3 Growth Companies Insiders Are Betting On

As the Dow Jones Industrial Average reaches new heights while the S&P 500 and Nasdaq experience slight declines, investors are closely monitoring market movements amid hopes for potential interest rate cuts by the Federal Reserve. In this environment of mixed market signals, insider ownership can be a compelling indicator of confidence in a company's growth prospects, as insiders often have unique insights into their firm's future potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Prairie Operating (PROP) | 30.4% | 91.3% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hippo Holdings (HIPO) | 12.7% | 41.2% |

| Hesai Group (HSAI) | 21.3% | 42.2% |

| FTC Solar (FTCI) | 23.2% | 63.1% |

| Credo Technology Group Holding (CRDO) | 11.5% | 36.4% |

| Cloudflare (NET) | 10.6% | 45.8% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.5% |

| Astera Labs (ALAB) | 12.3% | 37.2% |

Click here to see the full list of 192 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Let's explore several standout options from the results in the screener.

Liquidia (LQDA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liquidia Corporation is a biopharmaceutical company that develops, manufactures, and commercializes products for unmet patient needs in the United States, with a market cap of $2.22 billion.

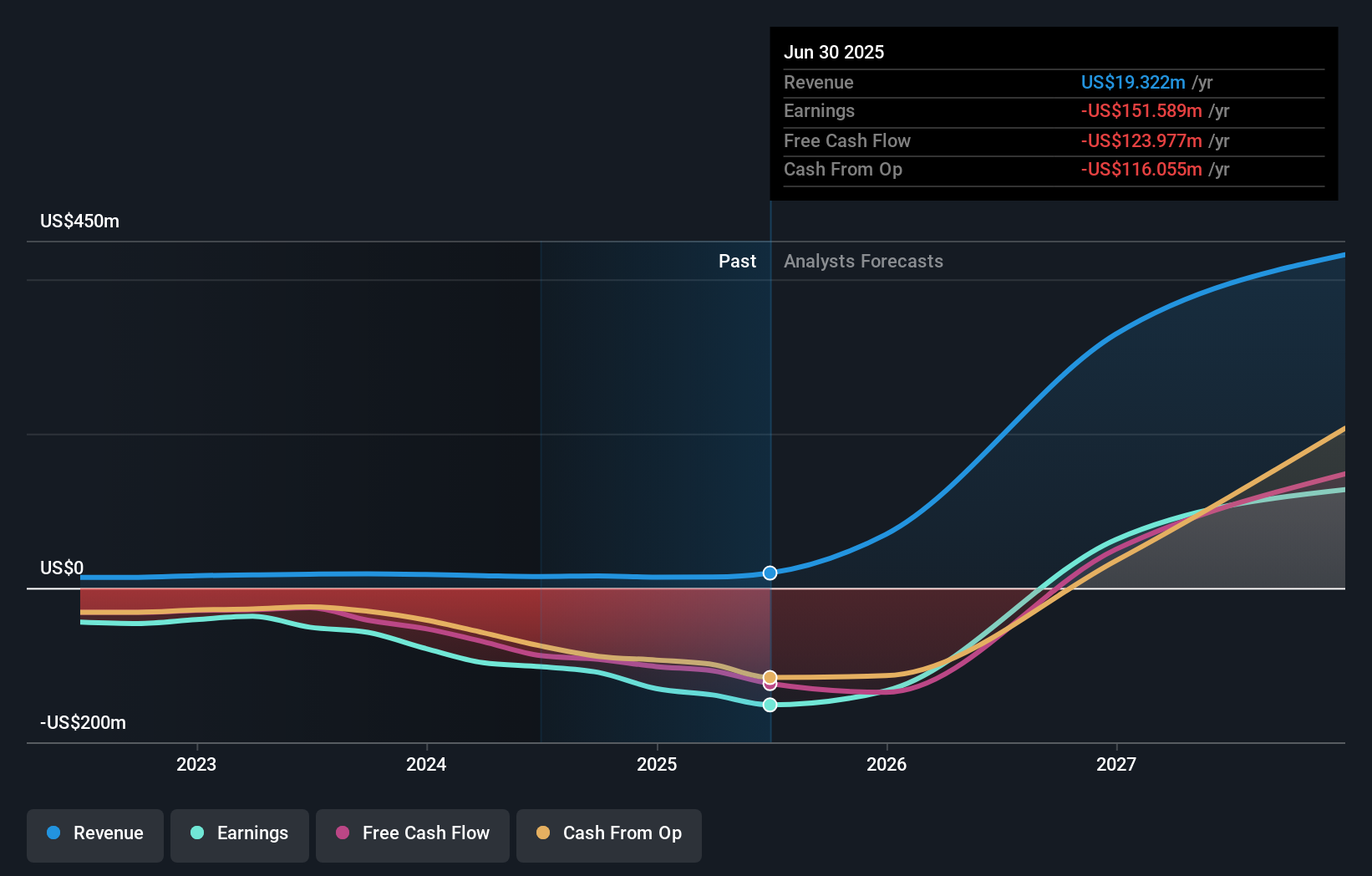

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, which generated $19.32 million.

