Despite an already strong run, Linmon Media Limited (HKG:9857) shares have been powering on, with a gain of 44% in the last thirty days. The last 30 days bring the annual gain to a very sharp 26%.

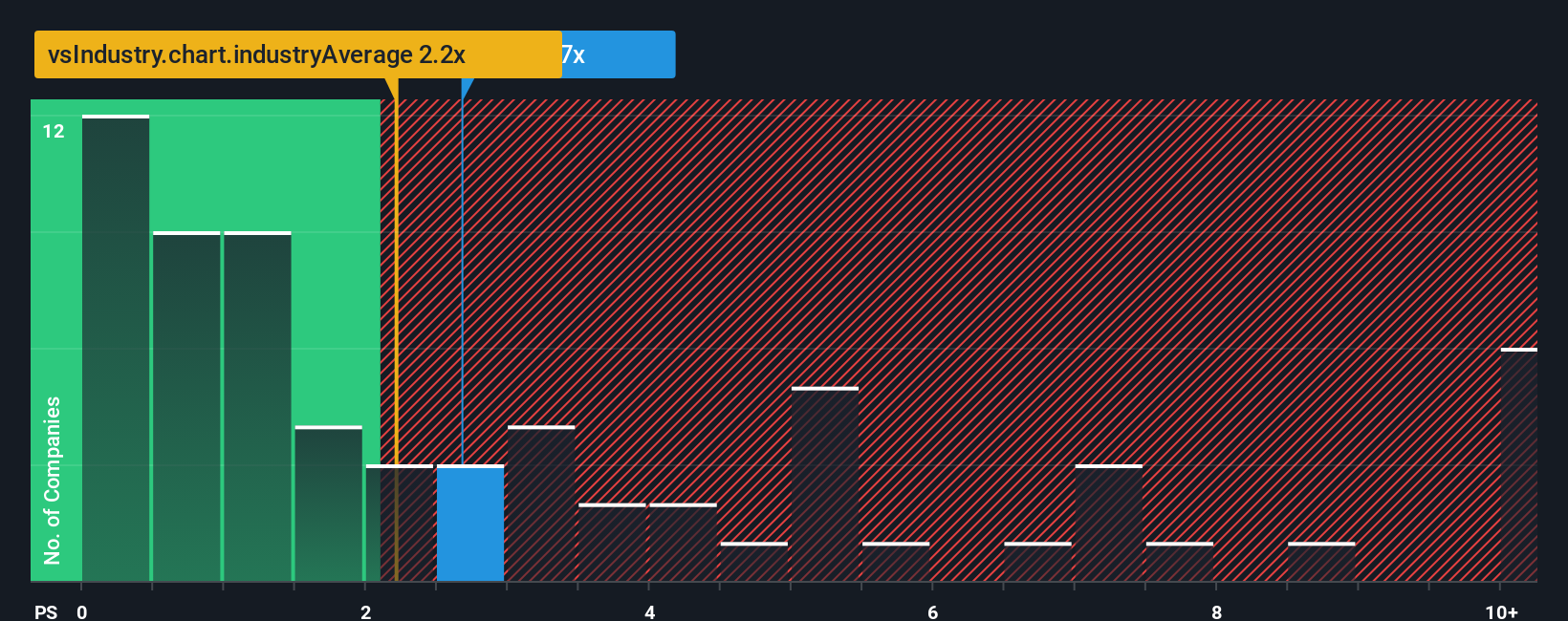

Although its price has surged higher, you could still be forgiven for feeling indifferent about Linmon Media's P/S ratio of 2.7x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in Hong Kong is also close to 2.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Check out our latest analysis for Linmon Media

What Does Linmon Media's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Linmon Media's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Linmon Media will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Linmon Media?

The only time you'd be comfortable seeing a P/S like Linmon Media's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 46%. The last three years don't look nice either as the company has shrunk revenue by 47% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 56% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 12%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Linmon Media's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Linmon Media's P/S Mean For Investors?

Its shares have lifted substantially and now Linmon Media's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Linmon Media's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware Linmon Media is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.