3 Penny Stocks With Market Caps Over $700M To Watch

As the Nasdaq closes at a record high, driven by a tech stock rally led by Apple, investors are witnessing solid weekly gains across major indexes. In such an optimistic market landscape, penny stocks remain a noteworthy area for those seeking growth opportunities. Although the term 'penny stock' might seem outdated, it continues to signify smaller or emerging companies that can offer substantial value when backed by strong financials and clear growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.81 | $654.61M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9323 | $158.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $3.69 | $185.87M | ✅ 3 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.791 | $22.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $87.75M | ✅ 3 ⚠️ 2 View Analysis > |

| Riverview Bancorp (RVSB) | $4.92 | $103.07M | ✅ 2 ⚠️ 1 View Analysis > |

| BAB (BABB) | $0.89 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.98 | $89.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.60 | $153.36M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $3.92 | $522.46M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 418 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

LifeStance Health Group (LFST)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LifeStance Health Group, Inc. operates through its subsidiaries to offer outpatient mental health services across various age groups in the United States and has a market cap of approximately $1.70 billion.

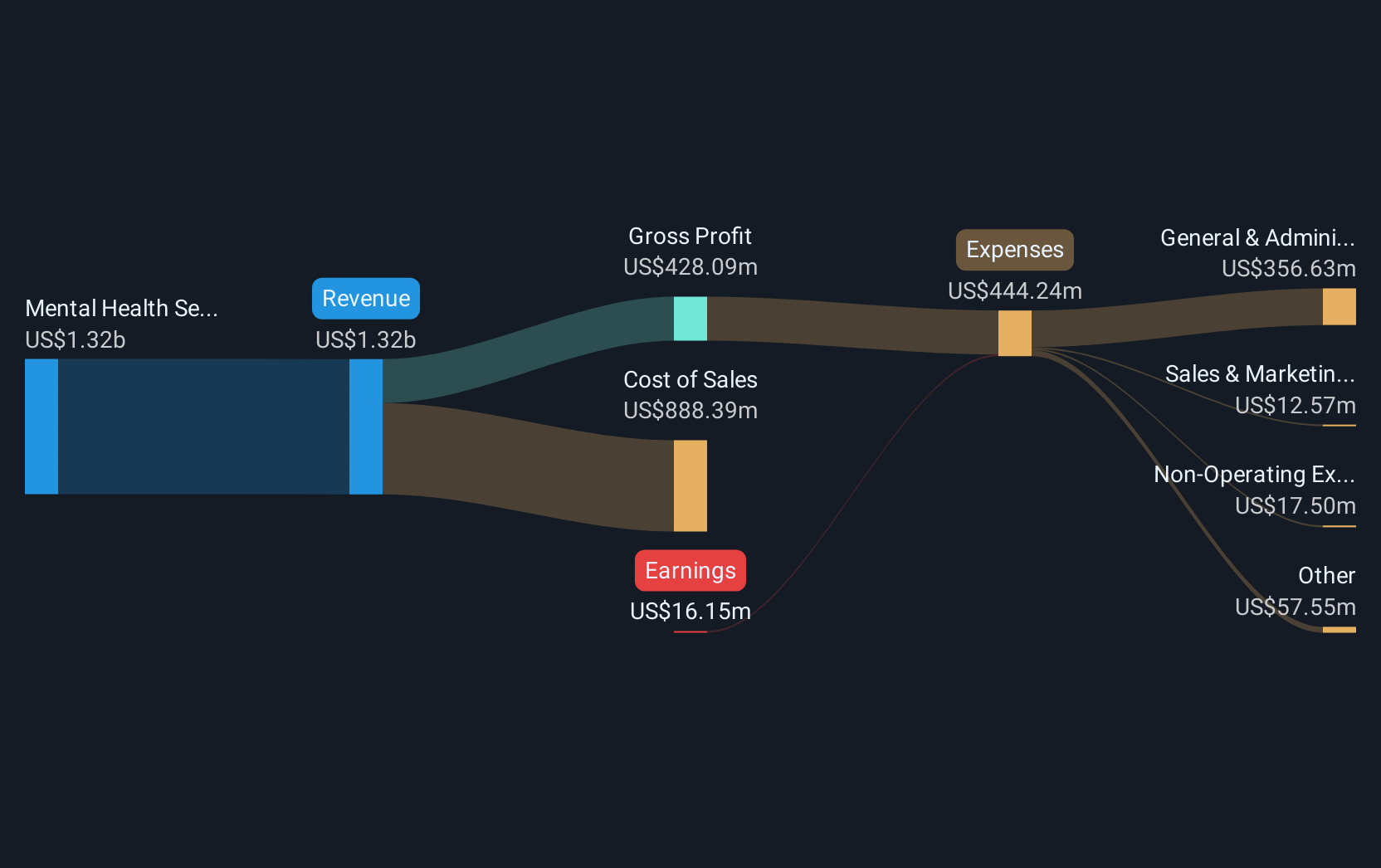

Operations: The company generates revenue primarily from its mental health services, totaling $1.32 billion.

