Exploring Granite Ridge Resources And 2 Promising Undervalued Small Caps With Insider Buying

As the U.S. markets navigate a landscape marked by fluctuating indices and anticipation of key economic data, small-cap stocks continue to capture investor interest due to their potential for growth amidst broader market volatility. In this environment, identifying promising small-cap opportunities involves assessing factors such as insider buying trends and valuation metrics, which can provide insights into a stock's potential value in the current economic climate.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 9.8x | 2.9x | 34.03% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 20.31% | ★★★★★☆ |

| Citizens & Northern | 10.9x | 2.7x | 44.85% | ★★★★☆☆ |

| S&T Bancorp | 10.6x | 3.6x | 41.87% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 31.33% | ★★★★☆☆ |

| GEN Restaurant Group | NA | 0.1x | -659.67% | ★★★★☆☆ |

| Lindblad Expeditions Holdings | NA | 1.0x | 14.94% | ★★★★☆☆ |

| Blue Bird | 15.0x | 1.2x | -12.30% | ★★★☆☆☆ |

| Farmland Partners | 7.1x | 8.6x | -41.53% | ★★★☆☆☆ |

| Montrose Environmental Group | NA | 1.1x | 22.24% | ★★★☆☆☆ |

Click here to see the full list of 87 stocks from our Undervalued US Small Caps With Insider Buying screener.

Let's take a closer look at a couple of our picks from the screened companies.

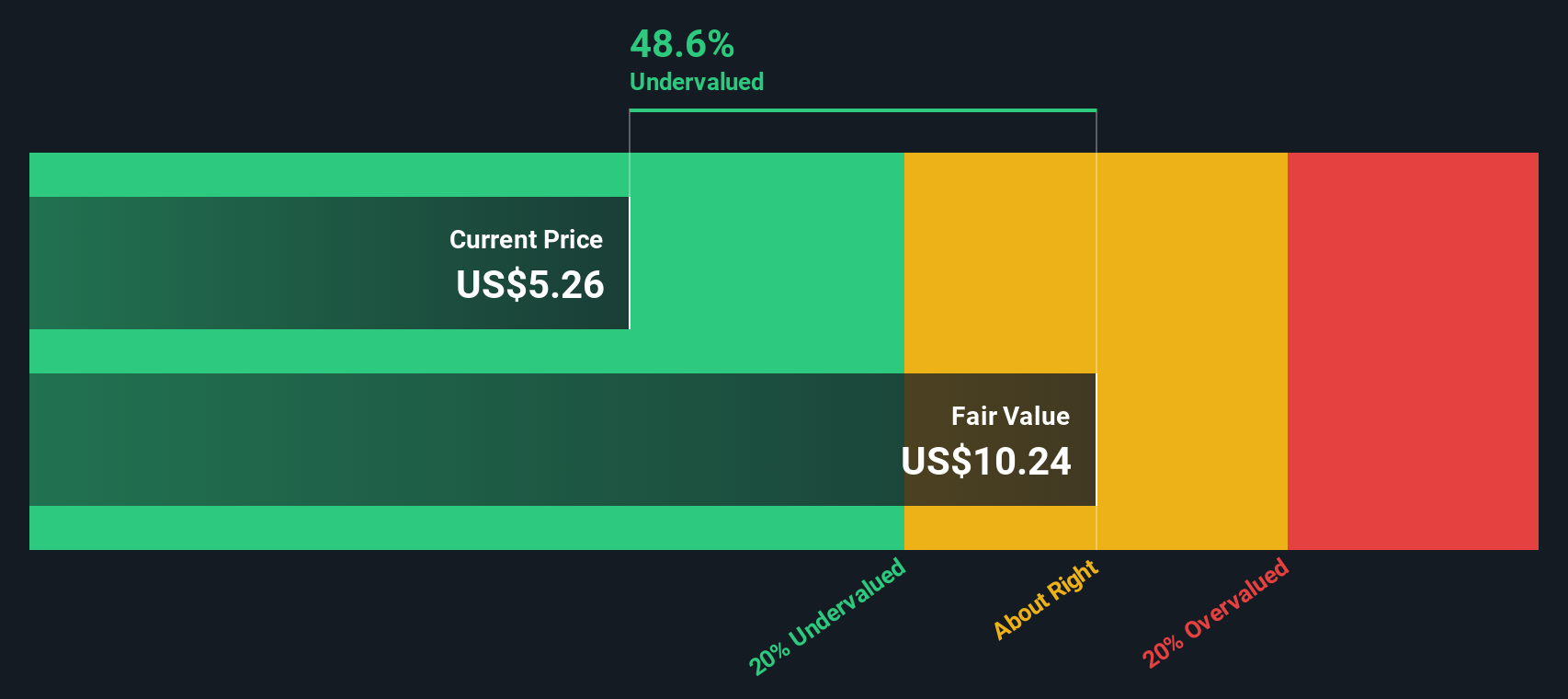

Granite Ridge Resources (GRNT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Granite Ridge Resources is involved in the development, exploration, and production of oil and natural gas with a market capitalization of approximately $1.5 billion.

