Pfizer (PFE) Reports Promising Phase 3 Results For Bladder Cancer Treatment Combination

Pfizer (PFE) recently announced positive topline results from the Phase 3 EV-303 clinical trial, showcasing promising outcomes for PADCEV in treating muscle-invasive bladder cancer. Over the last quarter, Pfizer's stock saw an 11% rise, with these results potentially adding weight to this performance. The company also reached milestones in other research and development areas and maintained strong profitability, exemplified by a net income leap in its Q2 2025 earnings. Despite broader market trends pushing the S&P 500 and Nasdaq to record highs, Pfizer's product developments remain key contributors to its recent market position.

We've spotted 2 warning signs for Pfizer you should be aware of.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

The recent results from Pfizer's Phase 3 EV-303 trial offer promising insights for the company's oncology portfolio, potentially enhancing future revenue streams. Despite this positive development, Pfizer's shares experienced an 8.56% decline over the past year, reflecting challenges beyond short-term gains. In the broader context, Pfizer outperformed the US Pharmaceuticals industry, which saw a 16.1% decline over the same period, although it underperformed the overall US market, which returned 19.6%.

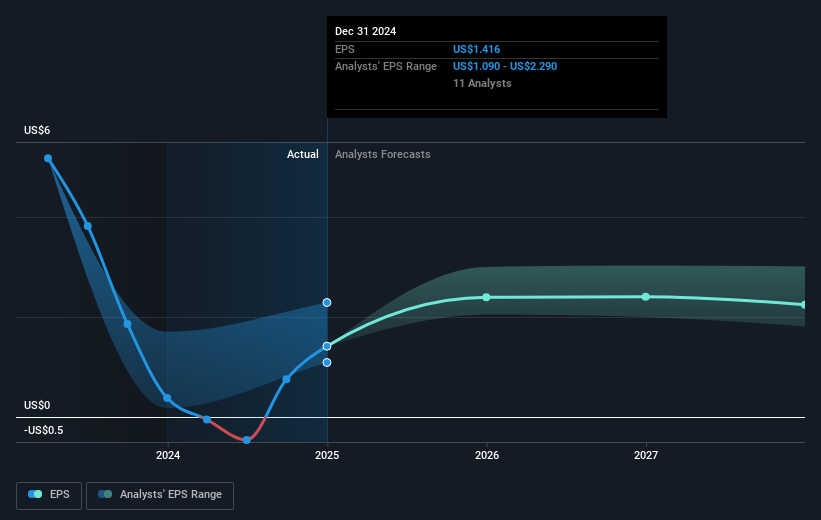

The recent 11% rise in Pfizer's stock in the last quarter provides a contrast to the longer-term decline, suggesting a potential shift in investor sentiment influenced by recent successes in clinical trials. Analysts' consensus price target of approximately $28.86 suggests room for upside from the current share price of $24.65. However, projections must factor in the ongoing challenges of regulatory pressures and upcoming patent expirations, which may impact revenue and earnings forecasts. As the company continues to navigate these hurdles, the sustained advancement of its R&D initiatives remains a critical component in striving to achieve the forecasted revenue and earnings growth.

Our comprehensive valuation report raises the possibility that Pfizer is priced lower than what may be justified by its financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10