- Fidelity National Financial, Inc. announced its Board of Directors has declared a quarterly cash dividend of US$0.50 per share, payable on September 30, 2025, to stockholders of record as of September 16, 2025.

- The company's recent performance included robust growth in adjusted pretax earnings in its core Title segment and a strong increase in commercial volumes, underscoring operational momentum and ongoing capital returns to shareholders.

- We will now examine how this affirmation of dividend payments and continued free cash flow generation could impact the company’s broader investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

Fidelity National Financial Investment Narrative Recap

At the heart of Fidelity National Financial’s investment case is confidence in the resilience of US real estate transactions and the company’s leading role in title insurance and related services. The reaffirmed US$0.50 per share dividend and steady free cash flow provide income predictability, yet the most important near-term catalyst, commercial volume growth, remains sensitive to macroeconomic conditions, particularly the pace of recovery in the office sector. The recent dividend announcement is not likely to significantly change these short-term drivers or mitigate the biggest risk from sluggish home sales amid high mortgage rates.

Among recent company updates, the August earnings report stands out: Fidelity posted a 4 percent year-over-year gain in adjusted pretax title earnings and saw direct commercial revenue rise 23 percent for the first half of 2025. This momentum highlights how continued strength in commercial transactions can remain a key lever for offsetting softness in residential activity, especially if mortgage rates remain elevated.

In contrast, what investors should watch closely is the risk that persistently high mortgage rates could continue to depress home sales and reduce title transaction volumes...

Read the full narrative on Fidelity National Financial (it's free!)

Fidelity National Financial's narrative projects $16.2 billion revenue and $2.0 billion earnings by 2028. This requires 7.2% yearly revenue growth and an increase in earnings of $0.9 billion from current earnings of $1.1 billion.

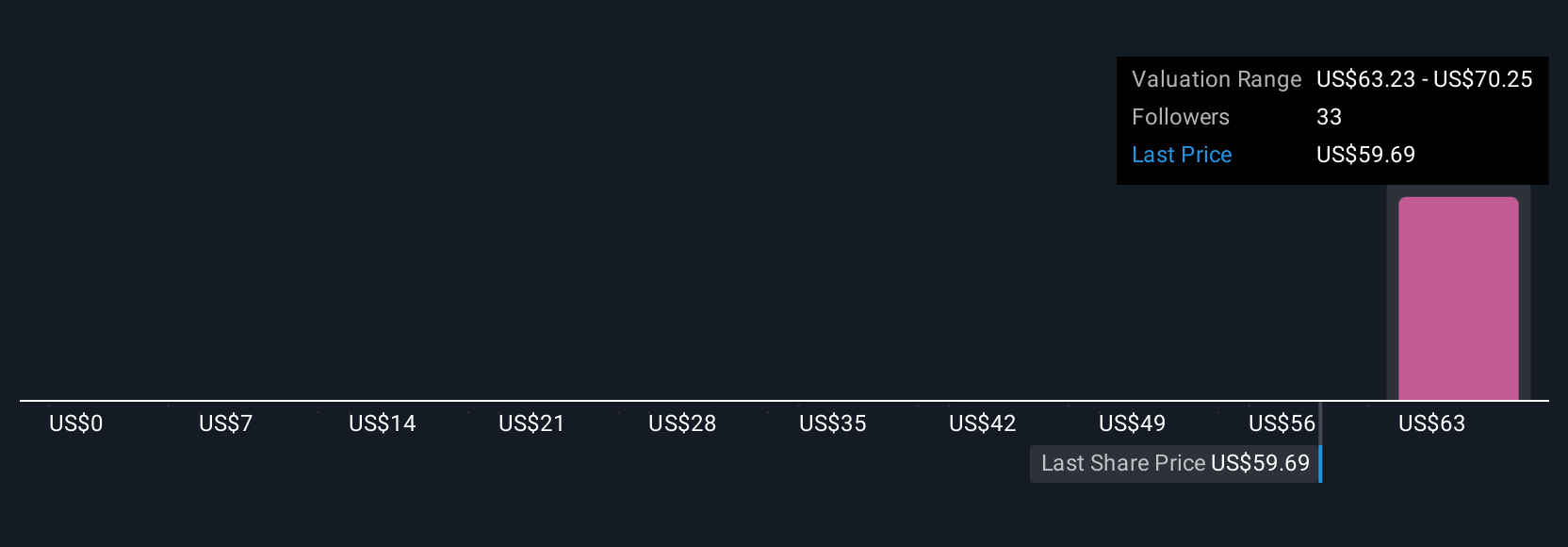

Uncover how Fidelity National Financial's forecasts yield a $70.25 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Six individual investor fair value estimates from the Simply Wall St Community range from US$7.03 to US$70.25 per share. While most see opportunity in Fidelity’s commercial growth, views on future risks like continued weakness in residential real estate are split, encouraging a look at several viewpoints.

Explore 6 other fair value estimates on Fidelity National Financial - why the stock might be worth as much as 21% more than the current price!

Build Your Own Fidelity National Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelity National Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Fidelity National Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelity National Financial's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com