Most major electric vehicle (EV) makers mostly saw insurance registrations drop in China last week, as vehicle deliveries typically slow down at the beginning of the month.

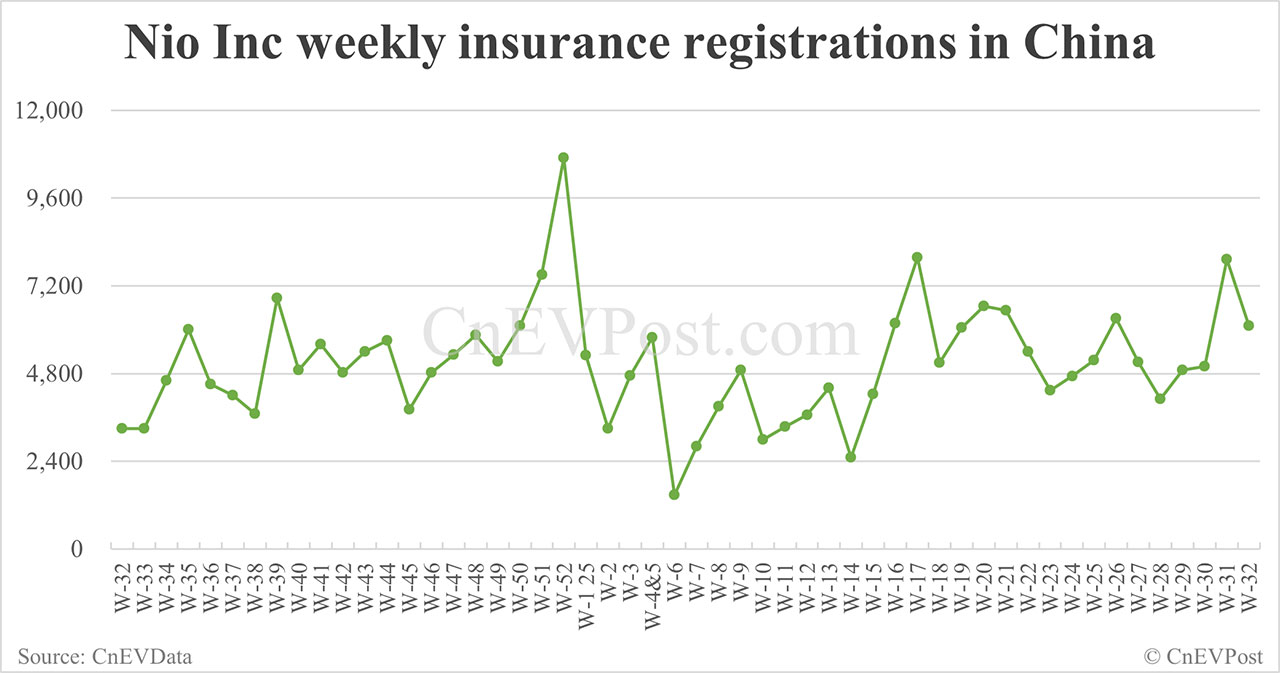

During the week of August 4-10 -- week 32 of 2025 -- Nio Inc (NYSE: NIO) recorded 6,100 vehicle insurance registrations in China, a decrease of 23.08 percent from the previous week's 7,930 units, according to figures shared today by several automotive industry observers on Weibo.

