Uncovering 3 Undiscovered Gems in the US Market

As the U.S. market experiences a resurgence with major indexes posting solid weekly gains and the Nasdaq closing at record highs, investors are keenly observing the shifts in economic indicators and market sentiment. Amidst this backdrop, identifying promising stocks often involves looking beyond the well-trodden paths of mega-cap technology companies to uncover lesser-known opportunities that may offer unique growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Wilson Bank Holding | NA | 8.04% | 8.12% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Click here to see the full list of 288 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Underneath we present a selection of stocks filtered out by our screen.

Tiptree (TIPT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tiptree Inc. operates through its subsidiaries to offer specialty insurance products and related services in the United States and Europe, with a market capitalization of $813 million.

Operations: The company generates revenue primarily from its insurance segment, amounting to $1.96 billion, and a smaller contribution from the mortgage segment at $65.55 million.

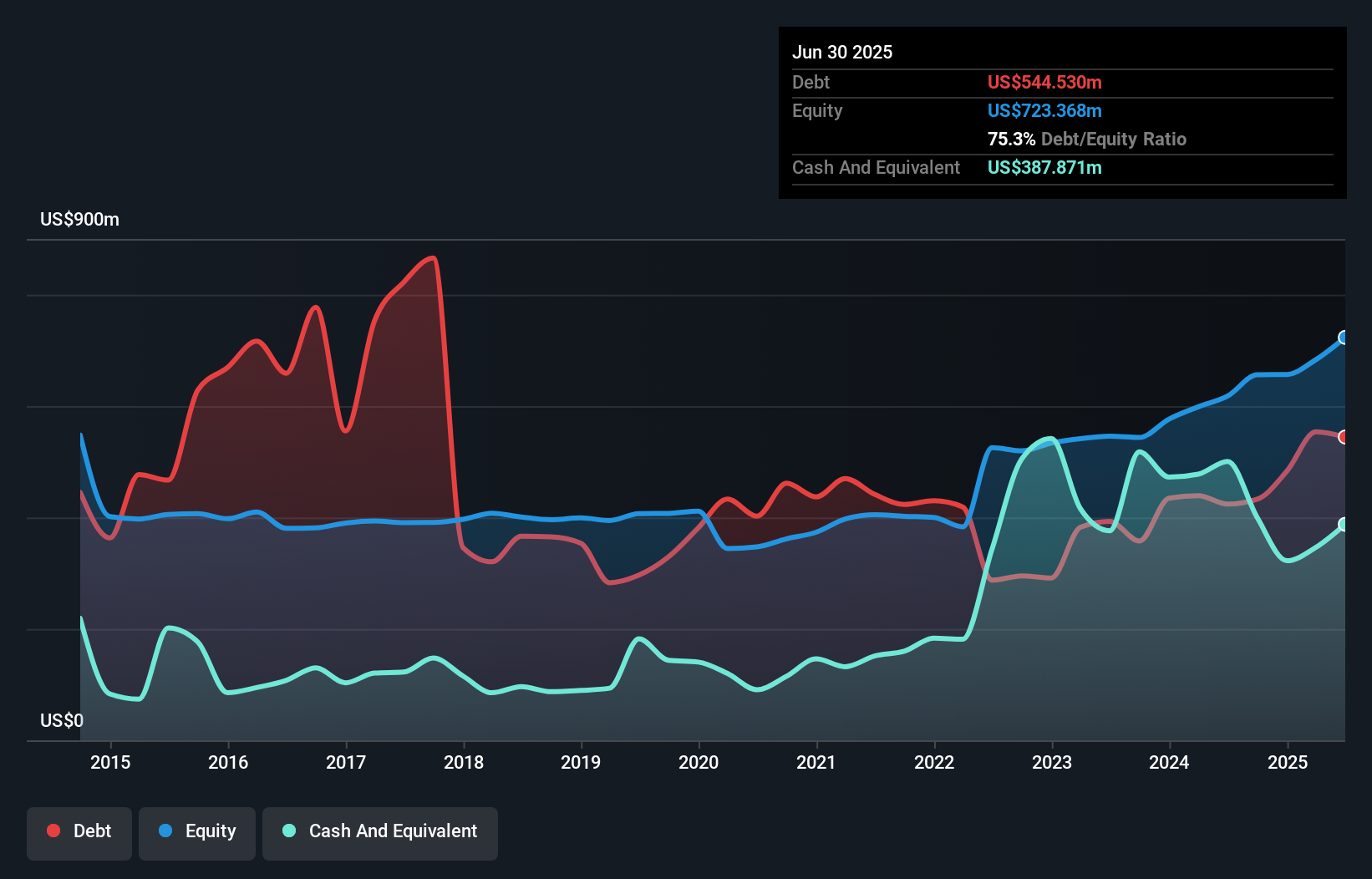

Tiptree, a financial services company, has shown notable resilience with its net debt to equity ratio improving from 115.9% to 75.3% over five years, suggesting effective debt management. Its earnings growth of 81.4% in the past year outpaced the insurance industry average of 8.7%, highlighting robust performance despite revenue dipping slightly to US$528.75 million in Q2 2025 from US$546.67 million last year. The company's price-to-earnings ratio at 14.6x remains attractive compared to the broader market's 18.5x, and its inclusion in multiple Russell indices underscores market confidence in its strategic direction and potential growth trajectory.

- Click to explore a detailed breakdown of our findings in Tiptree's health report.

Evaluate Tiptree's historical performance by accessing our past performance report.

ePlus (PLUS)

Simply Wall St Value Rating: ★★★★★★

Overview: ePlus Inc., along with its subsidiaries, offers IT solutions to enhance IT environments and supply chain processes for organizations both in the United States and internationally, with a market capitalization of approximately $1.83 billion.

