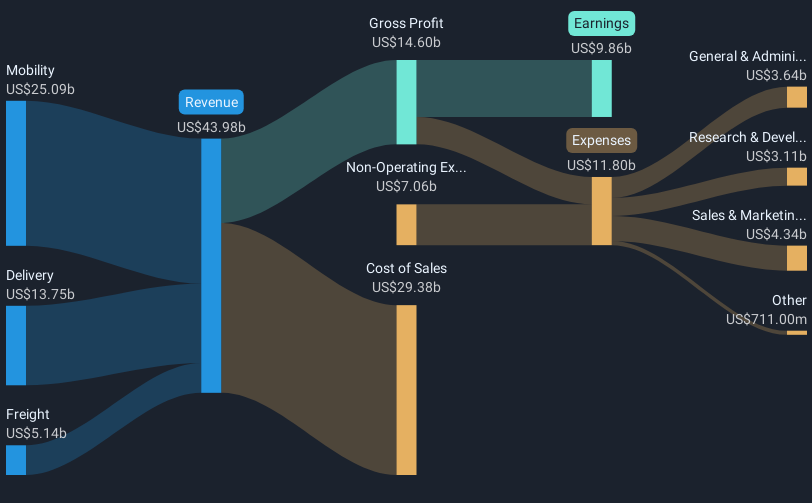

Over the past five years, Uber's total shareholder return, including dividends, was 198.63%, reflecting its transformation from a loss-making entity to one with growing profitability. In the last year, Uber outperformed the US market, which returned 20.2%, and also the US Transportation industry, which returned 7.5%. This performance underscores Uber’s ability to capitalize on both technology and mobility trends despite competitive and regulatory challenges.

Although Uber’s current share price of US$89.56 is below the analyst consensus price target of approximately US$105.25, it still signals potential upside. The fair value perception and the anticipated revenue growth of 12.2% per year suggest investor optimism about Uber's future performance. However, the forecasted decline in earnings of 0.4% per year over the next three years indicates ongoing risks, including capital intensiveness in autonomous vehicles and competitive pressures. Shareholders will likely watch how these developments influence Uber’s ability to meet or exceed revenue and earnings targets.

Our comprehensive valuation report raises the possibility that Uber Technologies is priced lower than what may be justified by its financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10