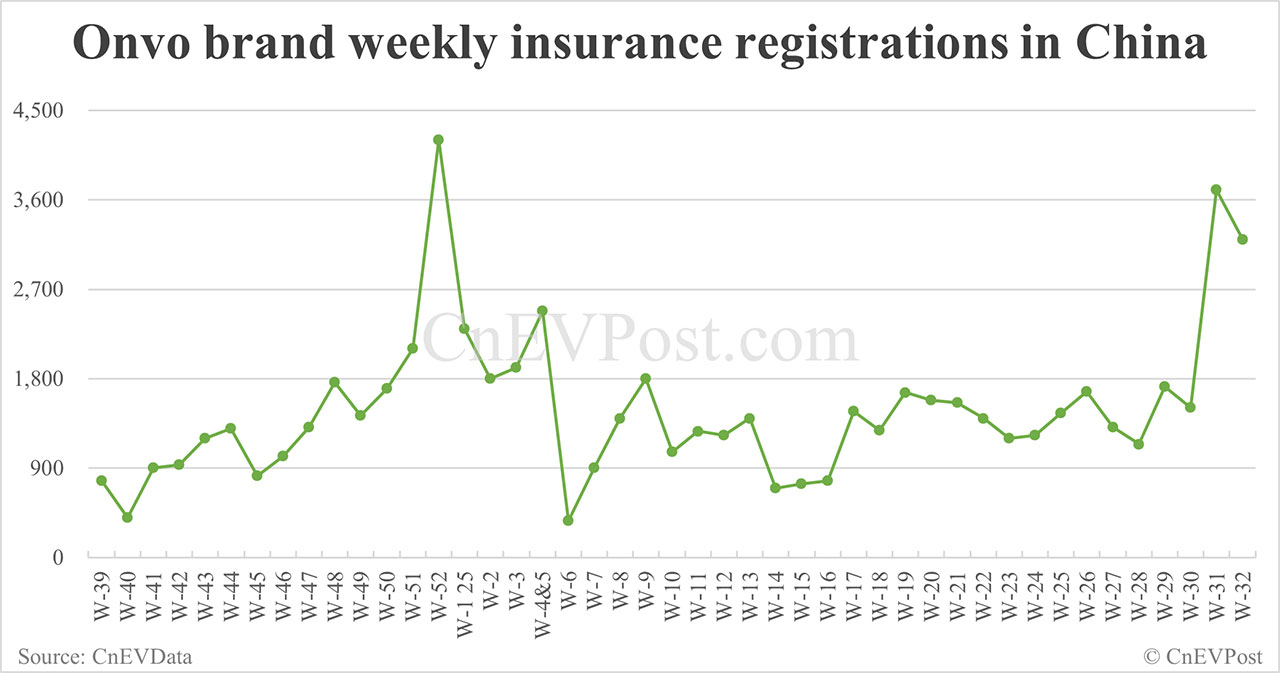

Nio's sub-brand Onvo had 3,200 insurance registrations last week, remaining near record highs despite a 13.51 percent decrease from the previous week's 3,700 units.

Insurance registration figures for the Nio main brand and Firefly sub-brand are currently unavailable, though the two brands combined for 2,900 registrations last week.

Onvo launched its L90 flagship electric SUV (sport utility vehicle) on July 31 and began deliveries the following day on August 1.

Onvo L90 had 2,090 insurance registrations last week, while Onvo's other model, the L60 mid-size SUV, had 1,110 registrations.

Nio Inc delivered 21,017 vehicles in July, marking the fourth consecutive month exceeding the 20,000-unit threshold, according to data released on August 1.

This represents a 2.53 percent increase from the 20,498 units delivered in the same period last year, though it marks a 15.68 percent decrease from the 24,925 units delivered in June.

The Nio main brand delivered 12,675 units in July, Onvo delivered 5,976 units, and Firefly delivered 2,366 units.

Firefly will begin deliveries in Norway and the Netherlands on August 14, Nio announced last week.

