The Bull Case For Upbound Group (UPBD) Could Change Following Q2 Revenue Gains Amid Profit Decline

- Upbound Group recently reported its second quarter 2025 earnings, showing sales of US$904.58 million and revenue of US$1.16 billion, both higher than the prior year, while net income for the period declined to US$15.49 million from US$33.95 million previously.

- The results highlight significant top-line gains in Acima and Brigit from digital product expansion, but profitability was pressured by operational challenges in other segments such as Rent-A-Center.

- We’ll consider how the dual trend of revenue growth and declining net income reshapes Upbound Group’s investment narrative and future outlook.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Upbound Group Investment Narrative Recap

To be a shareholder in Upbound Group, you need to believe in the company’s ability to deliver long-term value by expanding digital leasing options and broadening its customer base, particularly through Acima and Brigit. The latest quarterly results reinforce revenue momentum but highlight profitability concerns, especially as growing sales came with a significant drop in net income. While the digital-driven upside remains a key catalyst in the near term, earnings pressure from operational issues in Rent-A-Center currently stands out as the most important risk; the latest results make this risk more visible rather than materially changing it.

One recent announcement that ties directly to these results is the launch of Acima’s virtual lease card, alongside new credit products in Brigit. This move is designed to reinforce the company’s digital transformation, which is central to capturing more revenue, a bright spot reflected in segment growth despite headwinds elsewhere. Yet, as revenue growth becomes increasingly reliant on successful execution in digital channels, maintaining profitability amid operational challenges remains a major focal point for investors.

However, with results showing widening cracks in net income, investors should also be aware that…

Read the full narrative on Upbound Group (it's free!)

Upbound Group's narrative projects $4.8 billion in revenue and $278.5 million in earnings by 2028. This requires 3.9% yearly revenue growth and a $197.3 million increase in earnings from $81.2 million today.

Uncover how Upbound Group's forecasts yield a $36.25 fair value, a 68% upside to its current price.

Exploring Other Perspectives

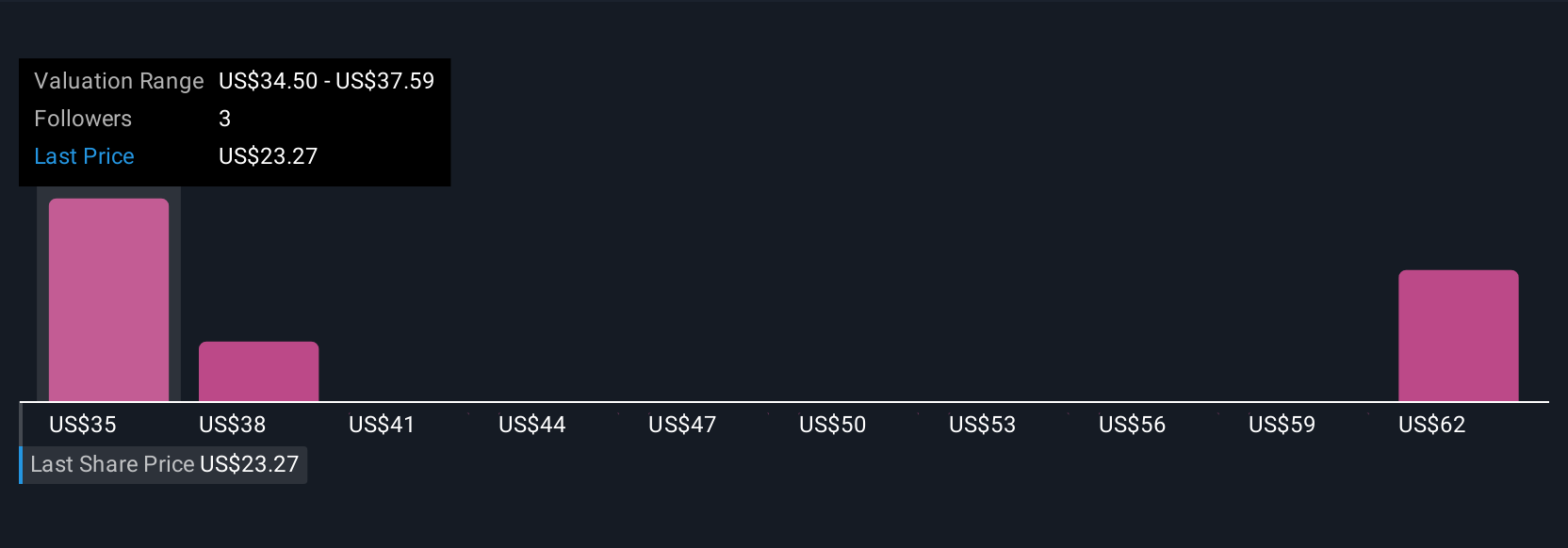

Fair value estimates from four Simply Wall St Community members range from US$34.50 to US$62.89 per share. Some see strong potential in new digital initiatives, though concerns about declining profitability prompt a closer look at future earnings quality and margin trends.

Explore 4 other fair value estimates on Upbound Group - why the stock might be worth just $34.50!

Build Your Own Upbound Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upbound Group research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Upbound Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upbound Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10