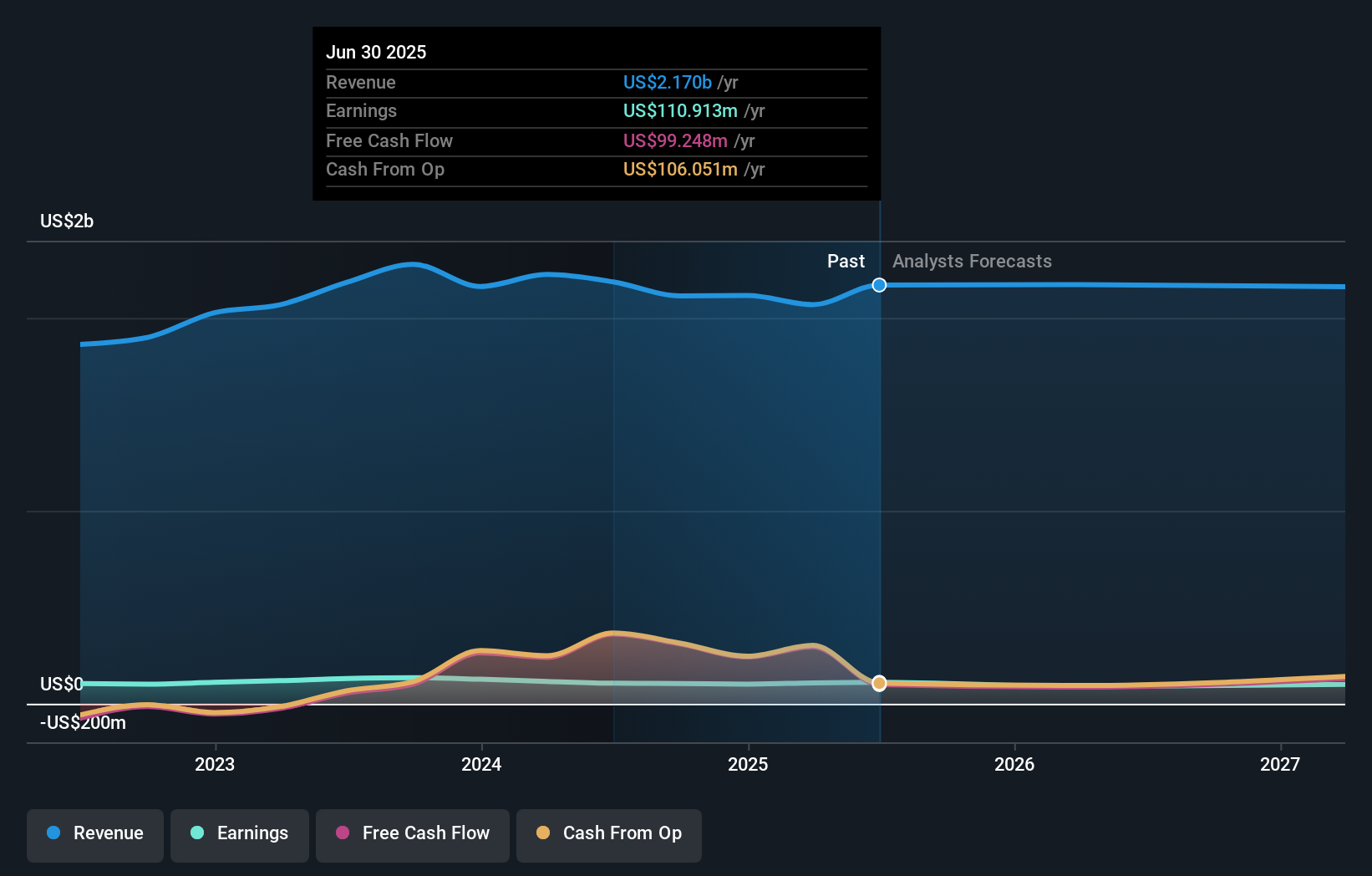

Operations: ePlus generates revenue primarily from product sales ($1.67 billion), managed services ($175.02 million), and professional services ($263.48 million). The company's financial performance is influenced by its net profit margin, which reflects the efficiency of its operations and cost management strategies.

ePlus, a tech-focused company, has been making waves with its strategic pivot towards a services-led model and AI investments. Recent earnings showed revenue at US$637 million, up from US$536 million the previous year, while net income rose to US$37.7 million from US$27.3 million. The firm's price-to-earnings ratio of 16.5x is appealing compared to the broader market's 18.5x, and its debt-to-equity ratio impressively decreased from 54% to 13% over five years. Despite being dropped from several indices recently, ePlus remains committed to growth through acquisitions and enhancing service offerings in security solutions.

- ePlus is strategically transitioning to a services-led model with subscription-based income driving growth. Click here to explore the narrative on ePlus's strategic transition and growth potential.

Banco Latinoamericano de Comercio Exterior S. A (BLX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Banco Latinoamericano de Comercio Exterior S.A. (BLX) is a financial institution that provides trade financing to commercial banks, corporations, and sovereign entities in Latin America and the Caribbean, with a market cap of $1.57 billion.

Operations: BLX generates revenue primarily from its Commercial segment, contributing $274.85 million, followed by the Treasury segment at $31.33 million.

