HK Electric Investments and HK Electric Investments (HKG:2638) Is Due To Pay A Dividend Of HK$0.1594

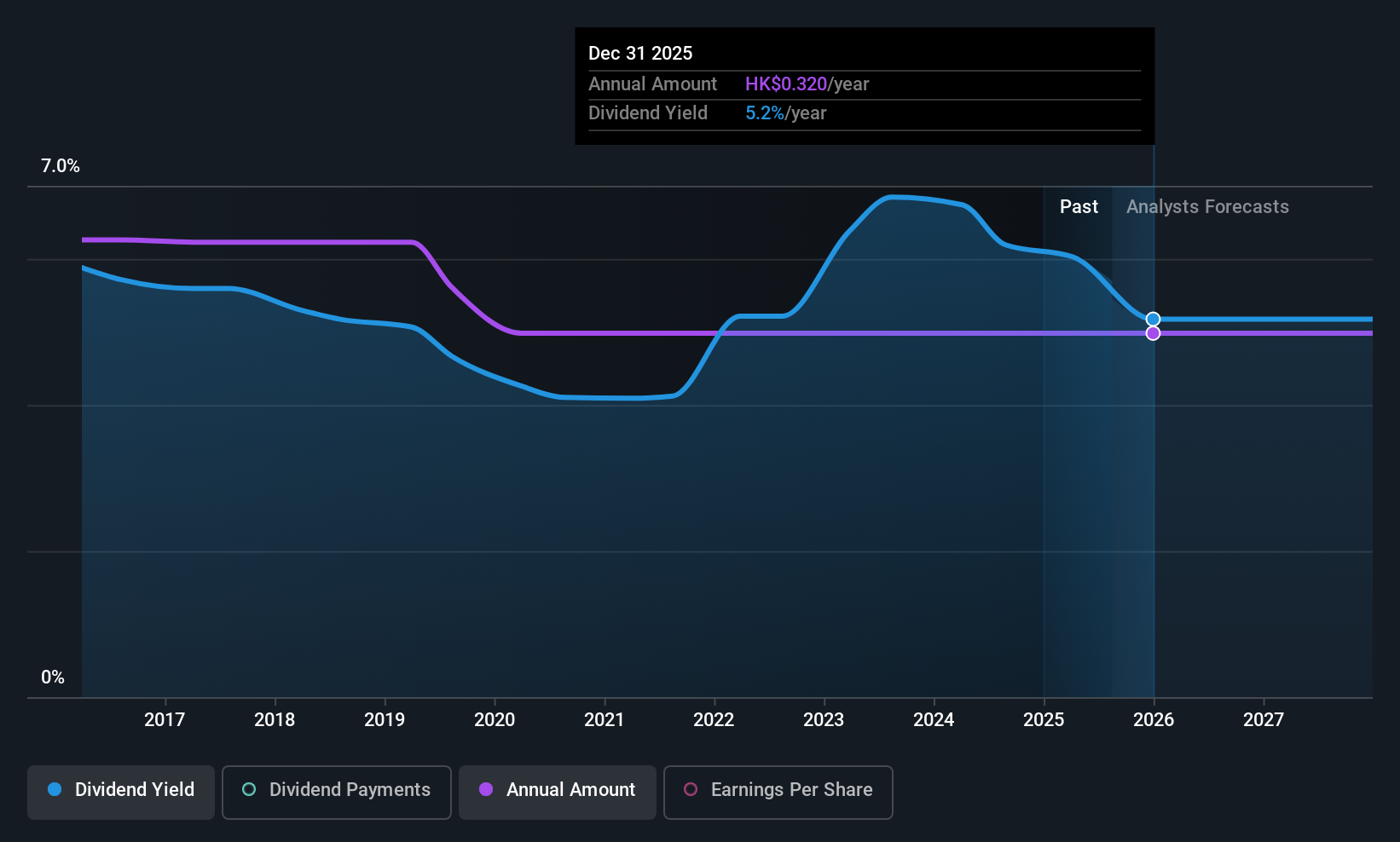

HK Electric Investments and HK Electric Investments Limited (HKG:2638) has announced that it will pay a dividend of HK$0.1594 per share on the 8th of September. This payment means that the dividend yield will be 5.2%, which is around the industry average.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

HK Electric Investments and HK Electric Investments' Future Dividend Projections Appear Well Covered By Earnings

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. At the time of the last dividend payment, HK Electric Investments and HK Electric Investments was paying out a very large proportion of what it was earning and 119% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Over the next year, EPS is forecast to expand by 8.7%. If the dividend continues along recent trends, we estimate the payout ratio could reach 80%, which is on the higher side, but certainly still feasible.

View our latest analysis for HK Electric Investments and HK Electric Investments

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2015, the dividend has gone from HK$0.398 total annually to HK$0.32. This works out to be a decline of approximately 2.1% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

HK Electric Investments and HK Electric Investments Could Grow Its Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. HK Electric Investments and HK Electric Investments has seen EPS rising for the last five years, at 5.4% per annum. Past earnings growth has been decent, but unless this is one of those rare businesses that can grow without additional capital investment or marketing spend, we'd generally expect the higher payout ratio to limit its future growth prospects.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about HK Electric Investments and HK Electric Investments' payments, as there could be some issues with sustaining them into the future. The payments are bit high to be considered sustainable, and the track record isn't the best. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for HK Electric Investments and HK Electric Investments (of which 1 shouldn't be ignored!) you should know about. Is HK Electric Investments and HK Electric Investments not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if HK Electric Investments and HK Electric Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10