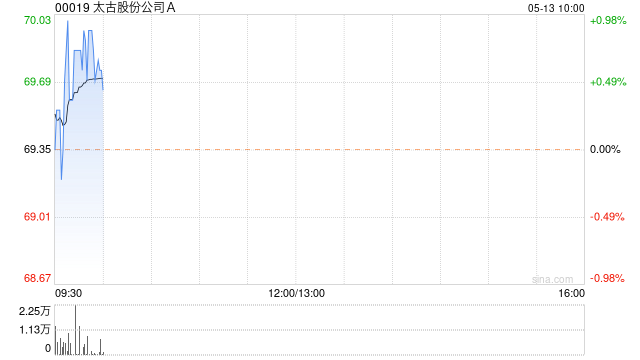

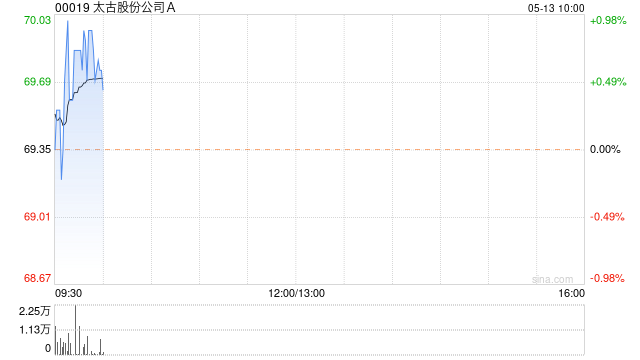

瑞银发布研报称,太古A(00019)中期经常性基础盈利为47亿港元,同比跌1%,低于该行预期达12%,主要是国泰航空(00293)贡献低于预期。集团中期派息1.3港元,同比升4%,大致上符合预期。管理层重申,他们优先考虑长期策略投资和渐进式股息,而非股票回购。

未来的股票回购将取决于股价、负债比率和市场状况。该行表示,将公司在2025年至2027年盈利预测下调1%至5%,以反映对国泰、HAECO及饮料业务盈测的调整,对太古目标价由75港元轻微下调至74港元,其评级为“中性”。

责任编辑:史丽君

瑞银发布研报称,太古A(00019)中期经常性基础盈利为47亿港元,同比跌1%,低于该行预期达12%,主要是国泰航空(00293)贡献低于预期。集团中期派息1.3港元,同比升4%,大致上符合预期。管理层重申,他们优先考虑长期策略投资和渐进式股息,而非股票回购。

未来的股票回购将取决于股价、负债比率和市场状况。该行表示,将公司在2025年至2027年盈利预测下调1%至5%,以反映对国泰、HAECO及饮料业务盈测的调整,对太古目标价由75港元轻微下调至74港元,其评级为“中性”。

责任编辑:史丽君

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.