3 Promising Penny Stocks With Market Caps Under $2B

As the Dow Jones Industrial Average reaches an all-time high, investors are keenly watching for opportunities amid mixed performances in major indices. In this context, penny stocks—often representing smaller or newer companies—remain a compelling area of interest due to their potential for growth at lower price points. Despite being considered a niche investment, these stocks can offer significant upside when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.80 | $650.99M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.03 | $233.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.86 | $23.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $92.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Koil Energy Solutions (KLNG) | $1.64 | $19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Table Trac (TBTC) | $4.84 | $22.46M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.915 | $6.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.86 | $87.46M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.63 | $154.36M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $3.92 | $522.46M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 390 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Mereo BioPharma Group (MREO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mereo BioPharma Group plc is a biopharmaceutical company focused on developing and commercializing therapeutics for oncology and rare diseases across the United Kingdom, the United States, and internationally, with a market cap of $276.83 million.

Operations: Mereo BioPharma Group plc has not reported any specific revenue segments.

Market Cap: $276.83M

Mereo BioPharma Group, with a market cap of US$276.83 million, remains pre-revenue, reporting just US$0.5 million in sales for the recent quarter while managing a net loss of US$14.62 million. Despite its unprofitability and high share price volatility, Mereo maintains a robust cash position with short-term assets covering both its long-term and short-term liabilities comfortably. The company is debt-free and has not diluted shareholders significantly over the past year. Its ongoing Phase 3 clinical trials for setrusumab in osteogenesis imperfecta show promise but carry inherent risks typical of biopharmaceutical ventures at this stage.

- Take a closer look at Mereo BioPharma Group's potential here in our financial health report.

- Review our growth performance report to gain insights into Mereo BioPharma Group's future.

Commerce.com (CMRC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Commerce.com, Inc. provides a software-as-a-service e-commerce platform for brands and retailers across various regions globally, with a market cap of $375.42 million.

Operations: Commerce.com generates revenue primarily from its Internet Information Providers segment, totaling $337.54 million.

Market Cap: $375.42M

Commerce.com, Inc., with a market cap of US$375.42 million, operates an e-commerce platform generating significant revenue from its Internet Information Providers segment. Despite being unprofitable, the company has reduced losses over five years by 5.8% annually and maintains a strong cash position with assets exceeding liabilities. Recent strategic partnerships and product launches, such as integrations with BlueSnap for B2B payments and PROS for digital commerce solutions, aim to enhance operational efficiency and customer experience in the B2B sector. The management team is experienced, supporting efforts to navigate the competitive landscape effectively while maintaining financial stability.

- Unlock comprehensive insights into our analysis of Commerce.com stock in this financial health report.

- Examine Commerce.com's earnings growth report to understand how analysts expect it to perform.

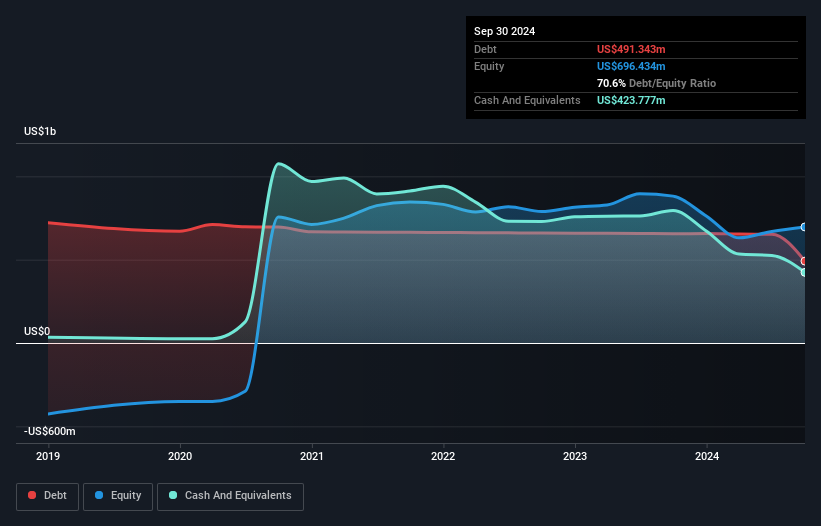

GoodRx Holdings (GDRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoodRx Holdings, Inc. provides consumers in the United States with tools and information to compare prices and save on prescription drugs, with a market cap of approximately $1.30 billion.

Operations: The company's revenue is primarily derived from its Healthcare Software segment, totaling $799.87 million.

Market Cap: $1.3B

GoodRx Holdings, with a market cap of US$1.30 billion, has shown resilience in the penny stock arena by becoming profitable this year. The company's revenue of US$799.87 million is primarily driven by its Healthcare Software segment. Recent earnings reports indicate steady growth, with Q2 2025 sales reaching US$203.07 million and net income doubling compared to the previous year. GoodRx's strategic initiatives include launching new services like an ED subscription and Community Link for pharmacies, aimed at expanding market reach and enhancing consumer affordability. The management team is experienced, effectively steering through competitive challenges while maintaining financial health.

- Click here to discover the nuances of GoodRx Holdings with our detailed analytical financial health report.

- Explore GoodRx Holdings' analyst forecasts in our growth report.

Next Steps

- Access the full spectrum of 390 US Penny Stocks by clicking on this link.

- Contemplating Other Strategies? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10