Market Cap: $1.7B

LifeStance Health Group, Inc. has shown significant revenue growth, reporting US$345.31 million in sales for Q2 2025, an increase from the previous year. Despite being unprofitable, it reduced its net loss to US$3.79 million from US$23.28 million a year ago and maintains a satisfactory net debt to equity ratio of 6.4%. The company has a stable cash runway exceeding three years due to positive free cash flow growth and is trading at 74.6% below its estimated fair value according to analysts who expect the stock price to rise significantly by 92.9%.

- Jump into the full analysis health report here for a deeper understanding of LifeStance Health Group.

- Learn about LifeStance Health Group's future growth trajectory here.

Solid Power (SLDP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solid Power, Inc. focuses on developing solid-state battery technologies for electric vehicles and other markets in the United States, with a market cap of $707.01 million.

Operations: The company generates revenue from its Auto Parts & Accessories segment, amounting to $22.67 million.

Market Cap: $707.01M

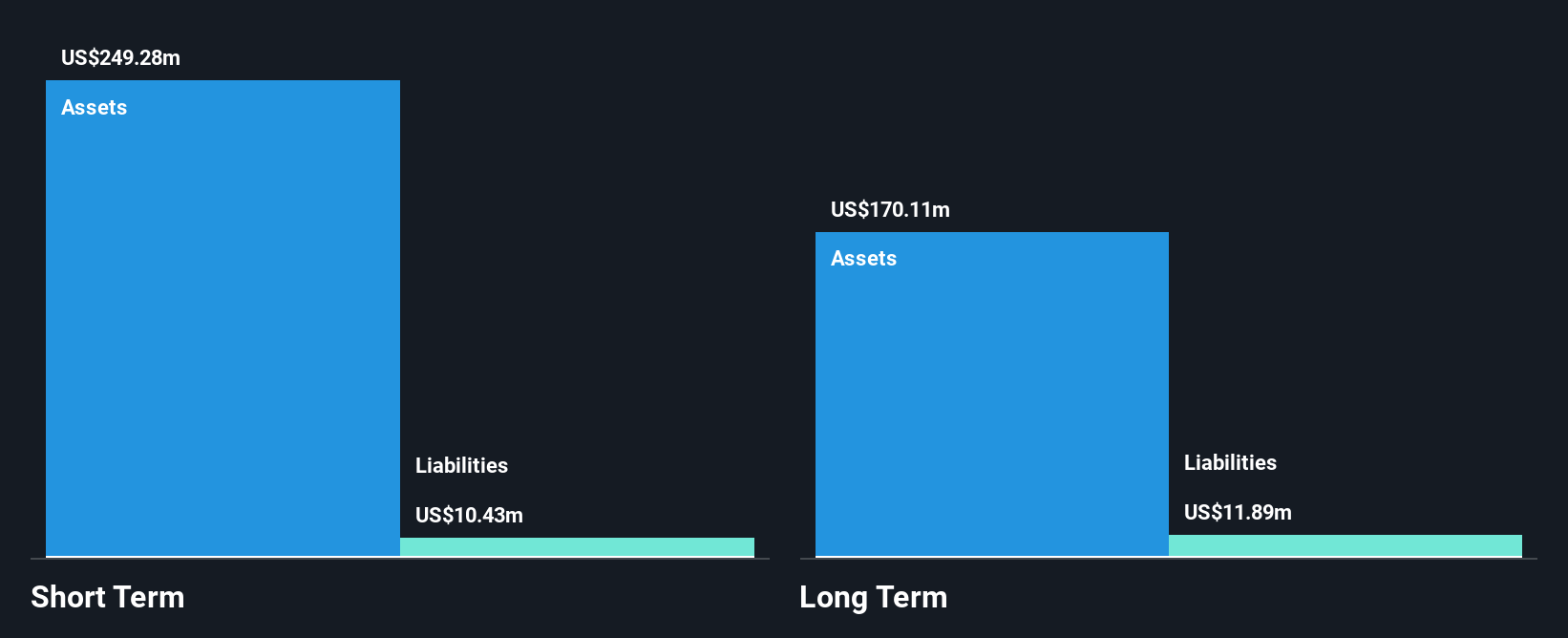

Solid Power, Inc. has been added to multiple Russell Growth indices, reflecting its potential interest within the investment community. Despite being unprofitable with a net loss of US$25.34 million for Q2 2025, the company reported increased revenue of US$7.54 million compared to the previous year. It remains debt-free and possesses sufficient short-term assets (US$239.7M) to cover liabilities, providing financial stability in the near term. However, significant insider selling and high share price volatility could be concerning for investors seeking stability in penny stocks focused on solid-state battery technology development for electric vehicles.

- Click to explore a detailed breakdown of our findings in Solid Power's financial health report.

- Gain insights into Solid Power's outlook and expected performance with our report on the company's earnings estimates.

