DoorDash (DASH) Expands Drone Deliveries And Enhances AI Supply Chain Capabilities

DoorDash (DASH) saw a notable collaboration with GoTo Foods to launch a drone delivery service in Texas. This initiative, along with the improved supply chain operations via RELEX Solutions, aligns with the firm's strategic innovation efforts. Despite DoorDash's shares rising 29% last quarter, the overall market backdrop, marked by all-time highs in the S&P 500 and Nasdaq, suggests broader market movements may have significantly influenced this growth. These developments, alongside impressive earnings results, likely reinforced confidence in DoorDash's progressive approach to meet increasing consumer demands.

We've discovered 1 risk for DoorDash that you should be aware of before investing here.

Find companies with promising cash flow potential yet trading below their fair value.

The recent collaboration between DoorDash and GoTo Foods to launch drone deliveries in Texas, paired with enhancements in supply chain operations, aligns with DoorDash's ongoing strategy of technological innovation and expansion. These efforts could potentially boost DoorDash's international presence and enhance operational efficiency, particularly through the integration of Deliveroo and SevenRooms, which may drive higher revenue and improve profit margins by refining restaurant and grocery delivery services.

Over the past three years, DoorDash has experienced a remarkable total return of 229.33%, illustrating significant long-term growth. In the past year, DoorDash outperformed the US Hospitality industry, which had a return of 29.5%. This indicates the company's strong position relative to peers in the industry.

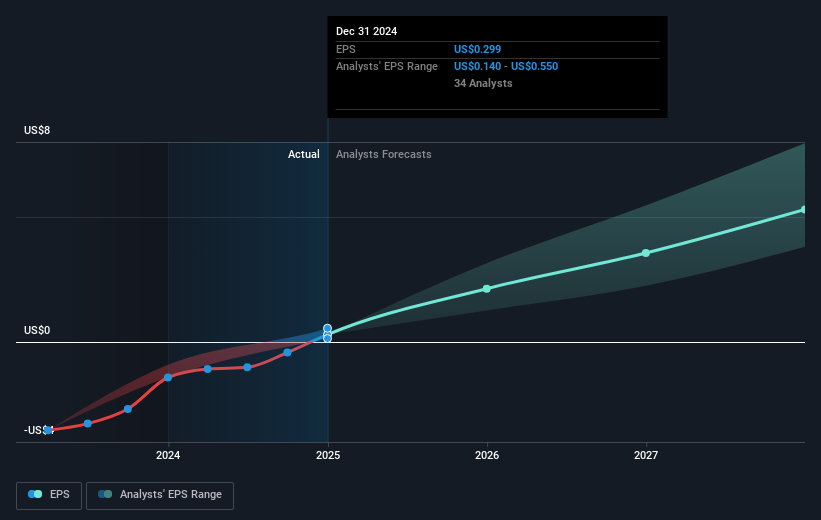

The recent news of strategic partnerships and initiatives could positively impact DoorDash's revenue and earnings forecasts, as analysts have already projected earnings growth to $2.7 billion by 2028. The integration of automated technology and expanded services may bolster these estimates further. Despite a current share price of US$256.09, which shows an 11.89% discount to the consensus price target of US$286.55, the minor discrepancy suggests analysts view the company as fairly valued based on its future growth potential. Keeping these factors in mind, DoorDash's innovative ventures appear to reinforce its position in a competitive landscape.

Jump into the full analysis health report here for a deeper understanding of DoorDash.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10