These 4 Measures Indicate That Yanlord Land Group (SGX:Z25) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Yanlord Land Group Limited (SGX:Z25) makes use of debt. But should shareholders be worried about its use of debt?

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

How Much Debt Does Yanlord Land Group Carry?

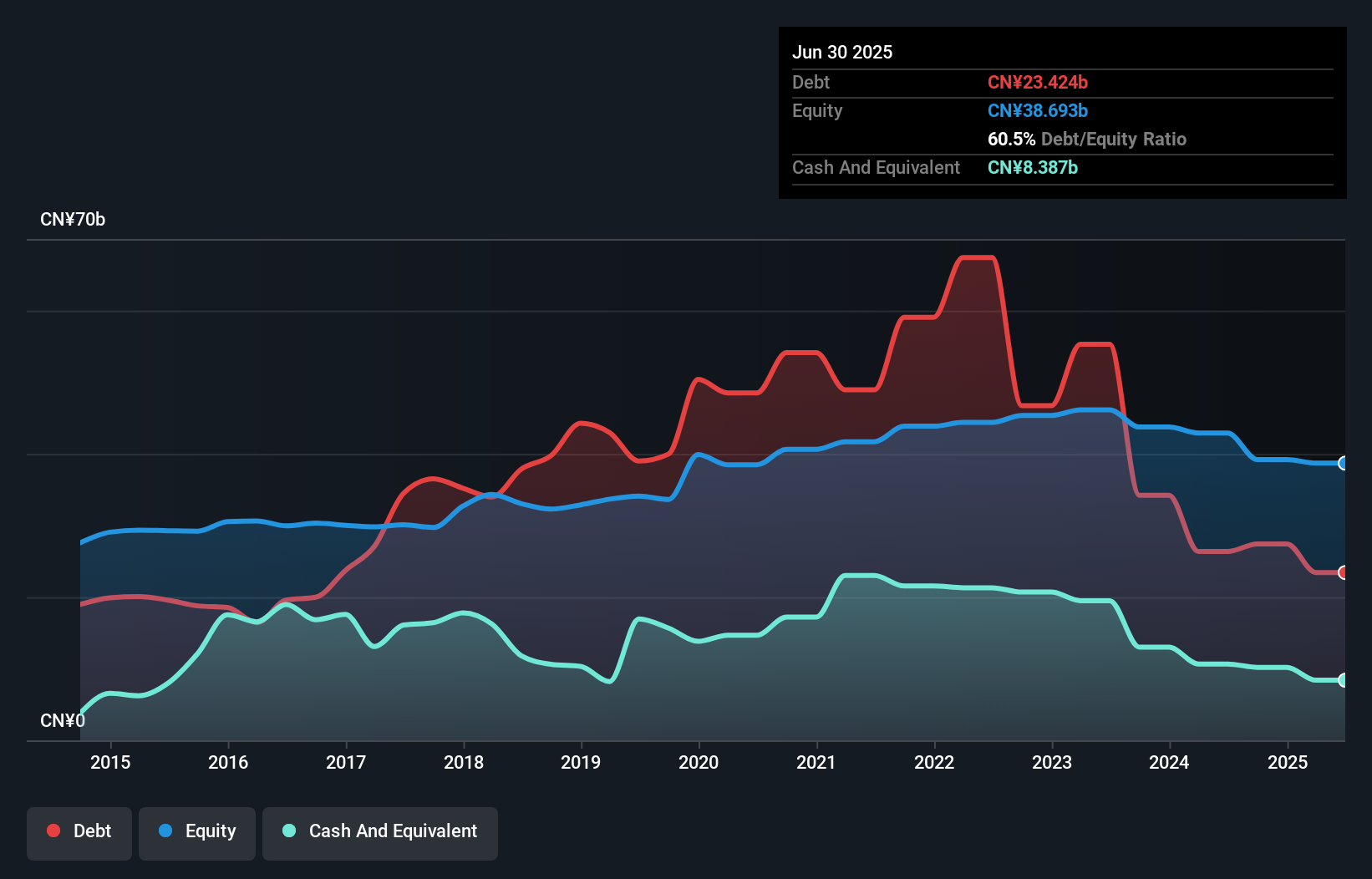

The image below, which you can click on for greater detail, shows that Yanlord Land Group had debt of CN¥23.4b at the end of June 2025, a reduction from CN¥26.4b over a year. However, because it has a cash reserve of CN¥8.39b, its net debt is less, at about CN¥15.0b.

A Look At Yanlord Land Group's Liabilities

We can see from the most recent balance sheet that Yanlord Land Group had liabilities of CN¥41.7b falling due within a year, and liabilities of CN¥24.4b due beyond that. On the other hand, it had cash of CN¥8.39b and CN¥15.4b worth of receivables due within a year. So its liabilities total CN¥42.3b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥6.70b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Yanlord Land Group would likely require a major re-capitalisation if it had to pay its creditors today.

See our latest analysis for Yanlord Land Group

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Yanlord Land Group shareholders face the double whammy of a high net debt to EBITDA ratio (29.1), and fairly weak interest coverage, since EBIT is just 0.43 times the interest expense. The debt burden here is substantial. Even worse, Yanlord Land Group saw its EBIT tank 90% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Yanlord Land Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Yanlord Land Group actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

On the face of it, Yanlord Land Group's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Taking into account all the aforementioned factors, it looks like Yanlord Land Group has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. While Yanlord Land Group didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away. Click here to see if its earnings are heading in the right direction, over the medium term.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10