NIO (NIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NIO Inc. designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally with a market cap of approximately $10.85 billion.

Operations: The company's revenue is primarily derived from its Smart Electric Vehicles Related Business, amounting to CN¥67.86 billion.

Market Cap: $10.85B

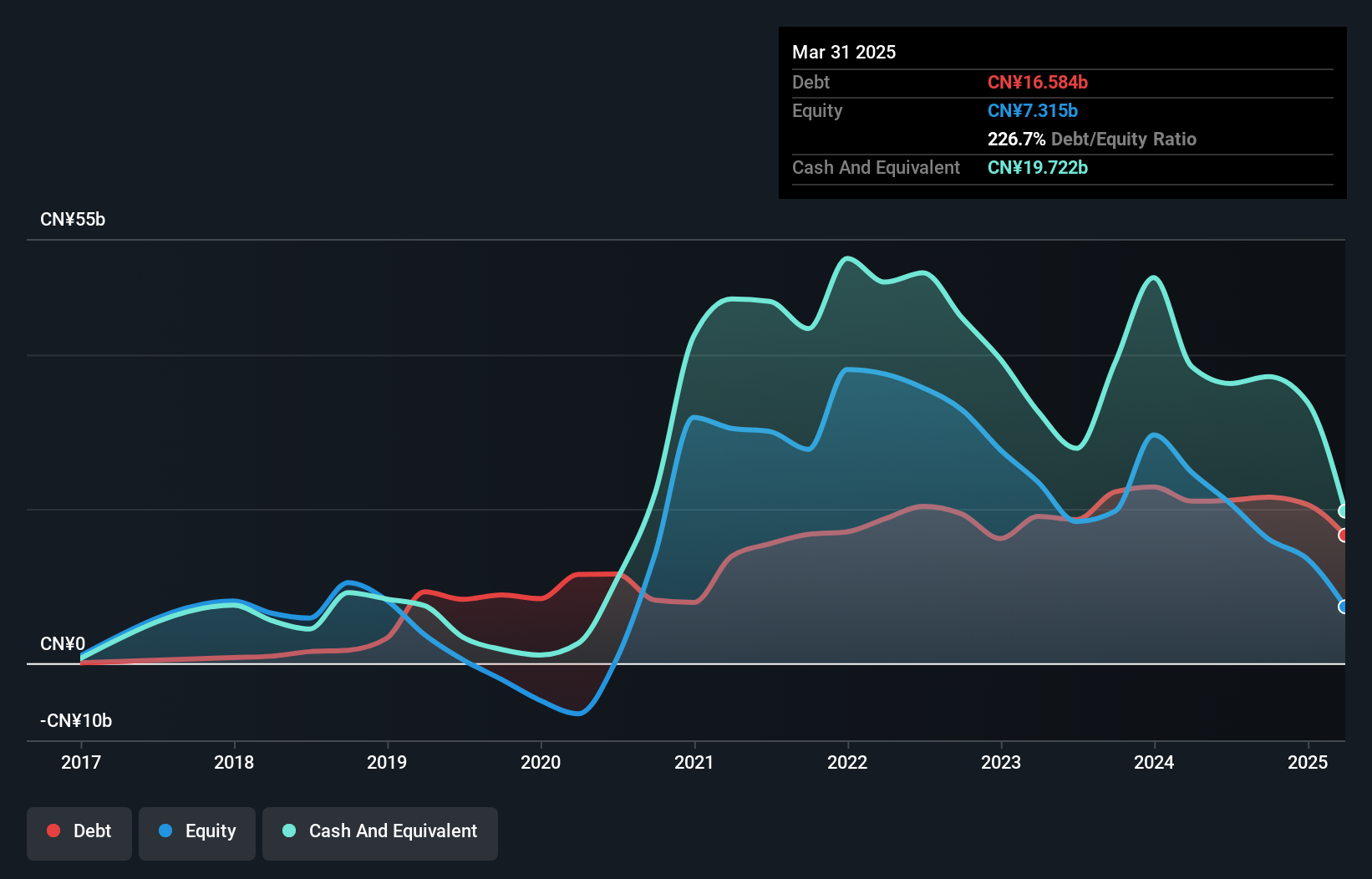

NIO Inc.'s market cap of approximately $10.85 billion positions it outside typical penny stock parameters, yet its financial dynamics offer insights for investors. The company is unprofitable with increasing losses over the past five years but maintains a positive shift in shareholder equity. Recent delivery results show robust vehicle sales growth, with July 2025 deliveries reaching 21,017 units across its brands. While NIO's board lacks seasoned experience, its management team is well-tenured. Despite a negative return on equity and short-term liabilities exceeding assets, NIO has sufficient cash runway and forecasts revenue growth of 18.3% annually.

- Navigate through the intricacies of NIO with our comprehensive balance sheet health report here.

- Explore NIO's analyst forecasts in our growth report.

Taking Advantage

- Explore the 418 names from our US Penny Stocks screener here.

- Seeking Other Investments? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10