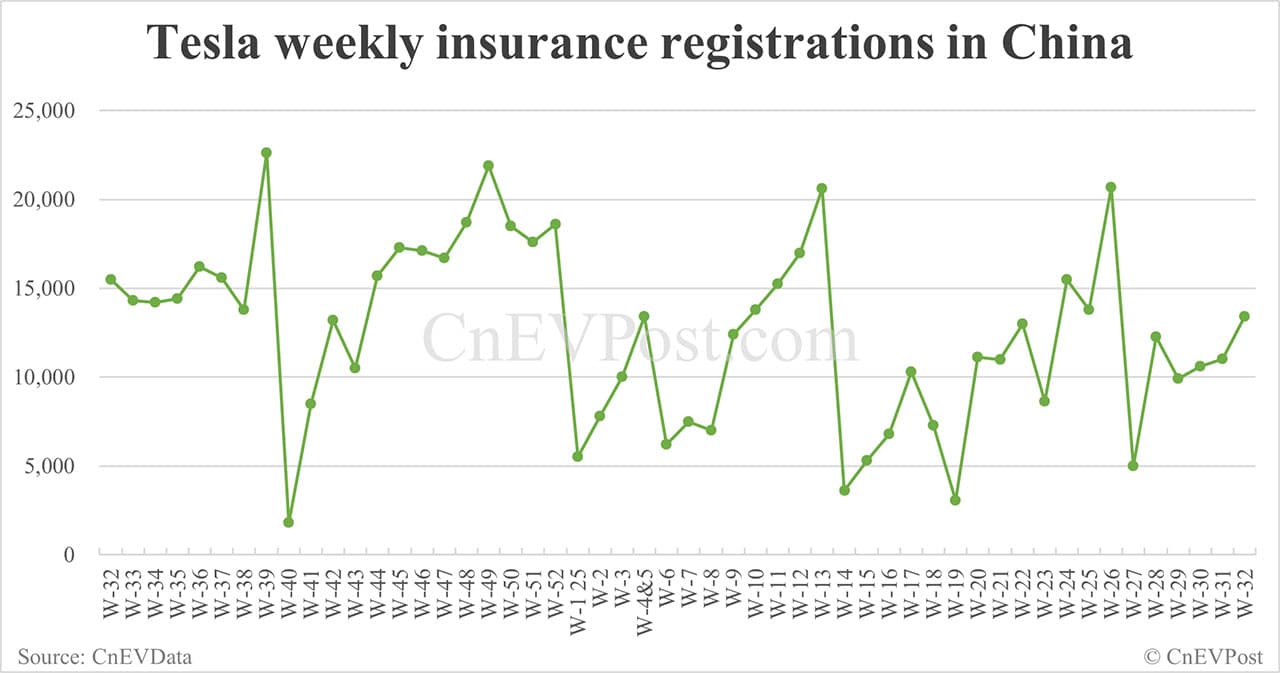

Tesla (NASDAQ: TSLA) had 13,400 insurance registrations in China last week, up 21.60 percent from 11,020 the previous week.

Earlier today, Tesla launched a new Model 3 variant in China with a CLTC range of 830 kilometers, priced at RMB 269,500 ($37,490), which is RMB 34,000 (14.44 percent) higher than the entry-level variant of the sedan priced at RMB 235,500.

Tesla will launch the six-seat Model Y L in China this fall, which is larger than the five-seat Model Y.

Tesla's retail sales in China in July were 40,617 units, down 12.14 percent from 46,227 units in the same period last year and down 33.94 percent from 61,484 units in June, according to data from the China Passenger Car Association (CPCA).

