Should Butterfield’s (NTB) Dividend Hike and Buyback Signal Stronger Commitment to Shareholder Returns?

- The Bank of N.T. Butterfield & Son Limited recently reported higher second quarter and half-year earnings, increased its quarterly dividend by 14% to US$0.50 per share, approved a new share buyback program, and appointed a new independent director with extensive offshore financial sector expertise.

- These combined actions highlight a continued focus on shareholder returns and governance as the company builds on solid financial results and advances in its capital management activities.

- With a fresh dividend increase and continued share buybacks, we’ll assess how these moves might influence Butterfield’s investment outlook.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bank of N.T. Butterfield & Son Investment Narrative Recap

To be a shareholder in Bank of N.T. Butterfield & Son Limited, you need confidence in the bank's ability to maintain stable deposit levels amid a focus on expanding its offshore wealth management offerings, despite potential risks around large, potentially volatile deposits. The recent news, highlighting increased earnings, a bigger dividend, and a new share buyback, does not appear to materially change the most important short-term catalyst (expansion in international wealth and trust), nor does it fully resolve the key risk related to deposit outflows.

Of the recent announcements, the 14% increase in the quarterly dividend to US$0.50 per share is especially relevant. It points to the bank’s commitment to rewarding existing shareholders, but sustainable payouts ultimately depend on the stability of core deposits and earnings, critical issues considering the bank’s exposure to large, non-sticky deposits in volatile environments.

Yet investors should not overlook the continued uncertainty around large transient deposit balances, a risk that remains front and center for anyone relying on Butterfield’s...

Read the full narrative on Bank of N.T. Butterfield & Son (it's free!)

Bank of N.T. Butterfield & Son's outlook points to $594.7 million in revenue and $194.4 million in earnings by 2028. This scenario assumes a 0.3% annual revenue decline and a $25 million decrease in earnings from the current $219.4 million.

Uncover how Bank of N.T. Butterfield & Son's forecasts yield a $51.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

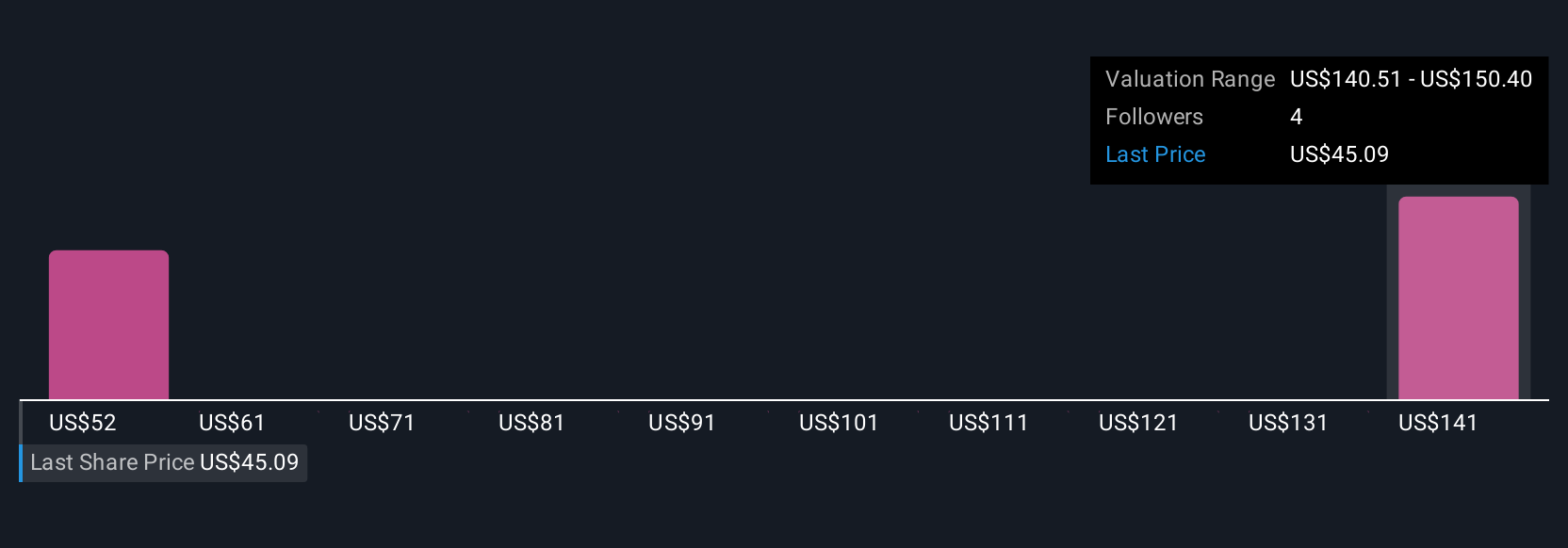

Three fair value estimates from the Simply Wall St Community range from US$51.50 to US$150.40 per share, with contrasting views on potential upside. While many see opportunities tied to the bank’s push into international wealth management, wide opinion gaps highlight the importance of reviewing multiple perspectives before making decisions.

Explore 3 other fair value estimates on Bank of N.T. Butterfield & Son - why the stock might be worth just $51.50!

Build Your Own Bank of N.T. Butterfield & Son Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of N.T. Butterfield & Son research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bank of N.T. Butterfield & Son research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of N.T. Butterfield & Son's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of N.T. Butterfield & Son might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10