Why Kennametal (KMT) Is Down 16.9% After Weaker Earnings and Cautious 2026 Outlook

- Kennametal recently reported full year and fourth quarter earnings for fiscal 2025, highlighting declines in sales and net income, and issued cautious financial guidance for fiscal 2026.

- Despite the challenging results, the company is accelerating its cost reduction initiatives and has secured new multi-year contracts in strategic segments like Aerospace & Defense.

- We’ll explore how Kennametal’s weaker results and conservative outlook may shift the company’s current investment narrative and expectations for recovery.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

Kennametal Investment Narrative Recap

To own Kennametal today, you need to believe in its ability to weather challenging industrial cycles and successfully capitalize on renewed demand in Aerospace & Defense, while proving out large-scale cost savings. The recent earnings miss and cautious 2026 outlook increase uncertainty around the timing and magnitude of any earnings recovery, while further highlighting the risk of persistent structural cost and margin pressures if market volumes remain weak. If these headwinds persist, near-term performance could remain under pressure.

Among recent announcements, Kennametal’s reaffirmed quarterly dividend of US$0.20 per share stands out. While earnings and revenue have softened, the company’s continued dividend payments offer investors some stability, though the sustainability of these returns is closely tied to its progress on cost reductions and a recovery in end-market demand. Contrast this with the potential for further margin compression if volumes do not rebound, a risk long-term investors should be keenly aware of and...

Read the full narrative on Kennametal (it's free!)

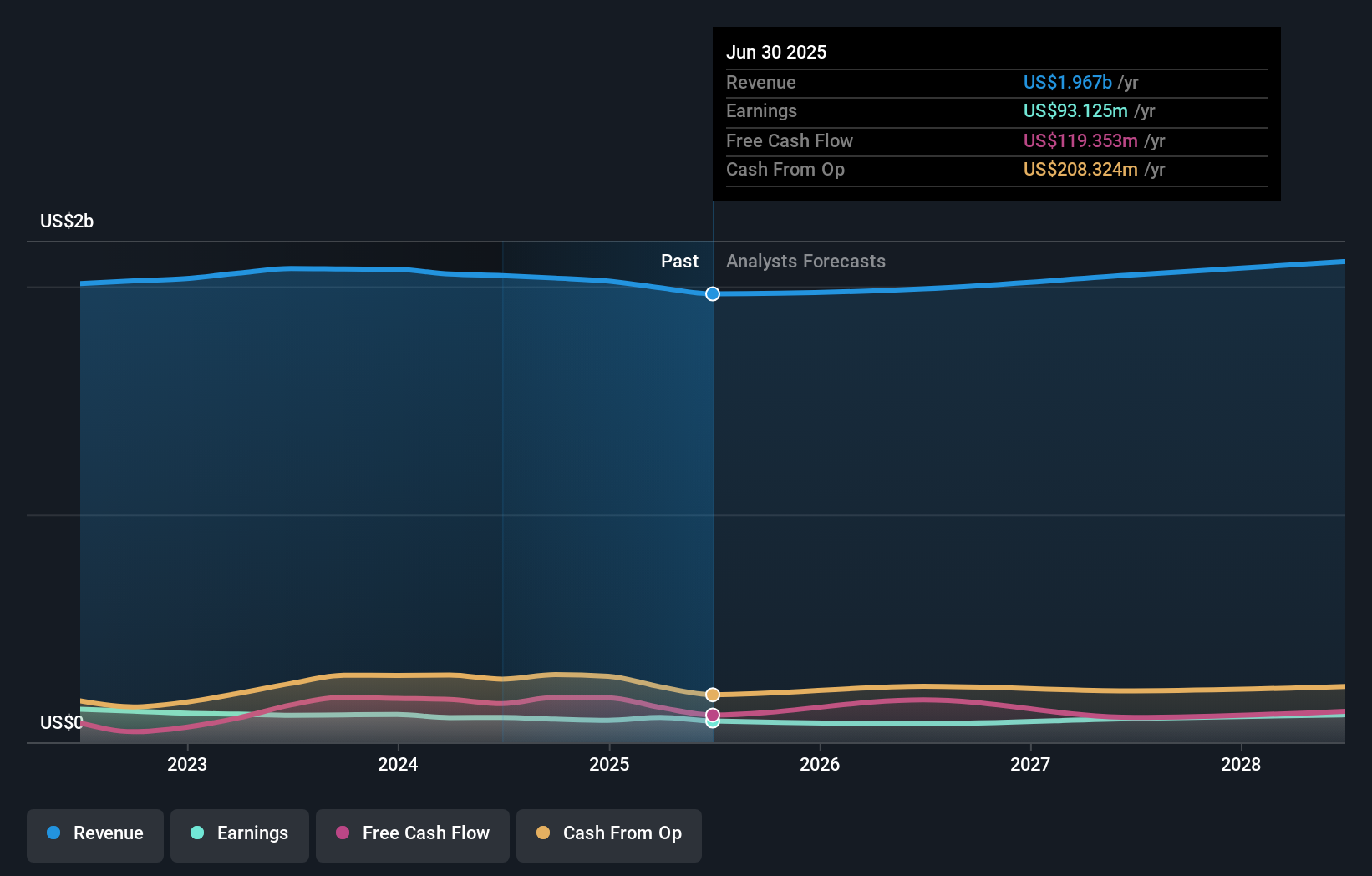

Kennametal's outlook anticipates $2.1 billion in revenue and $131.0 million in earnings by 2028. This reflects a 2.4% annual revenue growth rate and a $37.9 million increase in earnings from the current $93.1 million.

Uncover how Kennametal's forecasts yield a $22.19 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community place Kennametal’s fair value between US$22.19 and US$27.45 across 2 perspectives. However, persistently low market volumes and prolonged end-market weakness could keep pressure on both margins and valuation, explore the full range of views from our community and analysts alike.

Explore 2 other fair value estimates on Kennametal - why the stock might be worth as much as 36% more than the current price!

Build Your Own Kennametal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kennametal research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kennametal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kennametal's overall financial health at a glance.

No Opportunity In Kennametal?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10