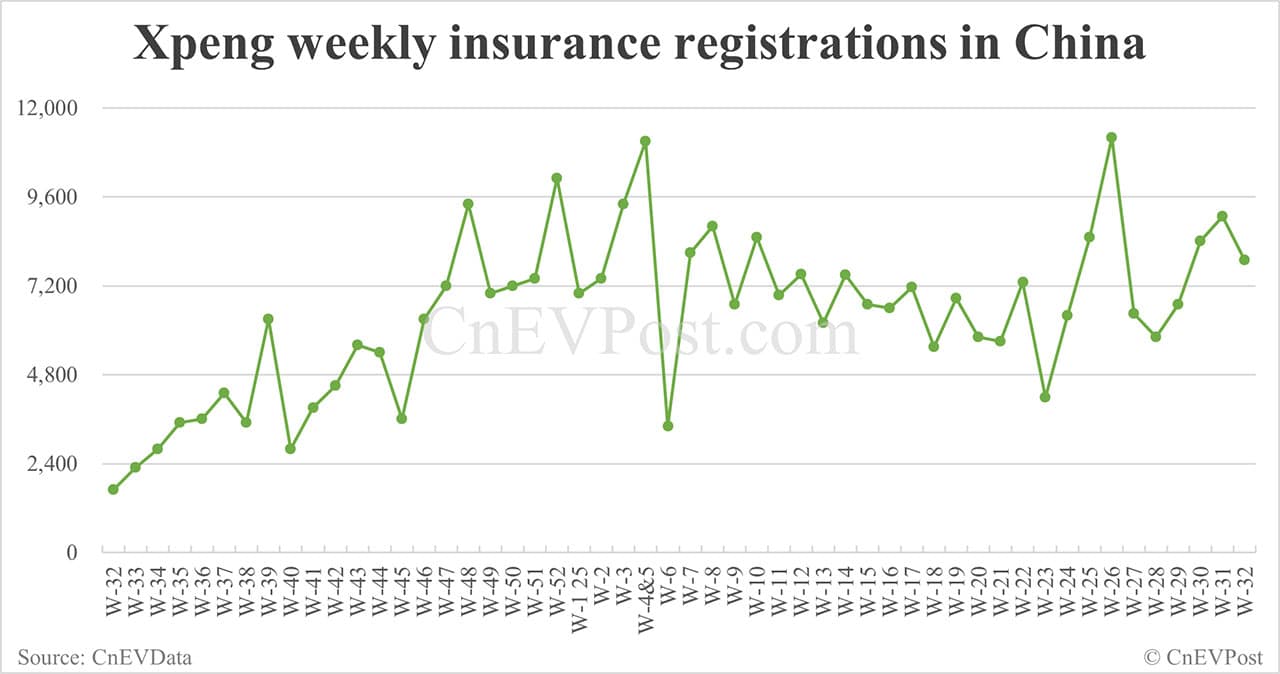

Xpeng (NYSE: XPEV) had 7,900 insurance registrations last week, a decrease of 12.90 percent from the previous week's 9,070.

It delivered 36,717 vehicles in July, surpassing the previous record of 36,695 set in December 2024 and setting a new high.

This marks the ninth consecutive month that Xpeng's monthly deliveries have exceeded 30,000 units since November 2024, representing a year-on-year increase of 229.45 percent and a month-on-month increase of 6.08 percent from June's 34,611 units.

Xpeng debuted its next-generation P7 electric sedan on August 6. The company plans to launch the extended-range electric vehicle (EREV) variant of its X9 MPV (multi-purpose vehicle) in the fourth quarter, which has already entered a regulatory filing catalog.

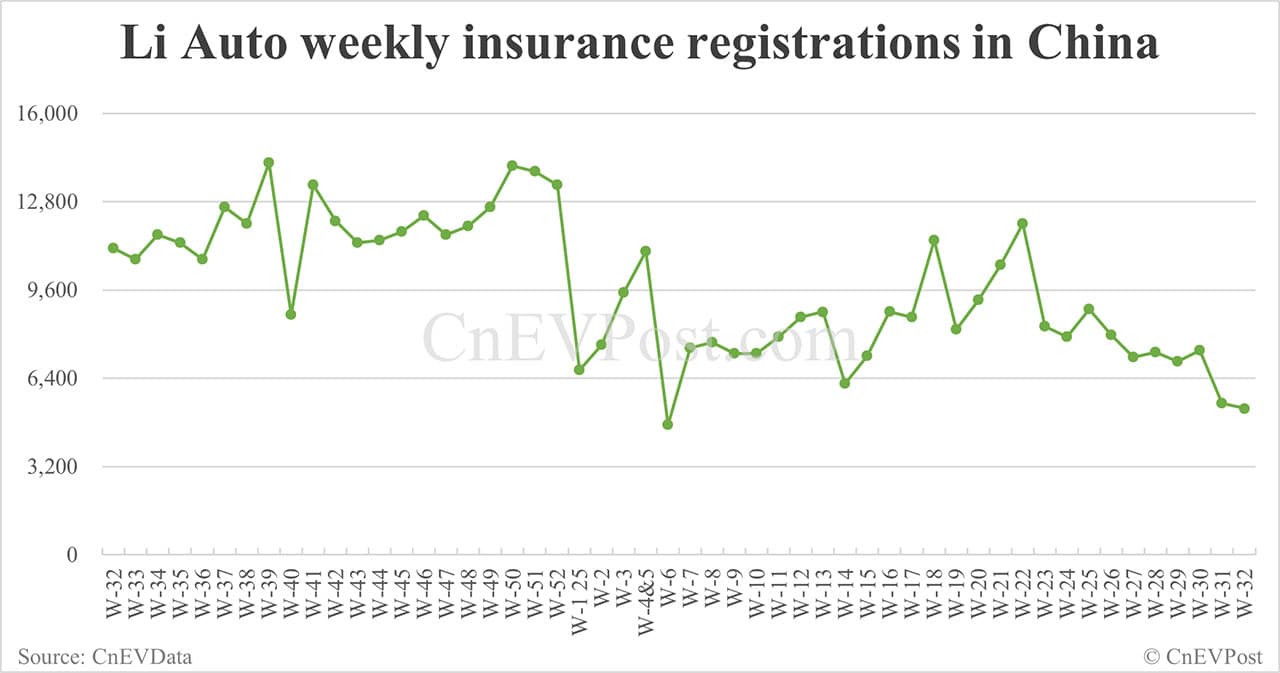

Li Auto (NASDAQ: LI) had 5,300 insurance registrations last week, a 3.28 percent decrease from the previous week's 5,480 units, marking a new low over the past 26 weeks.

