Insider Favorites For Growth In August 2025

As major U.S. indices like the S&P 500 and Nasdaq Composite edge toward new record highs, investors are closely monitoring key inflation data that could influence market trajectories. In this environment of cautious optimism, growth companies with high insider ownership often attract attention due to their potential for alignment between management and shareholder interests, making them intriguing options for those looking to navigate the current market landscape.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.1% |

| Niu Technologies (NIU) | 37.2% | 88.1% |

| Hippo Holdings (HIPO) | 12.8% | 52.5% |

| FTC Solar (FTCI) | 23.2% | 63.1% |

| Duolingo (DUOL) | 14.1% | 36.8% |

| Credo Technology Group Holding (CRDO) | 11.5% | 36.4% |

| Cloudflare (NET) | 10.6% | 45.8% |

| Celsius Holdings (CELH) | 10.8% | 39.6% |

| Atour Lifestyle Holdings (ATAT) | 22% | 23.5% |

| Astera Labs (ALAB) | 12.5% | 37% |

Click here to see the full list of 187 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Let's explore several standout options from the results in the screener.

Arq (ARQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arq, Inc. is an environmental technology company that provides consumable air, water, and soil treatment solutions using activated carbon in the United States and Canada, with a market cap of $279.44 million.

Operations: The company generates revenue from its Advanced Purification Technologies segment, which amounted to $114.47 million.

Insider Ownership: 18.5%

Earnings Growth Forecast: 50.8% p.a.

Arq, Inc. has demonstrated substantial insider buying over the past three months, indicating confidence in its strategic direction. The company recently achieved a significant milestone with the commissioning of its first Granular Activated Carbon production line, marking progress in its business transformation. Despite being dropped from several growth indices, Arq's revenue is forecast to grow at 17.2% annually, outpacing the US market average of 9.3%. However, it faces challenges with high share price volatility and past shareholder dilution.

- Click to explore a detailed breakdown of our findings in Arq's earnings growth report.

- In light of our recent valuation report, it seems possible that Arq is trading beyond its estimated value.

EHang Holdings (EH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EHang Holdings Limited is a technology platform company focused on urban air mobility (UAM) solutions across various regions including China, East Asia, West Asia, North America, South America, West Africa, and Europe with a market cap of approximately $1.29 billion.

Operations: The company's revenue primarily comes from its Aerospace & Defense segment, which generated CN¥420.52 million.

