- In the past week, Cummins Inc. reported second-quarter 2025 results with net income rising to US$890 million on US$8.64 billion in sales, largely driven by record gains in its Distribution and Power Systems segments even as core engine markets weakened.

- The company increased its quarterly dividend for the sixteenth consecutive year, underscoring confidence in its long-term growth prospects despite headwinds in traditional truck markets.

- We'll explore how Cummins' robust performance in Power Systems and a higher dividend impact the company's investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cummins Investment Narrative Recap

For an investor to remain confident in Cummins, it comes down to belief in the company’s ability to offset ongoing weakness in North American heavy truck engine demand by leveraging growth opportunities in Power Systems and Distribution. The latest quarterly results did little to alter this near-term outlook: while strong segment profitability and earnings surprised to the upside, persistent uncertainty around emissions regulations and truck order softness continue to represent the largest risk to short-term earnings momentum.

The most relevant recent announcement is Cummins’ sixteenth consecutive dividend increase, raising the quarterly payout to US$2.00 per share. This underscores management’s commitment to capital returns despite core market headwinds and signals confidence in the earnings power of its diversifying business lines, especially as data center-driven demand pushes Power Systems performance to new highs.

Yet, in contrast to resilient dividends, the real risk comes if North American truck demand lags further and...

Read the full narrative on Cummins (it's free!)

Cummins' outlook anticipates $40.0 billion in revenue and $4.1 billion in earnings by 2028. This scenario assumes a 5.9% annual revenue growth rate and an increase in earnings of $1.2 billion from the current $2.9 billion.

Uncover how Cummins' forecasts yield a $386.44 fair value, in line with its current price.

Exploring Other Perspectives

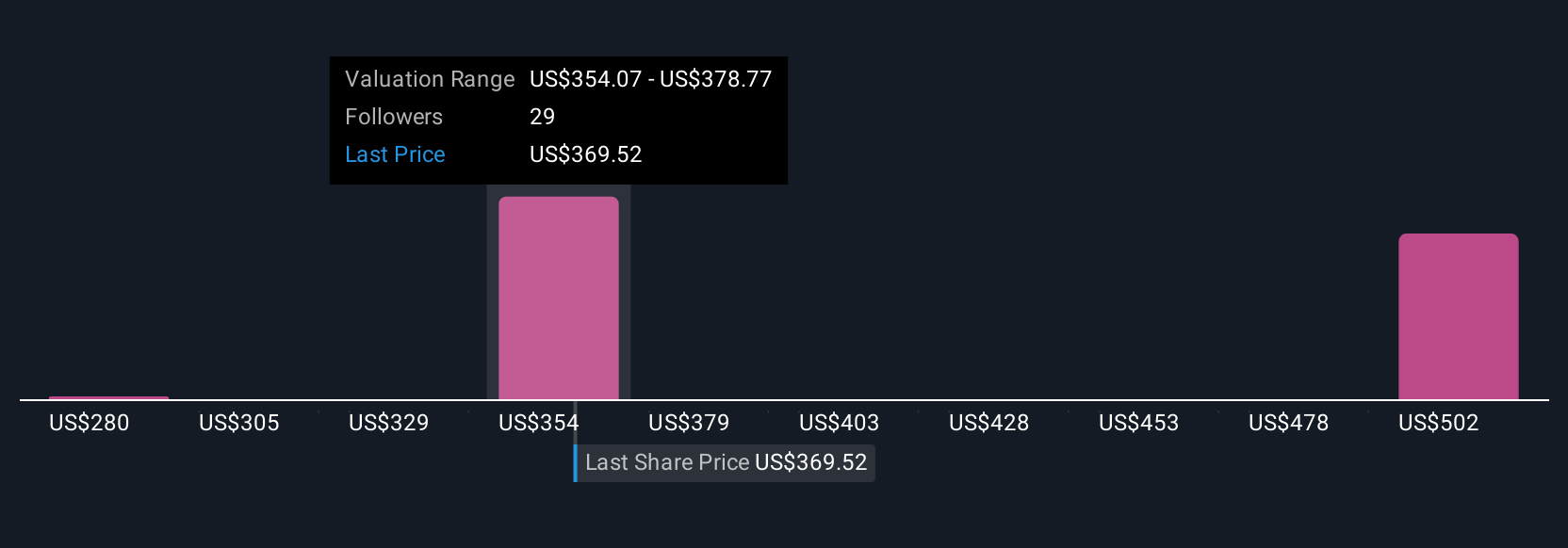

Four fair value estimates from the Simply Wall St Community range from US$280 to US$638 per share, with wide differences in growth outlooks. While many see opportunity in Cummins’ power generation expansion, risks from regulatory and truck market volatility still weigh on potential outcomes, consider several viewpoints before deciding.

Explore 4 other fair value estimates on Cummins - why the stock might be worth 28% less than the current price!

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cummins' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com