The company launched the Li i8, its first all-electric SUV (sport utility vehicle), on July 29, with deliveries set to begin on August 20.

On August 5, Li Auto relaunched the Li i8, reducing the available variants from three to one and lowering prices following disappointing initial acceptance.

The company delivered 30,731 vehicles in July, down 39.74 percent year-on-year and down 15.29 percent from June.

This marks the second consecutive month of year-on-year decline in monthly deliveries for Li Auto, with year-to-date deliveries totaling 234,669 units, down 2.21 percent year-on-year.

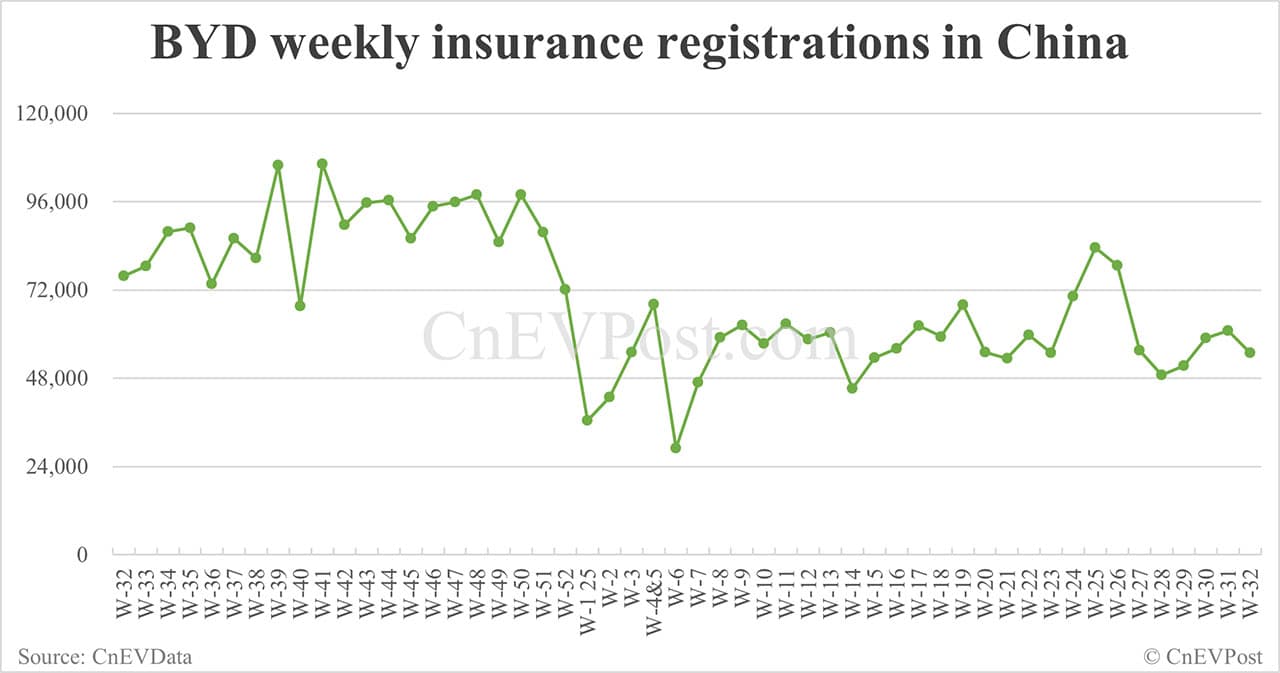

BYD (HKG: 1211, OTCMKTS: BYDDY) brand vehicles saw 54,800 insurance registrations last week, down 10.06 percent from 60,930 the previous week.

The company sold 344,296 vehicles in July, up 0.56 percent year-on-year while down 10.01 percent from June.

