Coherent Corp. (NYSE:COHR) announced the sale of its aerospace and defense business for $400 million and released its fourth-quarter results after Wednesday’s closing bell.

Coherent said it will sell its aerospace and defense business to private equity firm Advent for $400 million. The company added that proceeds from the sale will be used to reduce debt, which will be immediately accretive to Coherent's EPS.

Coherent reported quarterly earnings of $1 per share, which beat the analyst consensus estimate of 91 cents. Quarterly revenue came in at $1.52 billion, which beat the analyst consensus estimate of $1.5 billion and is up from revenue of $1.31 billion from the same period last year.

"We delivered a strong fiscal 2025 with revenue growth of 23% and non-GAAP EPS expansion of 191%. We believe we are well-positioned to continue to drive strong revenue and profit growth over the long-term given our exposure to key growth drivers such as AI datacenters," said Jim Anderson, CEO.

Coherent shares fell 20.8% to trade at $90.32 on Thursday.

These analysts made changes to their price targets on Coherent following earnings announcement.

- B of A Securities analyst Vivek Arya downgraded Coherent from Buy to Neutral and raised the price target from $92 to $105.

- Stifel analyst Ruben Roy maintained the stock with a Buy and raised the price target from $100 to $118.

- Rosenblatt analyst Mike Genovese maintained Coherent with a Buy and lowered the price target from $150 to $135.

- Barclays analyst Tom O’Malley maintained the stock with an Overweight rating and raised the price target from $90 to $110.

- Morgan Stanley analyst Meta Marshall maintained Coherent with an Equal-Weight rating and lowered the price target from $97 to $89

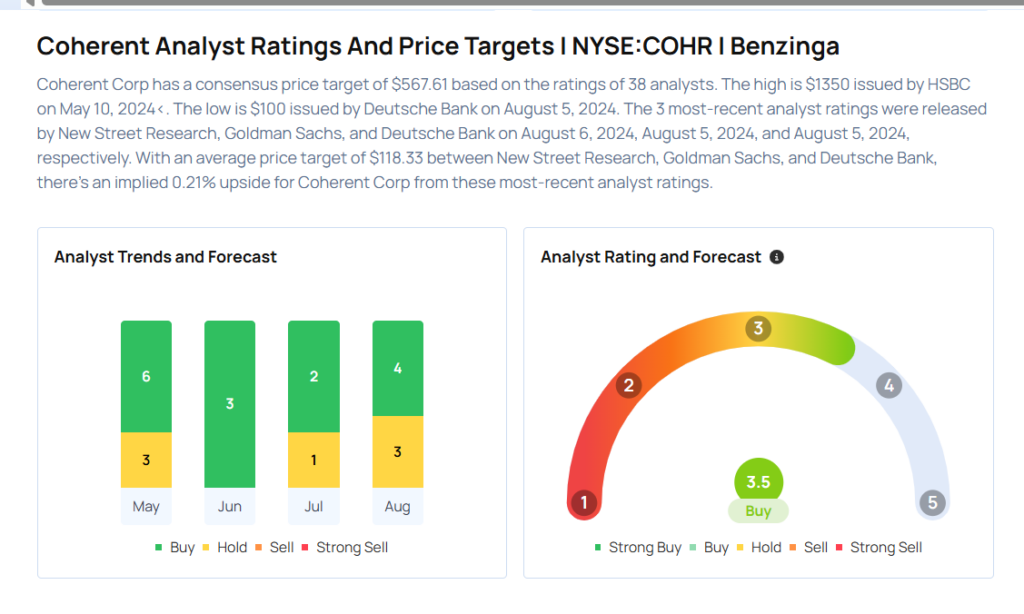

Considering buying COHR stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech & Telecom Stocks That May Fall Off A Cliff In Q3

Photo via Shutterstock