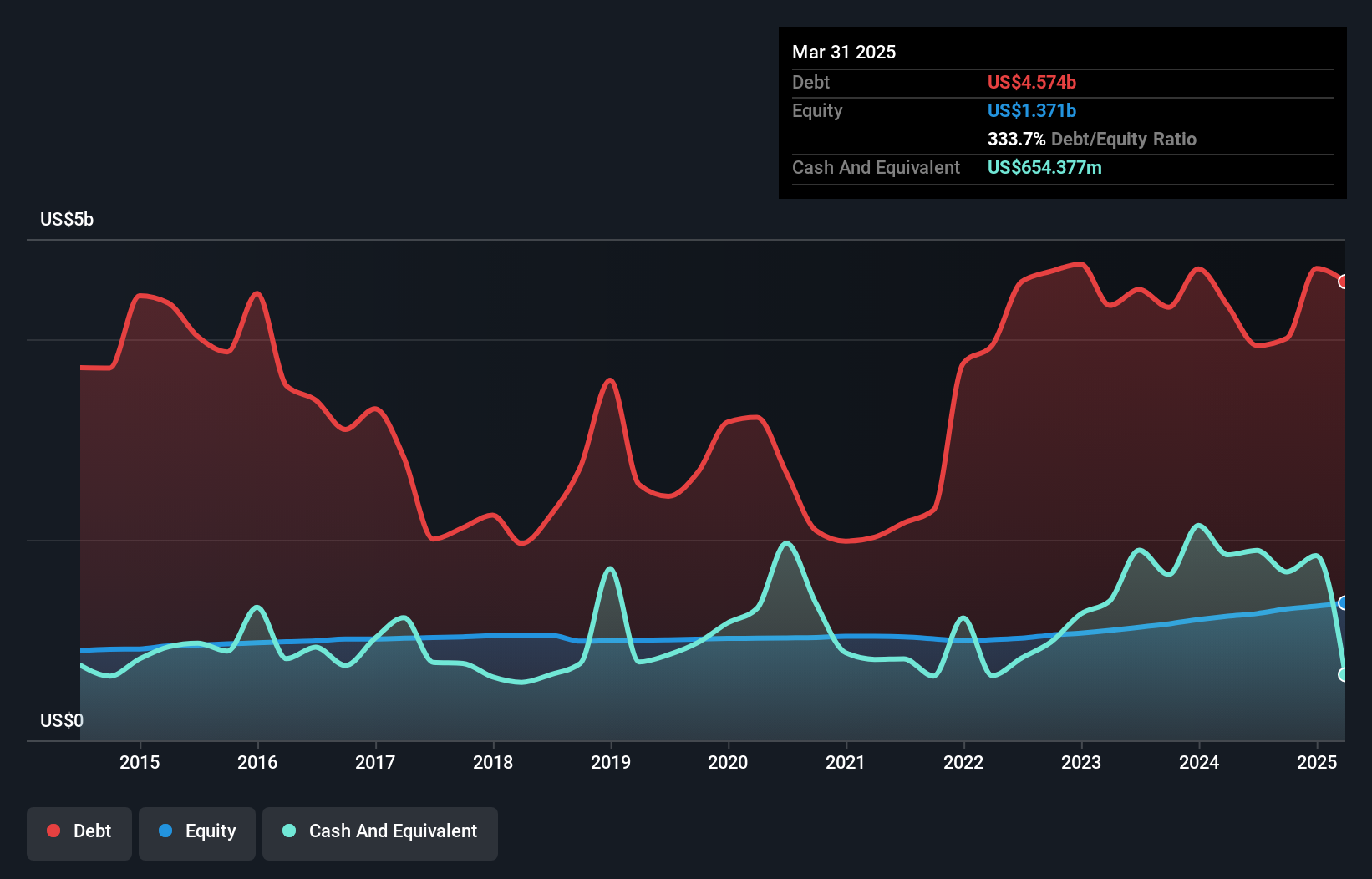

Bladex, a financial institution with total assets of US$12.7 billion and equity of US$1.4 billion, is making strides in the Latin American market through strategic alliances and product diversification. Holding deposits worth US$6.4 billion against loans of US$8.5 billion, it boasts a sufficient allowance for bad loans at 437% and maintains an appropriate non-performing loan ratio of 0.2%. Despite being dropped from several indices recently, Bladex's earnings grew by 13.9% last year, outpacing industry growth rates while trading at 7.3% below its fair value estimate suggests potential upside for investors seeking opportunities in evolving markets.

- Bladex's strategic expansion into new product offerings is driving revenue growth. Click here to explore the full narrative on Bladex's strategic initiatives and market positioning.

Make It Happen

- Navigate through the entire inventory of 288 US Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10