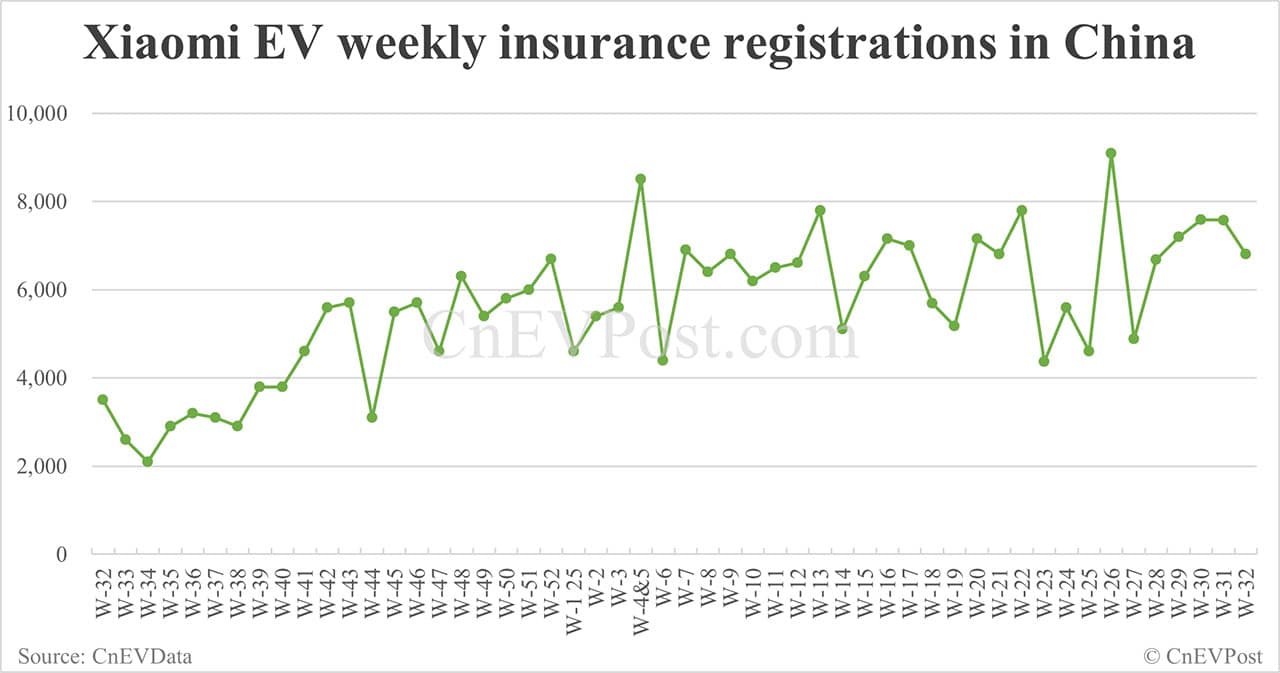

Xiaomi (HKG: 1810, OTCMKTS: XIACY) had 6,800 insurance registrations last week, down 10.29 percent from the previous week's 7,580 units.

Xiaomi EV delivered 30,452 vehicles in July, up 19.61 percent from June's 25,459 units, according to data released by the CPCA.

Xiaomi launched the YU7 on June 26, its first electric SUV and a competitor to the Tesla Model Y, with deliveries beginning on July 6.