Insider Ownership: 11%

Return On Equity Forecast: N/A (2028 estimate)

Liquidia is poised for significant growth with forecasted revenue expansion of 43.8% annually, well above the US market average. The recent FDA approval of YUTREPIA, its innovative inhalation powder for pulmonary arterial hypertension, marks a key milestone despite ongoing patent litigation with United Therapeutics. While insider trading data over the past three months is unavailable, Liquidia's shares trade significantly below estimated fair value. Profitability is anticipated within three years, reflecting robust future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Liquidia.

- The analysis detailed in our Liquidia valuation report hints at an inflated share price compared to its estimated value.

Workday (WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. offers enterprise cloud applications globally and has a market capitalization of $60.33 billion.

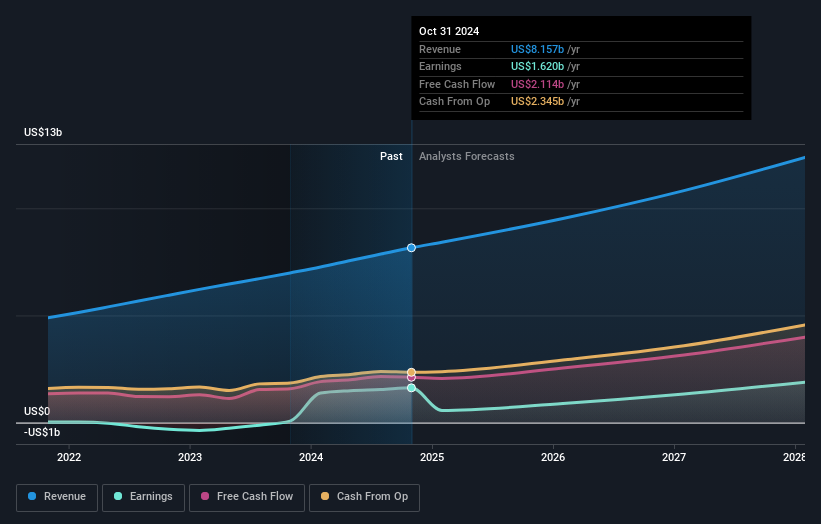

Operations: The company's revenue primarily comes from its Cloud Applications segment, generating $8.70 billion.

Insider Ownership: 19.4%

Return On Equity Forecast: 24% (2028 estimate)

Workday is positioned for significant growth, with earnings expected to increase by 29.9% annually, outpacing the broader US market. Despite recent challenges in profit margins and large one-off items affecting financial results, Workday's strategic partnerships and innovations—such as its AI developer toolset and new partner integrations—enhance its competitive edge. The stock trades below estimated fair value, offering potential upside as analysts predict a price rise of 30.3%. Insider trading data remains unavailable recently.

- Click to explore a detailed breakdown of our findings in Workday's earnings growth report.

- The valuation report we've compiled suggests that Workday's current price could be quite moderate.

Elastic (ESTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Elastic N.V. is a search artificial intelligence company offering software platforms for hybrid, public, private, and multi-cloud environments globally, with a market cap of approximately $8.16 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated approximately $1.48 billion.

Insider Ownership: 12.5%

Return On Equity Forecast: 22% (2028 estimate)

Elastic is poised for growth, with earnings projected to rise by 50.77% annually, surpassing the US market's average. Despite recent financial losses, revenue forecasts indicate an upward trajectory at 11.2%. Recent product innovations like Elastic Observability Logs Essentials and Elastic AI SOC Engine enhance its competitive position in scalable log analytics and security solutions. The stock trades significantly below estimated fair value, suggesting potential upside as analysts anticipate a notable price increase of 41.8%.

- Get an in-depth perspective on Elastic's performance by reading our analyst estimates report here.

- Our valuation report here indicates Elastic may be undervalued.

Turning Ideas Into Actions

- Click here to access our complete index of 192 Fast Growing US Companies With High Insider Ownership.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Elastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10