As global markets navigate a complex landscape of economic data and geopolitical developments, Asian stock markets are capturing attention with their unique opportunities. Despite the term "penny stocks" feeling somewhat outdated, these smaller or newer companies continue to offer intriguing investment prospects due to their affordability and potential for growth. In this article, we explore three penny stocks in Asia that stand out for their financial strength and ability to capitalize on current market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.06 | THB4.01B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.07B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.645 | SGD261.41M | ✅ 4 ⚠️ 2 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.69 | SGD657.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.91 | SGD11.45B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.96 | THB1.41B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.76 | THB9.62B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.50 | SGD960.23M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 971 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Broncus Holding (SEHK:2216)

Simply Wall St Financial Health Rating: ★★★★★☆

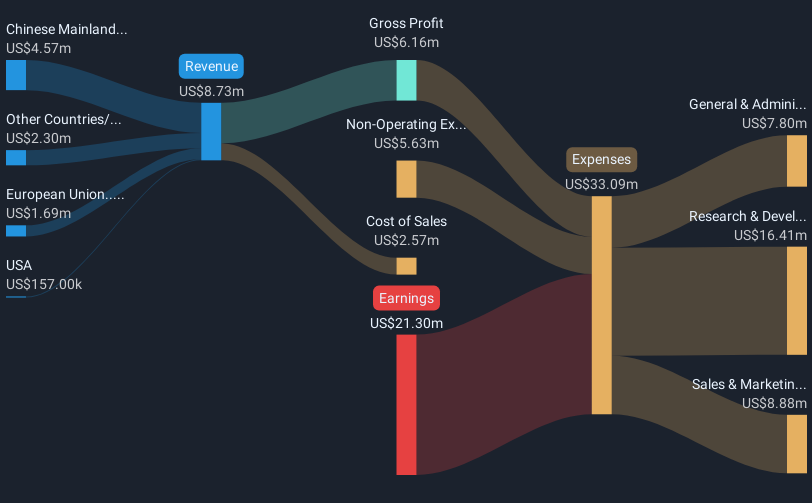

Overview: Broncus Holding Corporation is a medical device company specializing in interventional pulmonology products across Mainland China, the European Union, and internationally, with a market cap of HK$1.72 billion.

Operations: The company's revenue is derived entirely from its medical products segment, totaling $8.13 million.

Market Cap: HK$1.72B

Broncus Holding Corporation, with a market cap of HK$1.72 billion and revenue of US$8.13 million, is navigating the volatile penny stock landscape with a focus on interventional pulmonology products. Despite being unprofitable, the company has reduced its losses by 27.8% annually over five years and maintains a strong cash position exceeding its debt. Recent approval for marketing its BroncAblate system in China marks a significant milestone, potentially enhancing revenue prospects through commercialization of this innovative lung cancer treatment device. While share price volatility remains high, short-term assets comfortably cover liabilities, providing financial stability amidst market fluctuations.

- Click here and access our complete financial health analysis report to understand the dynamics of Broncus Holding.

- Evaluate Broncus Holding's prospects by accessing our earnings growth report.

Bosideng International Holdings (SEHK:3998)