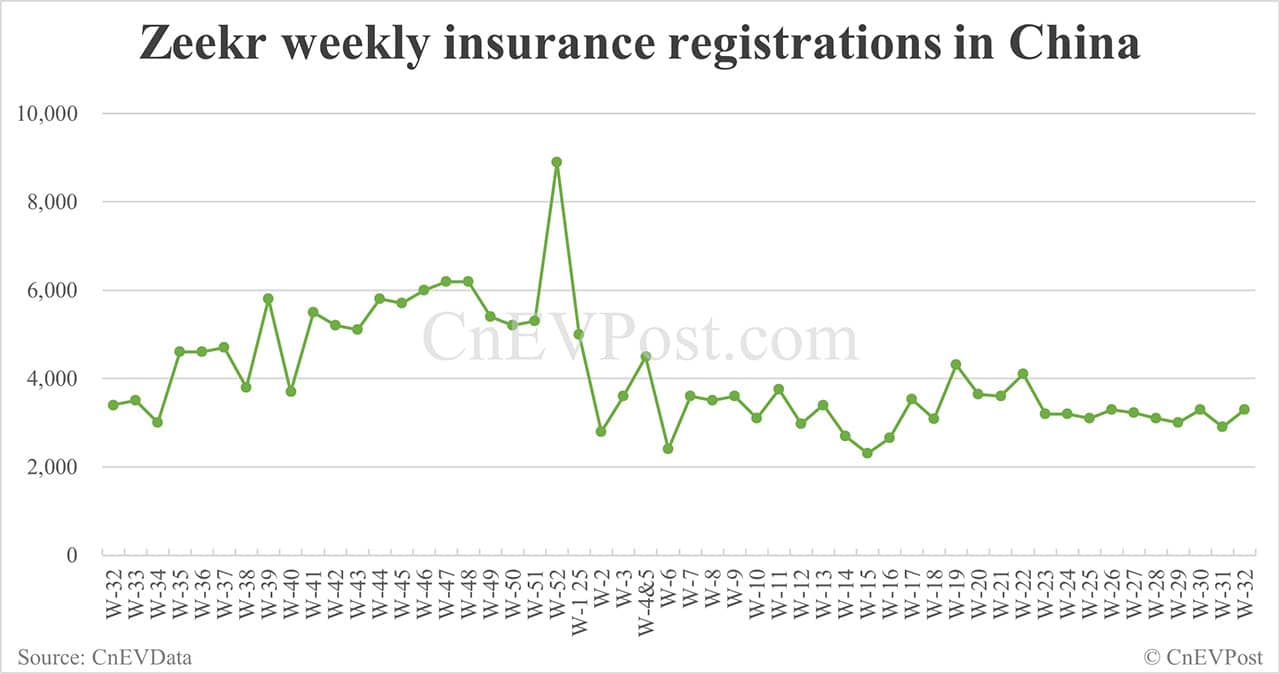

The Zeekr (NYSE: ZK) brand had 3,300 insurance registrations last week, up 13.40 percent from the previous week's 2,910.

The brand delivered 16,977 vehicles in July, up 8.44 percent year-on-year and up 1.65 percent month-on-month.

Lynk & Co delivered 27,216 vehicles in July, up 27.94 percent year-on-year and up 3.44 percent month-on-month.

Including these two brands, Zeekr Group delivered 44,193 vehicles in July, up 2.75 percent from 43,012 in June.