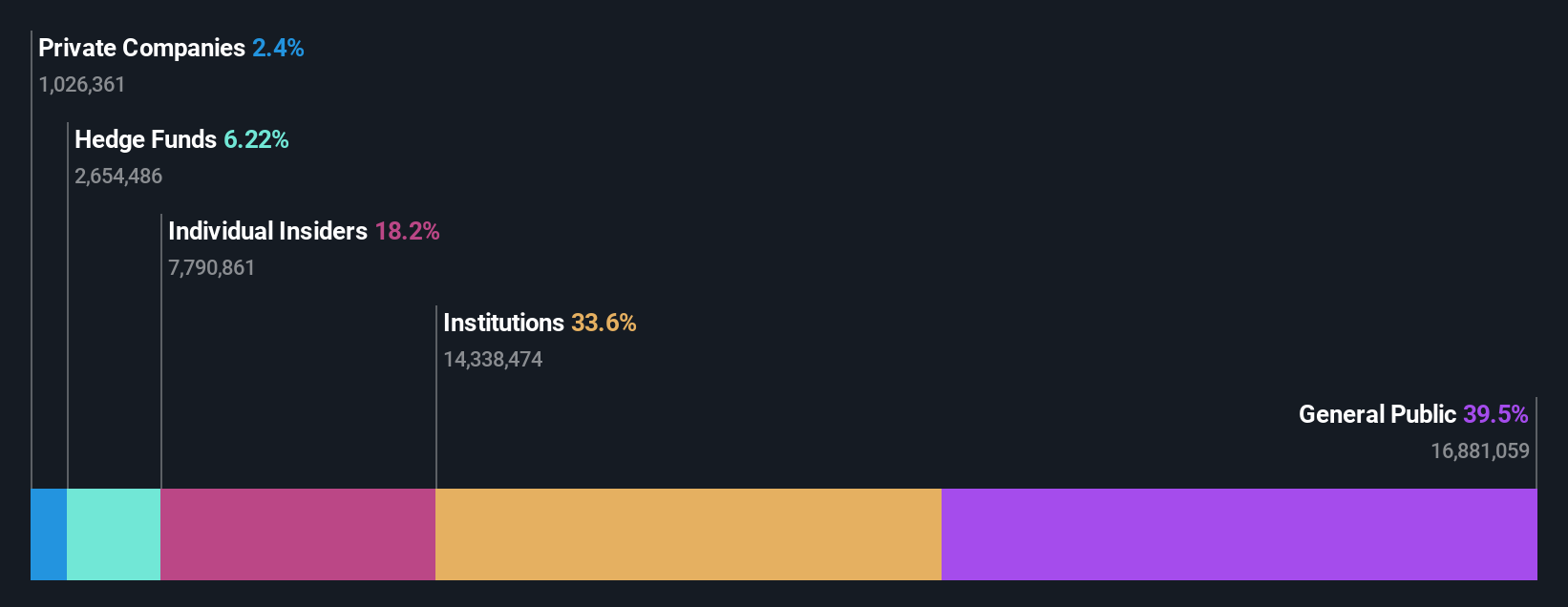

Insider Ownership: 27.8%

Earnings Growth Forecast: 63.7% p.a.

EHang Holdings is poised for substantial growth, with revenue expected to increase by 32.3% annually, outpacing the US market. The company recently completed successful UAV cargo flights in China, highlighting its potential in logistics. Despite a current net loss and low return on equity forecast, EHang is projected to become profitable within three years. Trading significantly below fair value estimates and with strong analyst support for price appreciation, it remains an intriguing prospect amidst strategic partnerships and expanding application scenarios.

- Dive into the specifics of EHang Holdings here with our thorough growth forecast report.

- Our valuation report here indicates EHang Holdings may be undervalued.

Ryan Specialty Holdings (RYAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ryan Specialty Holdings, Inc. provides specialty products and solutions for insurance brokers, agents, and carriers across several regions including the United States, Canada, the United Kingdom, Europe, India, and Singapore with a market cap of approximately $15.42 billion.

