In the current global market landscape, U.S. equity indexes have shown resilience, with the Nasdaq Composite reaching a new all-time high and small-cap indices like the Russell 2000 experiencing modest gains despite broader economic uncertainties. Amidst this backdrop of fluctuating interest rates and evolving trade policies, identifying potentially undervalued small-cap stocks with notable insider activity can present unique opportunities for investors seeking to navigate these dynamic conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morguard North American Residential Real Estate Investment Trust | 6.6x | 1.8x | 21.22% | ★★★★★☆ |

| Hemisphere Energy | 5.2x | 2.2x | 11.32% | ★★★★☆☆ |

| East West Banking | 3.7x | 0.9x | 12.92% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.9x | 3.1x | 17.84% | ★★★★☆☆ |

| Sagicor Financial | 9.4x | 0.4x | -81.57% | ★★★★☆☆ |

| CVS Group | 45.3x | 1.3x | 37.86% | ★★★★☆☆ |

| A.G. BARR | 19.5x | 1.8x | 46.17% | ★★★☆☆☆ |

| SmartCraft | 43.0x | 7.7x | 34.19% | ★★★☆☆☆ |

| Chinasoft International | 25.5x | 0.8x | 5.12% | ★★★☆☆☆ |

| Daiwa House Logistics Trust | 13.4x | 7.0x | 14.39% | ★★★☆☆☆ |

Click here to see the full list of 108 stocks from our Undervalued Global Small Caps With Insider Buying screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China XLX Fertiliser (SEHK:1866)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China XLX Fertiliser is engaged in the production and sale of urea, compound fertilisers, and methanol with a market cap of approximately CN¥6.78 billion.

Operations: The company's revenue streams have shown significant growth over the analyzed periods, with a notable increase from CN¥4.70 billion to CN¥23.73 billion. The cost of goods sold (COGS) has also risen, impacting gross profit margins which fluctuated between 15.15% and 24.49%. Operating expenses have consistently been a major component of costs, with general and administrative expenses being a significant portion within this category. Net income margins varied across the periods, reflecting changes in non-operating expenses and overall financial performance dynamics.

PE: 6.6x

China XLX Fertiliser, a smaller company in the fertiliser industry, recently reported half-year sales of CNY 12.67 billion, up from CNY 12.06 billion the previous year, though net income dipped to CNY 599.3 million from CNY 687 million. Insider confidence is evident with share purchases by executives earlier this year. Despite high debt levels and reliance on external borrowing, the company's forecasted earnings growth of 27% annually suggests potential for future expansion amidst its financial challenges.

- Delve into the full analysis valuation report here for a deeper understanding of China XLX Fertiliser.

Gain insights into China XLX Fertiliser's past trends and performance with our Past report.

Abbisko Cayman (SEHK:2256)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Abbisko Cayman is a biopharmaceutical company focused on the development of innovative medicines, with a market capitalization of CN¥3.45 billion.

Operations: The company generates revenue primarily from the development of innovative medicines, with recent figures reaching CN¥618.84 million. Over time, it has consistently achieved a gross profit margin of 1.00%, indicating that its cost of goods sold is negligible or not reported. Operating expenses are dominated by R&D costs, which have been substantial in each period reviewed. Notably, the net income margin has shown improvement from negative values to positive territory in recent periods, reflecting a shift towards profitability as net income reached CN¥149.98 million by mid-2025.

PE: 53.5x

Abbisko Cayman recently reported a significant increase in half-year sales, reaching CNY 612 million, and net income rose to CNY 328 million. Insider confidence is evident as Yao-Chang Xu purchased 45,000 shares for approximately CNY 291,600 in July 2025. Despite the forecasted decline in earnings over the next three years and reliance on higher-risk external borrowing, Abbisko's innovative drug developments like ABSK061 and irpagratinib show potential for future growth in niche markets such as Achondroplasia and Hepatocellular Carcinoma treatments.

- Dive into the specifics of Abbisko Cayman here with our thorough valuation report.

Review our historical performance report to gain insights into Abbisko Cayman's's past performance.

Tamarack Valley Energy (TSX:TVE)

