Prairie Operating (PROP) Sees US$35.7 Million Net Income Turnaround in Q2 2025 Earnings

Prairie Operating (PROP) recently announced its Q2 2025 earnings, reporting a significant turnaround with a net income of $35.7 million, compared to a net loss in the same quarter last year. Despite this positive financial performance and updated corporate guidance projecting robust production and net income for 2025, the company's stock saw a 24% decline over the past week. This move counteracted broader market trends, where major indexes hovered near record highs after two consecutive weeks of gains, fueled by tempered expectations for interest rate cuts and mixed signals from inflation data. Thus, market conditions likely contributed to the overall pressure on Prairie Operating's share price.

Prairie Operating has 3 risks (and 1 which doesn't sit too well with us) we think you should know about.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Over the past year, Prairie Operating's shares experienced a total return decline of 70.08%, a substantial drop when considering its recent financial improvements. In comparison, the company underperformed against the broader US Market and the US Oil and Gas industry, which saw returns of 16.1% and a 3.3% decline, respectively, over the same one-year period. This contrast highlights a more pronounced struggle for the company amid broader positive market trends.

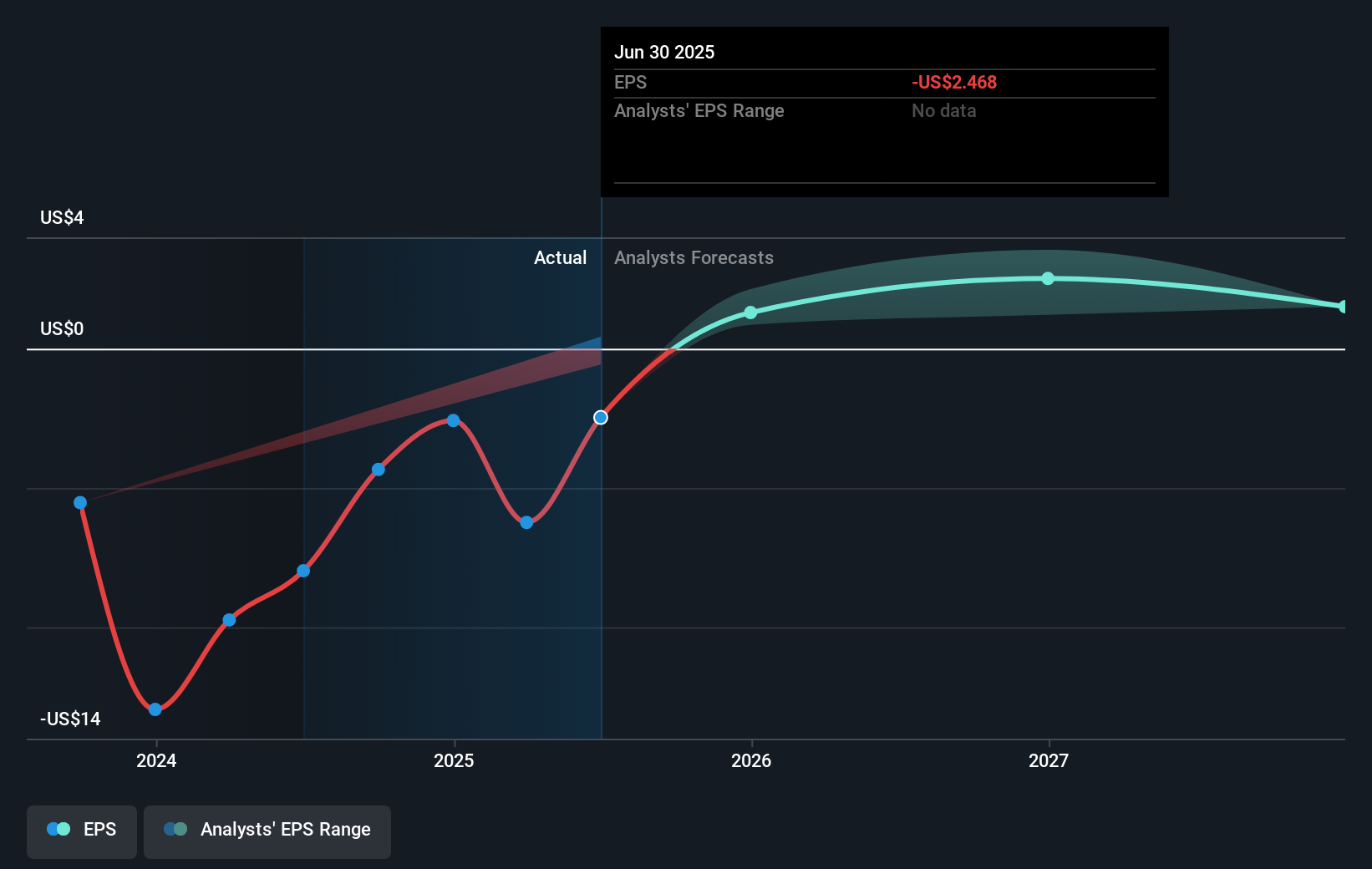

The positive earnings turnaround, highlighted by a net income of US$35.7 million for Q2 2025, seems not to have translated into market confidence, potentially due to prior volatility and restructuring efforts. Analysts' consensus puts the fair value price target at US$8.25, suggesting significant upside potential from the current share price of US$2.75. However, recent performance can influence revenue and earnings forecasts as market sentiment remains cautious despite improved projections, such as an expected net income of US$192 million to US$202 million for the year.

In light of our recent valuation report, it seems possible that Prairie Operating is trading behind its estimated value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10