Next week’s CPI, PPI, retail sales, and consumer sentiment could cement rate cuts and boost gold

(Kitco News) – While this week was a lean one for economic data, precious metals traders still had plenty of market-moving events – the unscheduled kind.

Gold prices were already trading in positive territory when news broke on Thursday afternoon that some gold bar imports from Switzerland would be subject to trade tariffs – with Switzerland's recently announced 39% tariff rate among the highest the Trump administration has imposed.

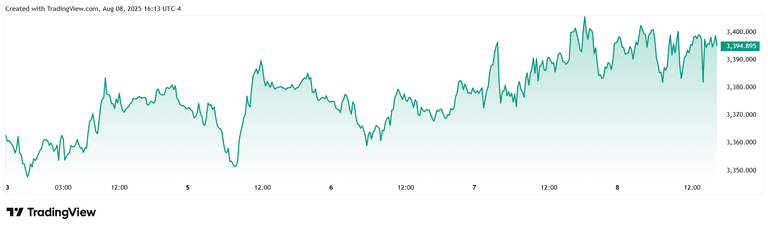

The news drove Comex gold futures to a new all-time high of $3,534.10 shortly after 6 pm EDT, and sent spot prices rocketing through $3,400 per ounce.

By Friday afternoon, the White House had characterized the FT story as ‘misinformation’ and reassured markets that gold was not slated for tariffs, but after a sharp yet brief selloff, the yellow metal still managed to hold onto its weekly gains.

At the time of writing, spot gold was trading at $3,394.91 per ounce for a gain of 3.15% on the weekly chart.

Next week’s economic news picks up again, with key measures of inflation and the health of consumers on the docket.

Early Tuesday morning will see the Reserve Bank of Australia’s interest rate decision, with markets pricing in a 25-basis point reduction from 3.85% to 3.60%. Then traders will turn their attention to the U.S. CPI report for July, which is expected to show core inflation ticking up to 0.3% from 0.2% in June.

Wednesday is a slow day, with the highlight comments from Fed governors Goolsbee and Bostic, but the data picks up again on Thursday with U.S. PPI – with core inflation forecast to rise 0.2% after a flat reading in June – as well as the weekly jobless claims report.

The week wraps up with an in-depth look at the American consumer, with retail sales for July expected to tick down from 0.6% to 0.5%, while core retail sales are projected to drop to 0.3% from 0.6% in June. Then later in the morning, preliminary University of Michigan Consumer Sentiment for August will tell markets what consumers are expecting going forward.

Economic data to watch next week:

Tuesday: RBA Interest Rate Decision, US CPI for July, Fed’s Barkin and Schmid speak

Wednesday: Fed’s Barkin, Bostic, and Goolsbee speak

Thursday: US PPI for July, US Jobless Claims

Friday: US Retail Sales for July, NY Empire State Manufacturing Index, Michigan Consumer Sentiment (Prel)

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10