Simply Wall St Financial Health Rating: ★★★★★★

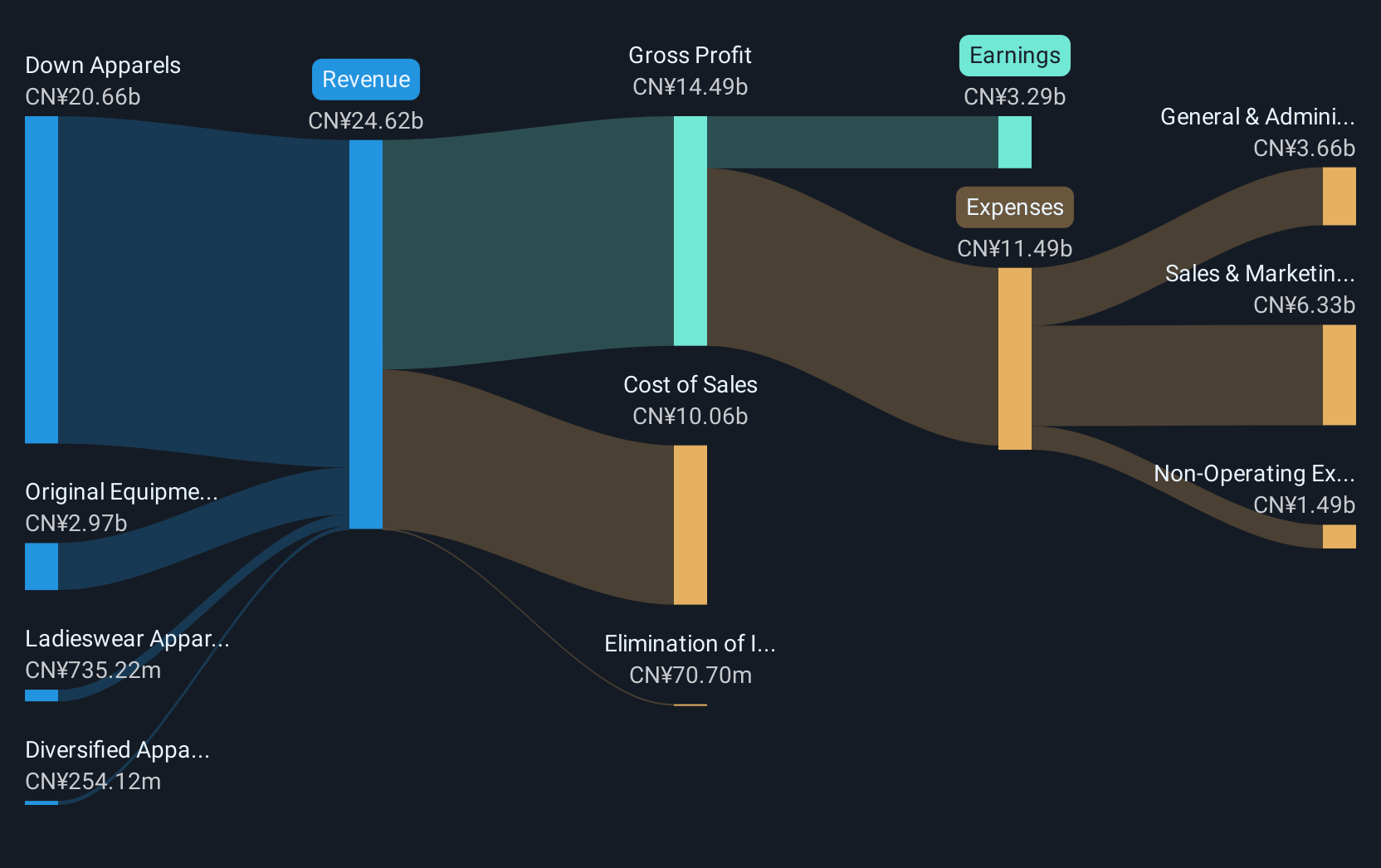

Overview: Bosideng International Holdings Limited operates in the apparel business in the People’s Republic of China, with a market cap of HK$55.11 billion.

Operations: The company's revenue is primarily derived from Down Apparels at CN¥21.71 billion, followed by Original Equipment Manufacturing (OEM) Management at CN¥3.42 billion, Ladieswear Apparels at CN¥651.15 million, and Diversified Apparels at CN¥231.76 million.

Market Cap: HK$55.11B

Bosideng International Holdings, with a market cap of HK$55.11 billion, has shown solid financial performance in the apparel sector. The company reported annual sales of CN¥25.90 billion and net income of CN¥3.51 billion for the year ending March 31, 2025, reflecting growth from the previous year. Earnings per share also increased during this period. Bosideng's short-term assets exceed both its short- and long-term liabilities, indicating robust financial health. However, significant insider selling over the past quarter could raise concerns among investors despite stable earnings growth and seasoned management contributing to its operational stability in a volatile penny stock environment.

- Unlock comprehensive insights into our analysis of Bosideng International Holdings stock in this financial health report.

- Review our growth performance report to gain insights into Bosideng International Holdings' future.

EVA Precision Industrial Holdings (SEHK:838)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EVA Precision Industrial Holdings Limited is an investment holding company offering precision manufacturing services in China, Vietnam, and Mexico with a market capitalization of HK$1.54 billion.

Operations: The company's revenue is primarily derived from two segments: Automotive Components, contributing HK$1.96 billion, and Office Automation Equipment, generating HK$4.34 billion.

Market Cap: HK$1.54B

EVA Precision Industrial Holdings, with a market cap of HK$1.54 billion, exhibits key strengths and challenges characteristic of penny stocks. The company's revenue is driven by its Automotive Components and Office Automation Equipment segments. Despite a low return on equity at 7.8%, EVA's interest payments are well covered by EBIT at 4.6 times, showcasing financial prudence. Its seasoned management team averages 32.6 years in tenure, contributing to operational stability amidst stable weekly volatility (4%). While the company has high-quality earnings and reduced debt levels over time, its dividend track record remains unstable, necessitating investor caution.

- Navigate through the intricacies of EVA Precision Industrial Holdings with our comprehensive balance sheet health report here.

- Gain insights into EVA Precision Industrial Holdings' outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Click here to access our complete index of 971 Asian Penny Stocks.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broncus Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com