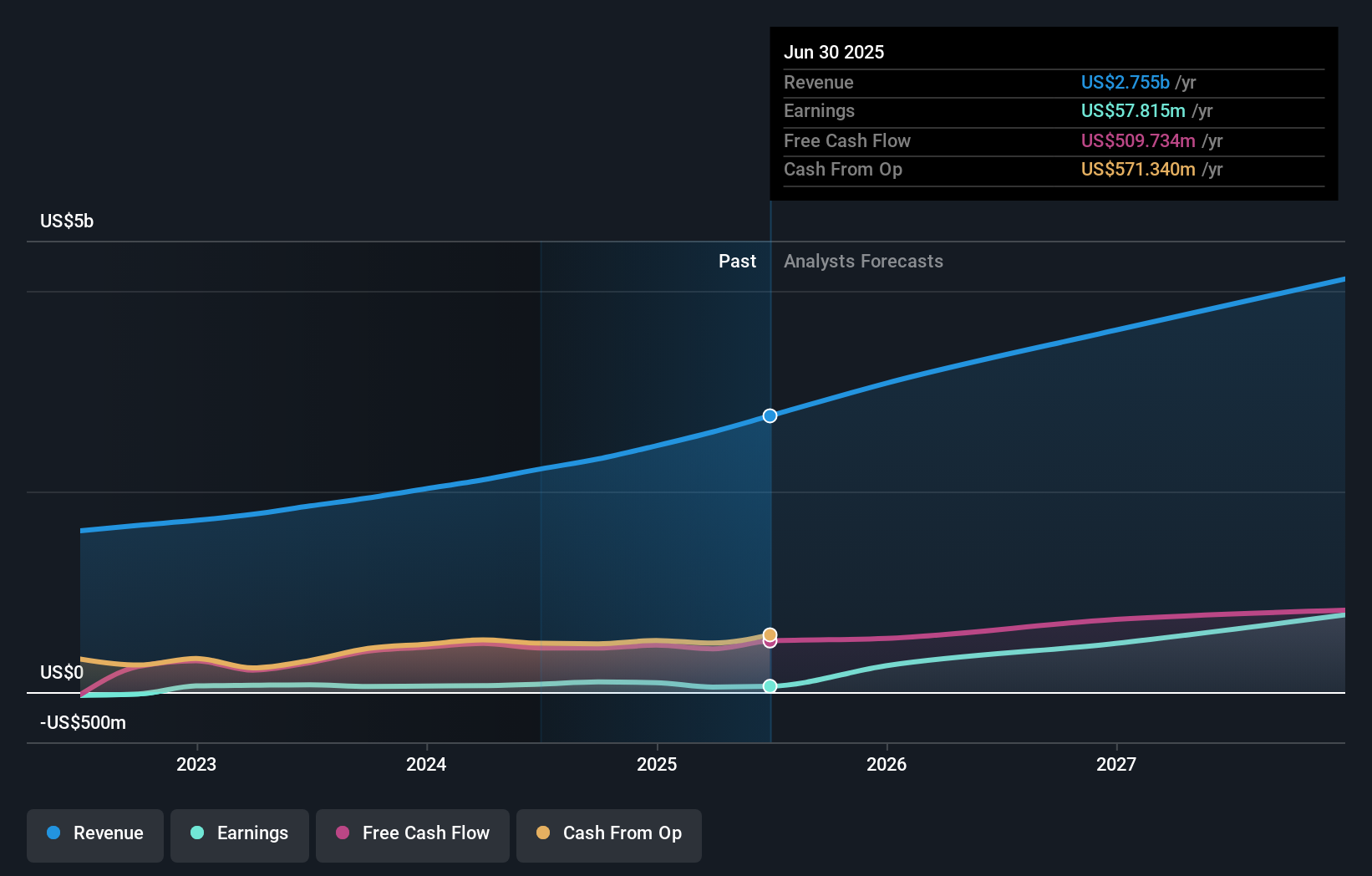

Operations: The company generates revenue from its insurance brokers segment, amounting to $2.75 billion.

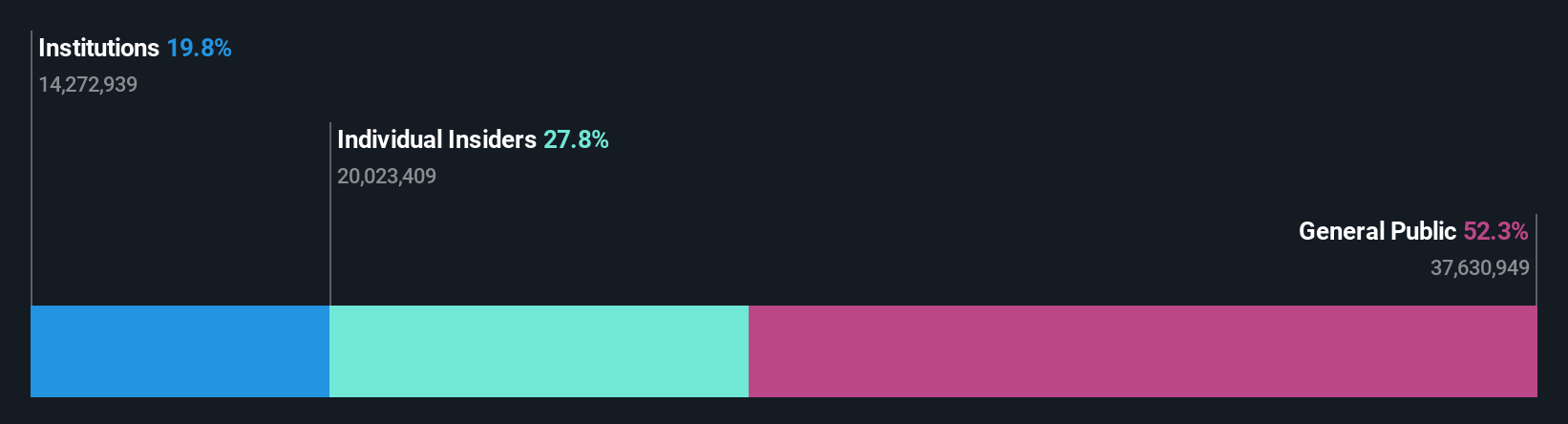

Insider Ownership: 15.1%

Earnings Growth Forecast: 69.7% p.a.

Ryan Specialty Holdings shows promising growth potential, with earnings forecasted to increase significantly at 69.7% annually, surpassing the US market average. Despite a recent decline in profit margins and substantial insider selling, analysts predict a stock price rise of 28.1%. The company is actively pursuing M&A opportunities, supported by strong free cash flow and balance sheet flexibility. However, lowered revenue growth guidance for 2025 may temper expectations amidst these strategic endeavors.

- Click here and access our complete growth analysis report to understand the dynamics of Ryan Specialty Holdings.

- Insights from our recent valuation report point to the potential overvaluation of Ryan Specialty Holdings shares in the market.

Summing It All Up

- Investigate our full lineup of 187 Fast Growing US Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10