Does Akso Health Group (NASDAQ:AHG) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Akso Health Group (NASDAQ:AHG) makes use of debt. But should shareholders be worried about its use of debt?

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Akso Health Group's Net Debt?

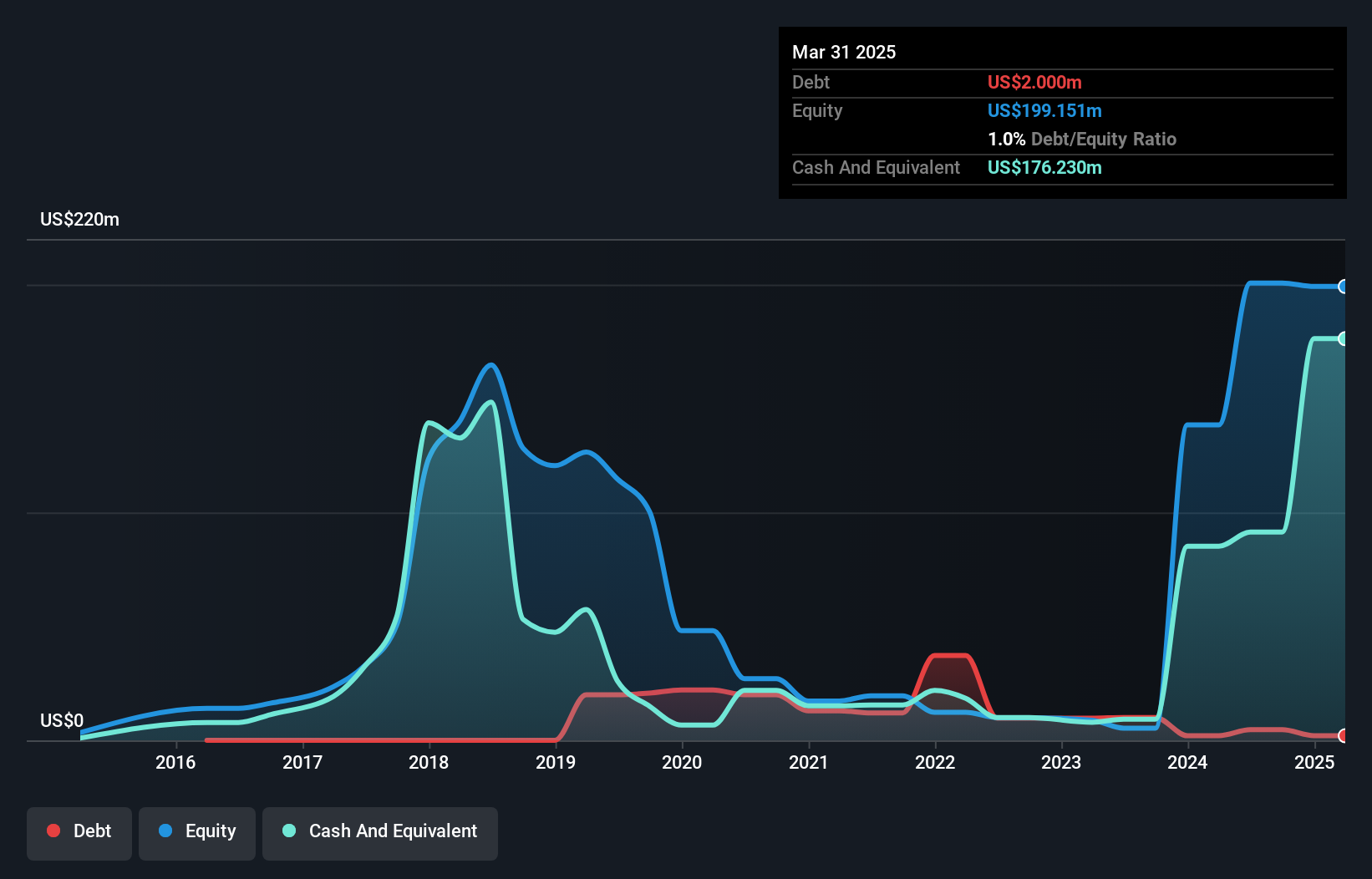

The chart below, which you can click on for greater detail, shows that Akso Health Group had US$2.00m in debt in March 2025; about the same as the year before. However, its balance sheet shows it holds US$176.2m in cash, so it actually has US$174.2m net cash.

How Healthy Is Akso Health Group's Balance Sheet?

The latest balance sheet data shows that Akso Health Group had liabilities of US$13.8m due within a year, and liabilities of US$1.99m falling due after that. Offsetting these obligations, it had cash of US$176.2m as well as receivables valued at US$12.9m due within 12 months. So it can boast US$173.3m more liquid assets than total liabilities.

This excess liquidity suggests that Akso Health Group is taking a careful approach to debt. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Succinctly put, Akso Health Group boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Akso Health Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Check out our latest analysis for Akso Health Group

Over 12 months, Akso Health Group reported revenue of US$15m, which is a gain of 512%, although it did not report any earnings before interest and tax. When it comes to revenue growth, that's like nailing the game winning 3-pointer!

So How Risky Is Akso Health Group?

While Akso Health Group lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow US$1.0m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Keeping in mind its 512% revenue growth over the last year, we think there's a decent chance the company is on track. We'd see further strong growth as an optimistic indication. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Akso Health Group (of which 2 are potentially serious!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10