Simply Wall St Value Rating: ★★★★☆☆

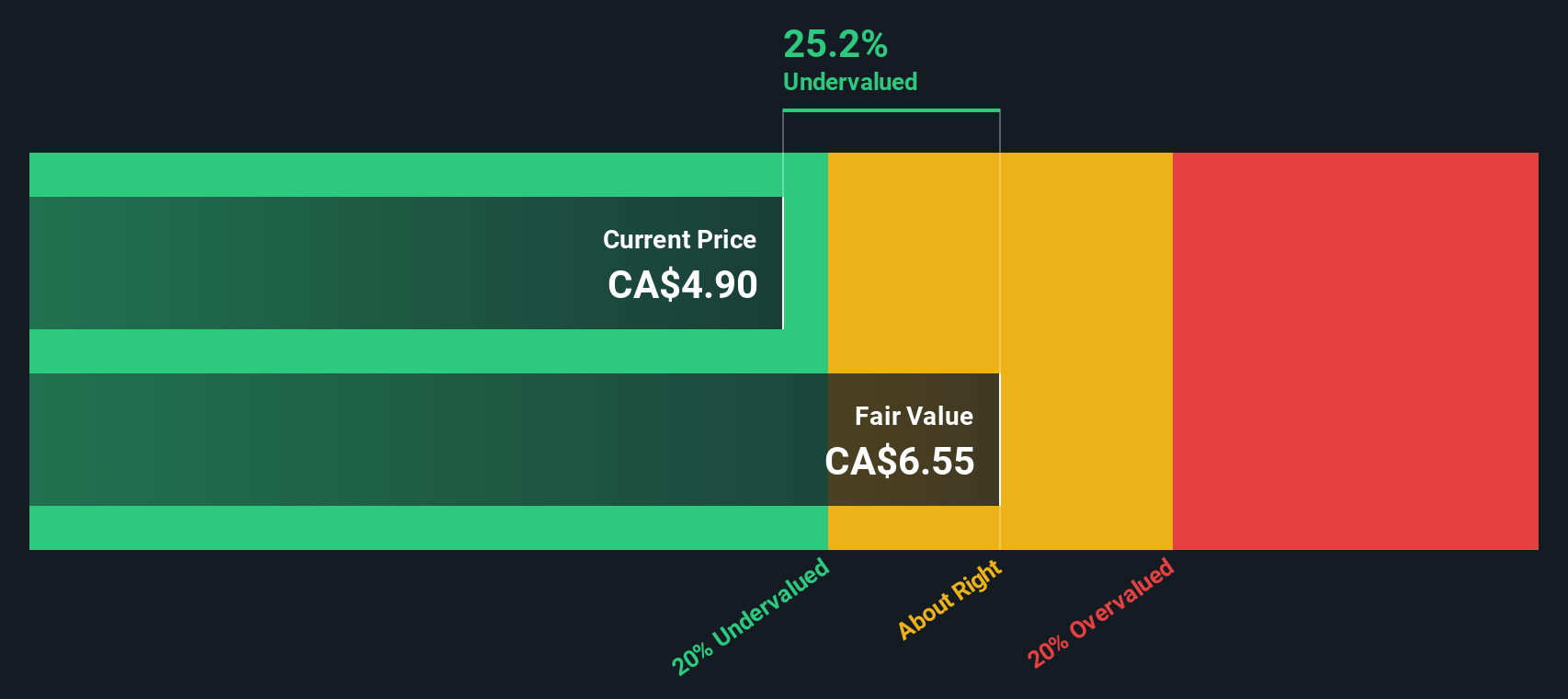

Overview: Tamarack Valley Energy is engaged in the exploration and production of oil and gas, with a market capitalization of approximately CA$2.01 billion.

Operations: The company primarily generates revenue from its oil and gas exploration and production activities, amounting to CA$1.40 billion in the latest period. Gross profit margin has shown an upward trend, reaching 79.27%. Operating expenses have fluctuated significantly over time, impacting net income margins which varied widely across periods.

PE: 10.6x

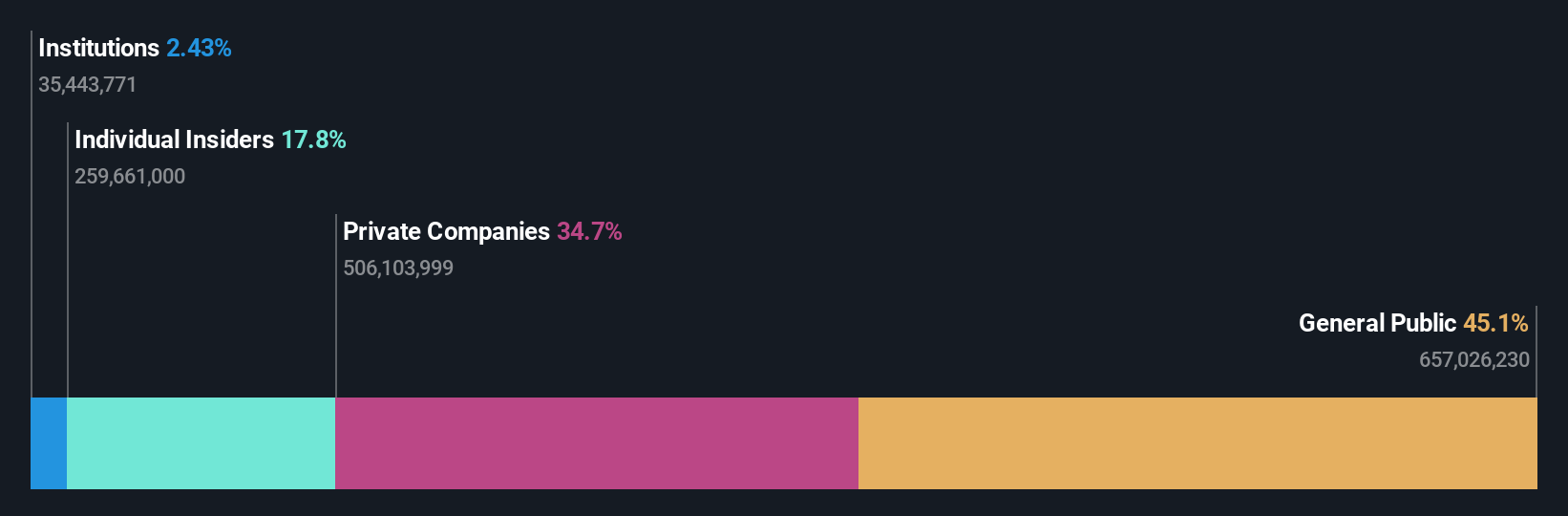

Tamarack Valley Energy, a smaller energy player, recently reported CAD 386.27 million in second-quarter revenue with CAD 86.24 million net income, showing resilience despite a slight dip from last year. The company repurchased over 10 million shares for CAD 41.77 million between April and June 2025, indicating strong insider confidence in its potential value. With revised production guidance and strategic debt refinancing extending maturities to 2030, Tamarack is positioning itself for future growth amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Tamarack Valley Energy's valuation report.

Explore historical data to track Tamarack Valley Energy's performance over time in our Past section.

Turning Ideas Into Actions

- Delve into our full catalog of 108 Undervalued Global Small Caps With Insider Buying here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com