Operations: Granite Ridge Resources generates its revenue primarily from oil and natural gas development, exploration, and production. The company's cost of goods sold (COGS) has shown an upward trend over recent periods, reaching $69.65 million in the latest quarter. Despite fluctuations in net income margin, which most recently stood at 7.83%, the gross profit margin has remained relatively stable around 82.98%. Operating expenses have consistently included significant depreciation and amortization costs, with general and administrative expenses contributing to overall expenditure levels.

PE: 21.5x

Granite Ridge Resources, a small-cap company in the U.S., recently reported strong earnings with net income for Q2 2025 at US$25.08 million, up from US$5.1 million a year ago. Their production guidance for 2025 increased by 10%, driven by early Permian wells and exceeding Utica forecasts. Despite high debt levels, insider confidence is evident through share purchases in recent months. The new CEO brings extensive finance experience, potentially steering future growth effectively.

- Click to explore a detailed breakdown of our findings in Granite Ridge Resources' valuation report.

Learn about Granite Ridge Resources' historical performance.

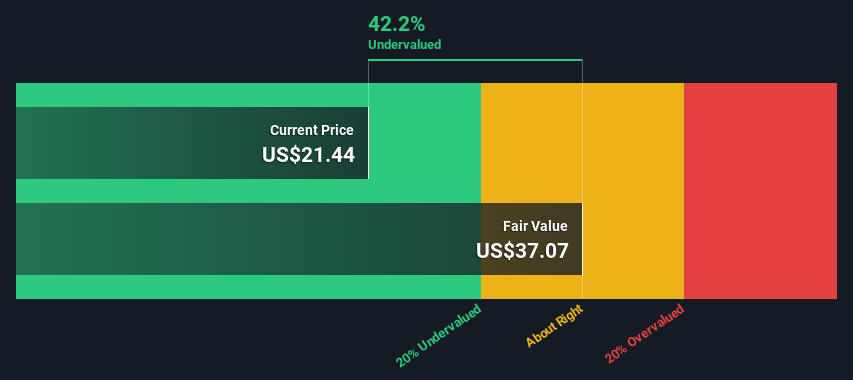

Magnera (MAGN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Magnera operates as a multinational corporation focusing on diverse industries across the Americas and the Rest of the World, with a market capitalization of $2.92 billion.

Operations: Magnera generates revenue from the Americas and Rest of World, totaling $2.92 billion in the most recent period. The company's gross profit margin has shown a downward trend, reaching 10.52% recently, impacted by rising cost of goods sold and operating expenses.

PE: -1.5x

Magnera's recent earnings report for Q3 2025 revealed a substantial increase in sales to US$839 million from US$556 million the previous year, yet it faced a net loss of US$18 million. Despite this, insider confidence is evident as Curtis Begle acquired 23,786 shares worth approximately US$501,297 in June 2025. The company's reliance on external borrowing poses higher risks but is counterbalanced by projected earnings growth of 111.7% annually.

- Click here to discover the nuances of Magnera with our detailed analytical valuation report.

Assess Magnera's past performance with our detailed historical performance reports.

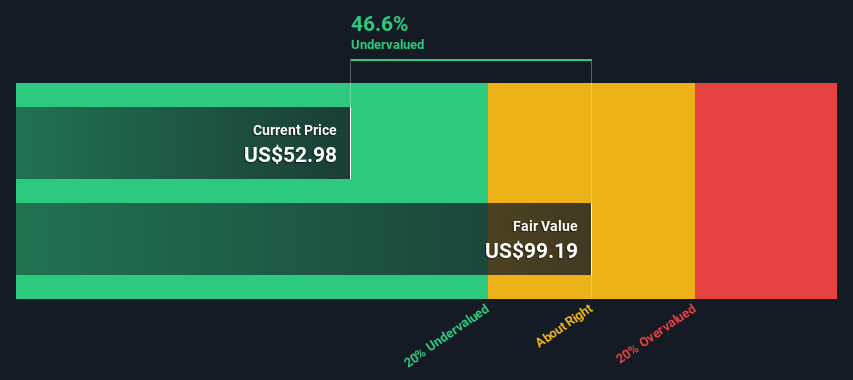

Minerals Technologies (MTX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Minerals Technologies is a company that specializes in engineered solutions and consumer & specialty products, with a market capitalization of approximately $2.42 billion.

Operations: Minerals Technologies generates revenue primarily from its Engineered Solutions and Consumer & Specialties segments, with the latter contributing more significantly. The company's gross profit margin has shown fluctuations, reaching 25.85% in the most recent period. Operating expenses include significant allocations to general and administrative costs, consistently exceeding $235 million in recent quarters.

PE: 871.5x

Minerals Technologies, a smaller player in its field, recently reported second-quarter sales of US$528.9 million and net income of US$45.4 million, reflecting a turnaround from last year's lower figures. The company anticipates steady third-quarter sales between US$525 million and US$535 million with operating income around US$75 million. From March to June 2025, they repurchased 336,376 shares for about US$18.97 million under their buyback plan, signaling confidence in their stock's potential value.

- Unlock comprehensive insights into our analysis of Minerals Technologies stock in this valuation report.

Review our historical performance report to gain insights into Minerals Technologies''s past performance.

Where To Now?

- Click here to access our complete index of 87 Undervalued US Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10