This Broker Just Slashed Their CaliberCos Inc. (NASDAQ:CWD) Earnings Forecasts

The analyst covering CaliberCos Inc. (NASDAQ:CWD) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analyst seeing grey clouds on the horizon.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

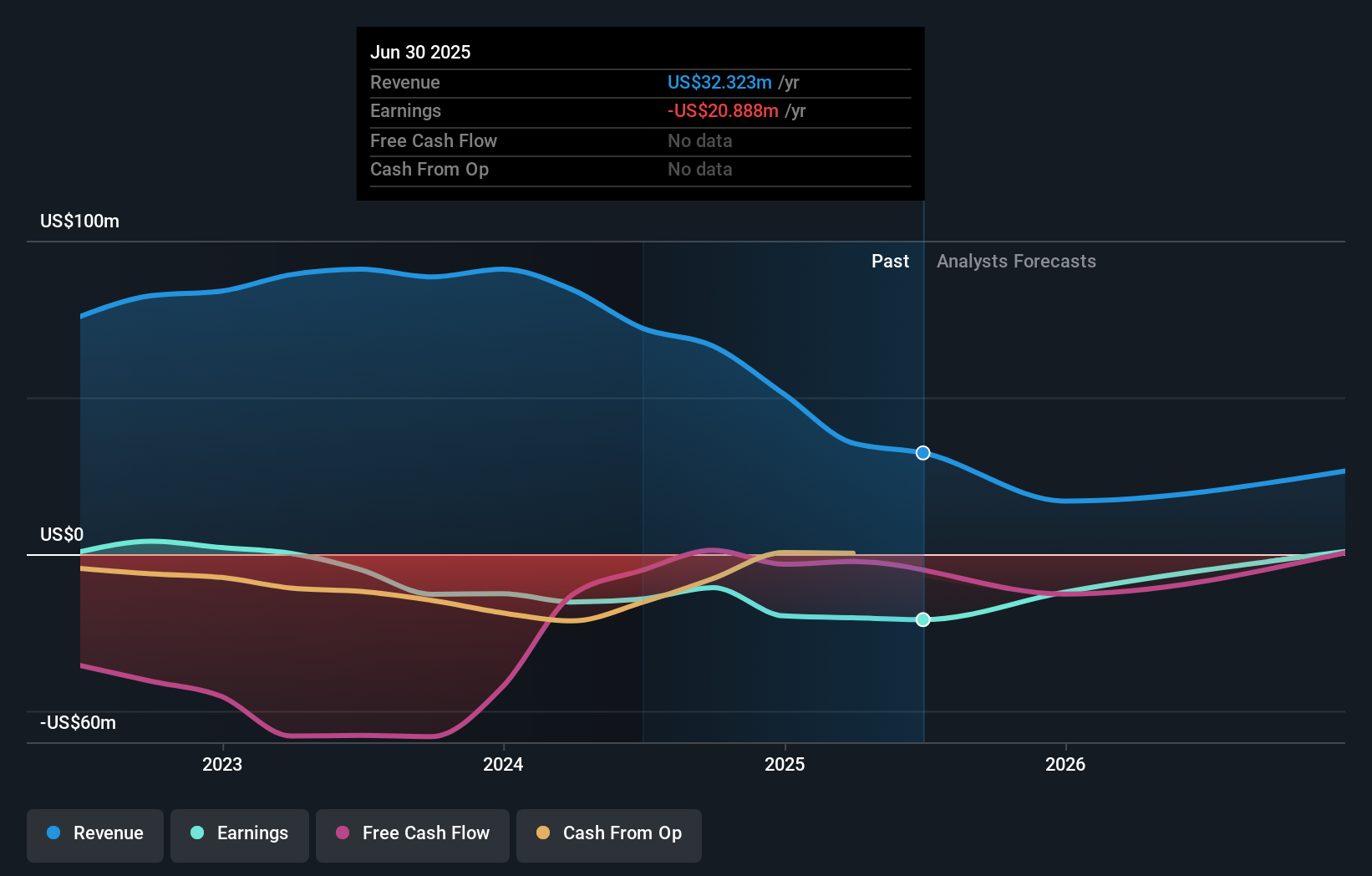

Following the latest downgrade, the current consensus, from the one analyst covering CaliberCos, is for revenues of US$17m in 2025, which would reflect a sizeable 48% reduction in CaliberCos' sales over the past 12 months. Losses are predicted to fall substantially, shrinking 42% to US$9.17 per share. Yet before this consensus update, the analyst had been forecasting revenues of US$23m and losses of US$3.81 per share in 2025. Ergo, there's been a clear change in sentiment, with the analyst administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

See our latest analysis for CaliberCos

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that sales are expected to reverse, with a forecast 72% annualised revenue decline to the end of 2025. That is a notable change from historical growth of 4.6% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 6.1% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - CaliberCos is expected to lag the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at CaliberCos. Unfortunately the analyst also downgraded their revenue estimates, and industry data suggests that CaliberCos' revenues are expected to grow slower than the wider market. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like the analyst has become a lot more bearish on CaliberCos, and their negativity could be grounds for caution.

There might be good reason for analyst bearishness towards CaliberCos, like dilutive stock issuance over the past year. For more information, you can click here to discover this and the 3 other concerns we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10