Most Shareholders Will Probably Agree With Asia-express Logistics Holdings Limited's (HKG:8620) CEO Compensation

Key Insights

- Asia-express Logistics Holdings' Annual General Meeting to take place on 25th of August

- Total pay for CEO Yu Chan includes HK$696.0k salary

- The total compensation is 48% less than the average for the industry

- Asia-express Logistics Holdings' three-year loss to shareholders was 57% while its EPS grew by 60% over the past three years

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The performance at Asia-express Logistics Holdings Limited (HKG:8620) has been rather lacklustre of late and shareholders may be wondering what CEO Yu Chan is planning to do about this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 25th of August. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for Asia-express Logistics Holdings

Comparing Asia-express Logistics Holdings Limited's CEO Compensation With The Industry

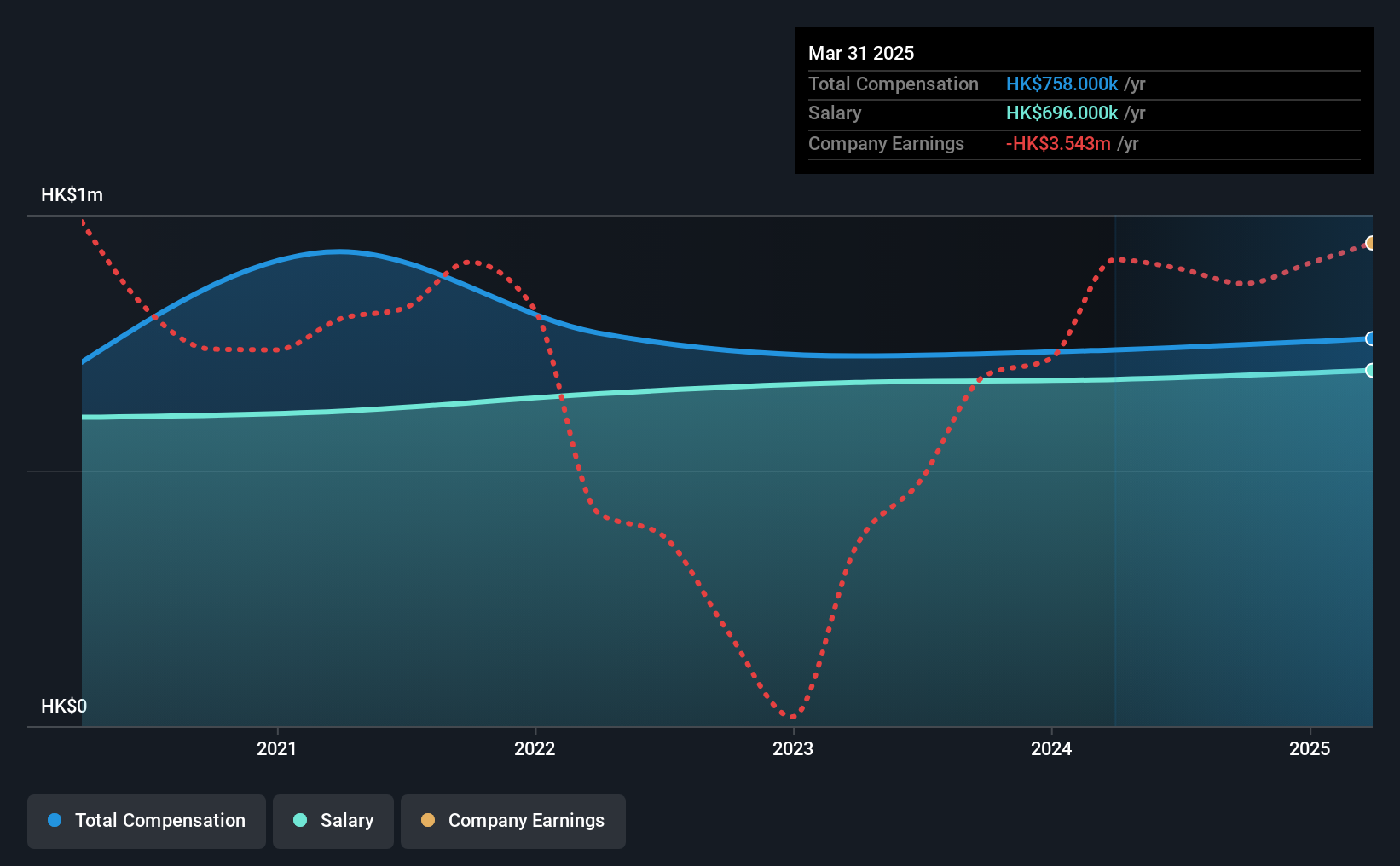

According to our data, Asia-express Logistics Holdings Limited has a market capitalization of HK$43m, and paid its CEO total annual compensation worth HK$758k over the year to March 2025. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at HK$696.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Hong Kong Logistics industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.5m. This suggests that Yu Chan is paid below the industry median.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | HK$696k | HK$678k | 92% |

| Other | HK$62k | HK$58k | 8% |

| Total Compensation | HK$758k | HK$736k | 100% |

On an industry level, around 90% of total compensation represents salary and 10% is other remuneration. There isn't a significant difference between Asia-express Logistics Holdings and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Asia-express Logistics Holdings Limited's Growth Numbers

Over the past three years, Asia-express Logistics Holdings Limited has seen its earnings per share (EPS) grow by 60% per year. In the last year, its revenue is down 2.3%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Asia-express Logistics Holdings Limited Been A Good Investment?

Few Asia-express Logistics Holdings Limited shareholders would feel satisfied with the return of -57% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The fact that shareholders are sitting on a loss is certainly disheartening. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. There needs to be more focus by management and the board to examine why the share price has diverged from fundamentals. In the upcoming AGM, shareholders will get the opportunity to discuss these concerns with the board and assess if the board's plan is likely to improve company performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Asia-express Logistics Holdings that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10