Quantum Computing Inc. (NASDAQ:QUBT) on Thursday reported a steep $36 million loss for its second quarter, far exceeding Wall Street expectations, though executives say most of the hit stems from a non-cash accounting adjustment tied to a 2022 merger.

Losses Spike Due To Non-Cash Warrant Adjustment

During the company's earnings call, Chris Roberts, CFO of Quantum Computing, said the company recorded a net loss of $36 million, or $0.26 per share, compared with a $5 million loss in the same quarter last year.

Roberts explained the surge was largely driven by a $28 million non-cash loss related to a warrant derivative liability from Quantum's merger with QPhoton in June 2022.

For the six months ended June 30, 2025, the company reported a net loss of $19.5 million, or $0.14 per share, compared with $11.6 million, or $0.13 per share, in the first half of 2024, Roberts said.

Despite the losses, Quantum's balance sheet showed strength. Total assets rose to $426 million from $154 million at the end of 2024, while cash and equivalents jumped by nearly $270 million to $349 million, boosted by $188 million raised from a second-quarter stock offering.

See Also: Netflix Rides Global Growth Wave As Squid Game 3, Stranger Things 5 Boost Subscribers

Revenue Misses Estimates, Expenses Rise

Quarterly revenue of $61,000 fell short of the $100,000 consensus estimate and declined from $183,000 a year ago. Operating expenses climbed to $10.2 million from $5.3 million, largely due to higher personnel costs.

Total liabilities decreased to $30 million, down $16 million from year-end 2024, reflecting the non-cash adjustment for the QPhoton warrants.

Foundry Expansion And Government Contracts Offer Long-Term Upside

Interim CEO Yuping Huang highlighted the company's progress beyond the headline losses. "During the quarter, we were awarded a subcontract valued at over $400,000 to support NASA's Landy Research Center," Huang said.

The project will apply Quantum's Direct3 quantum optimization technology to improve space-based LiDAR data by removing solar noise.

Huang also noted the Tempe, Arizona, quantum photonic chip facility, completed in March, is now fully operational. The foundry is producing thin-film niacinamide chips for telecom, sensing, and quantum computing applications.

"As we scale the foundry, we expect revenue to slowly grow and target a significant contribution in the next 12 to 18 months," Huang said.

Price Action: On Thursday, Quantum Computing shares fell sharply by 3.94% and extended their decline in Friday's pre-market session, dropping another 3.19%, according to Benzinga Pro.

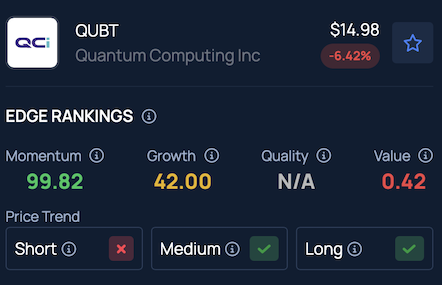

Benzinga’s Edge Stock Rankings indicate that while QUBT is experiencing a short-term downtrend, it has maintained solid gains over the medium and long term. More detailed performance insights are available here.

Read Next:

- Lisa Su Says AMD’s AI Chip MI355 Taking On Nvidia’s B200, GB200 Head-On As AI Customers Seek Scalable GPU Alternatives

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock