WH Group's (HKG:288) Dividend Will Be $0.20

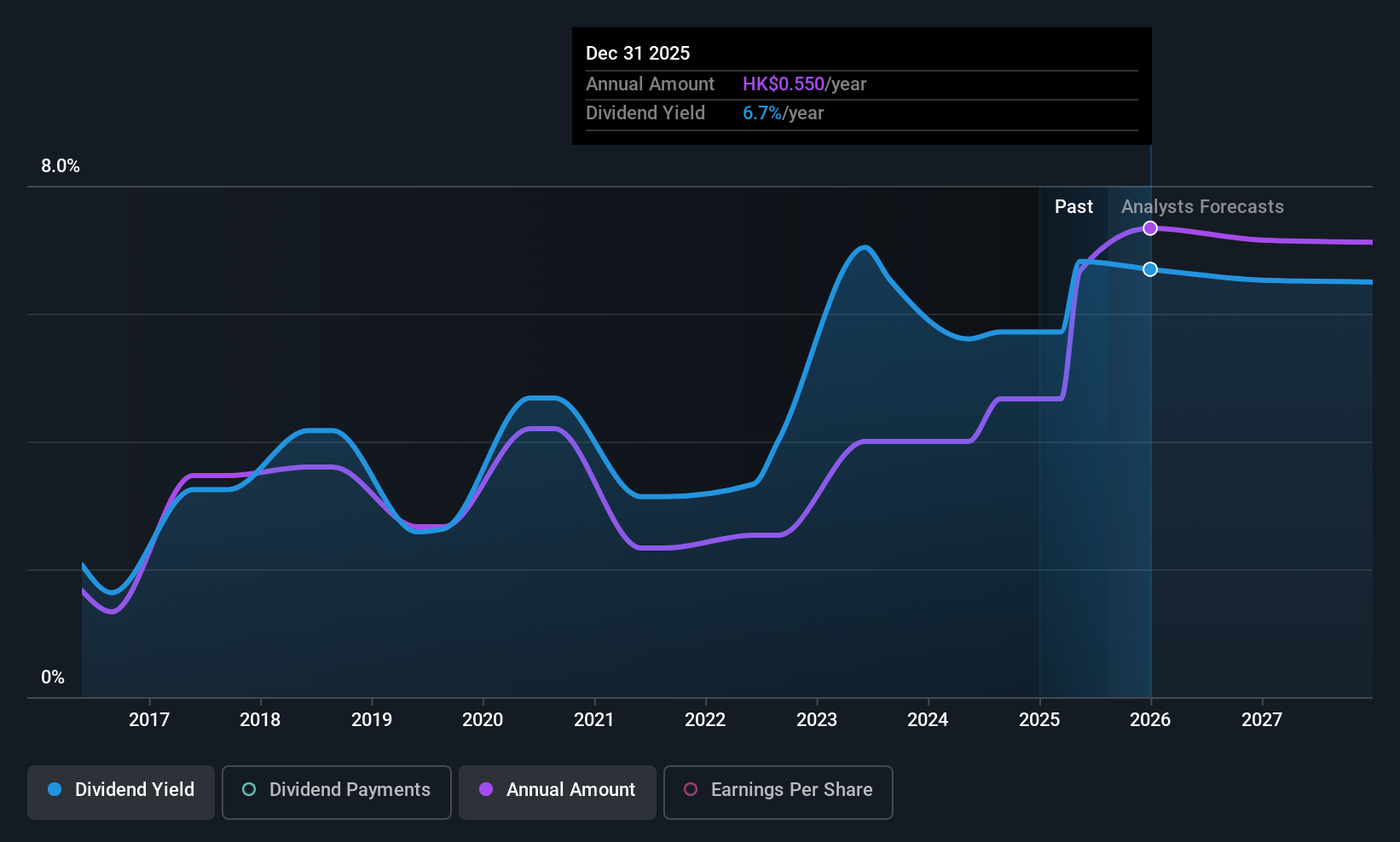

WH Group Limited (HKG:288) will pay a dividend of $0.20 on the 30th of September. Based on this payment, the dividend yield for the company will be 6.1%, which is fairly typical for the industry.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

WH Group's Projections Indicate Future Payments May Be Unsustainable

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Based on the last payment, WH Group was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

EPS is set to fall by 15.6% over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio could reach over 200%, which could put the dividend in jeopardy if the company's earnings don't improve.

Check out our latest analysis for WH Group

WH Group's Dividend Has Lacked Consistency

WH Group has been paying dividends for a while, but the track record isn't stellar. This suggests that the dividend might not be the most reliable. Since 2016, the dividend has gone from $0.0161 total annually to $0.0637. This means that it has been growing its distributions at 17% per annum over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

We Could See WH Group's Dividend Growing

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that WH Group has grown earnings per share at 8.9% per year over the past five years. Shareholders are getting plenty of the earnings returned to them, which combined with strong growth makes this quite appealing.

We Really Like WH Group's Dividend

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The distributions are easily covered by earnings, and there is plenty of cash being generated as well. If earnings do fall over the next 12 months, the dividend could be buffeted a little bit, but we don't think it should cause too much of a problem in the long term. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 2 warning signs for WH Group (1 can't be ignored!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if WH Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10