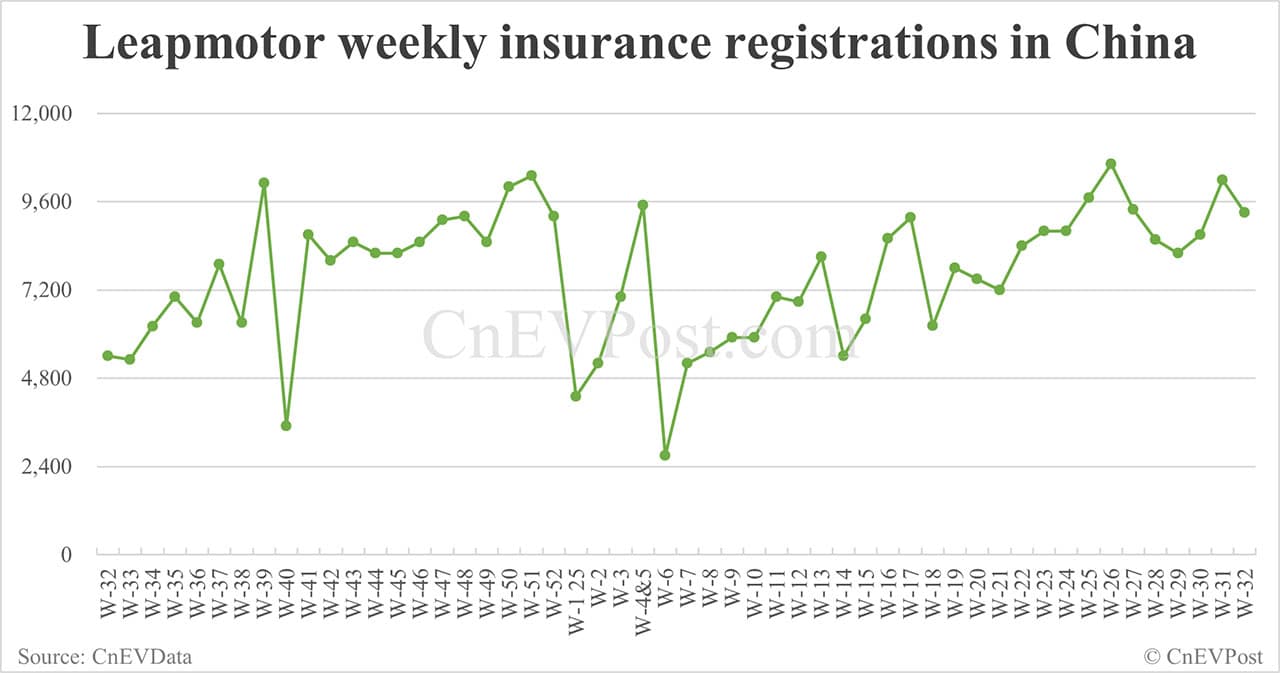

Leapmotor (HKG: 9863) had 9,300 insurance registrations last week, down 8.64 percent from 10,180 the previous week.

The company delivered 50,129 vehicles in July, marking its first monthly delivery exceeding 50,000 units, up 126.90 percent from the same period last year and up 4.42 percent from June's 48,006 units.

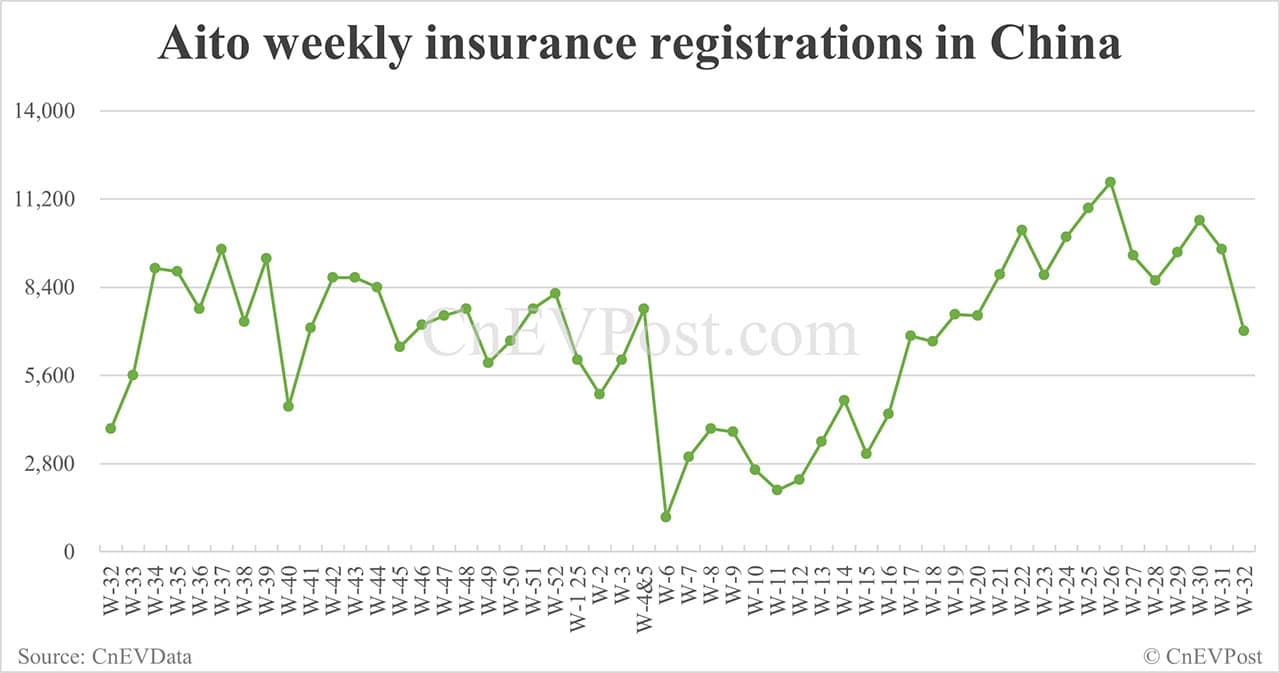

Aito, the brand jointly developed by Huawei and Seres Group, had 7,000 insurance registrations last week, a decrease of 27.16 percent from the previous week's 9,610.