Old National Bancorp (NASDAQ:ONB) Has Announced A Dividend Of $0.14

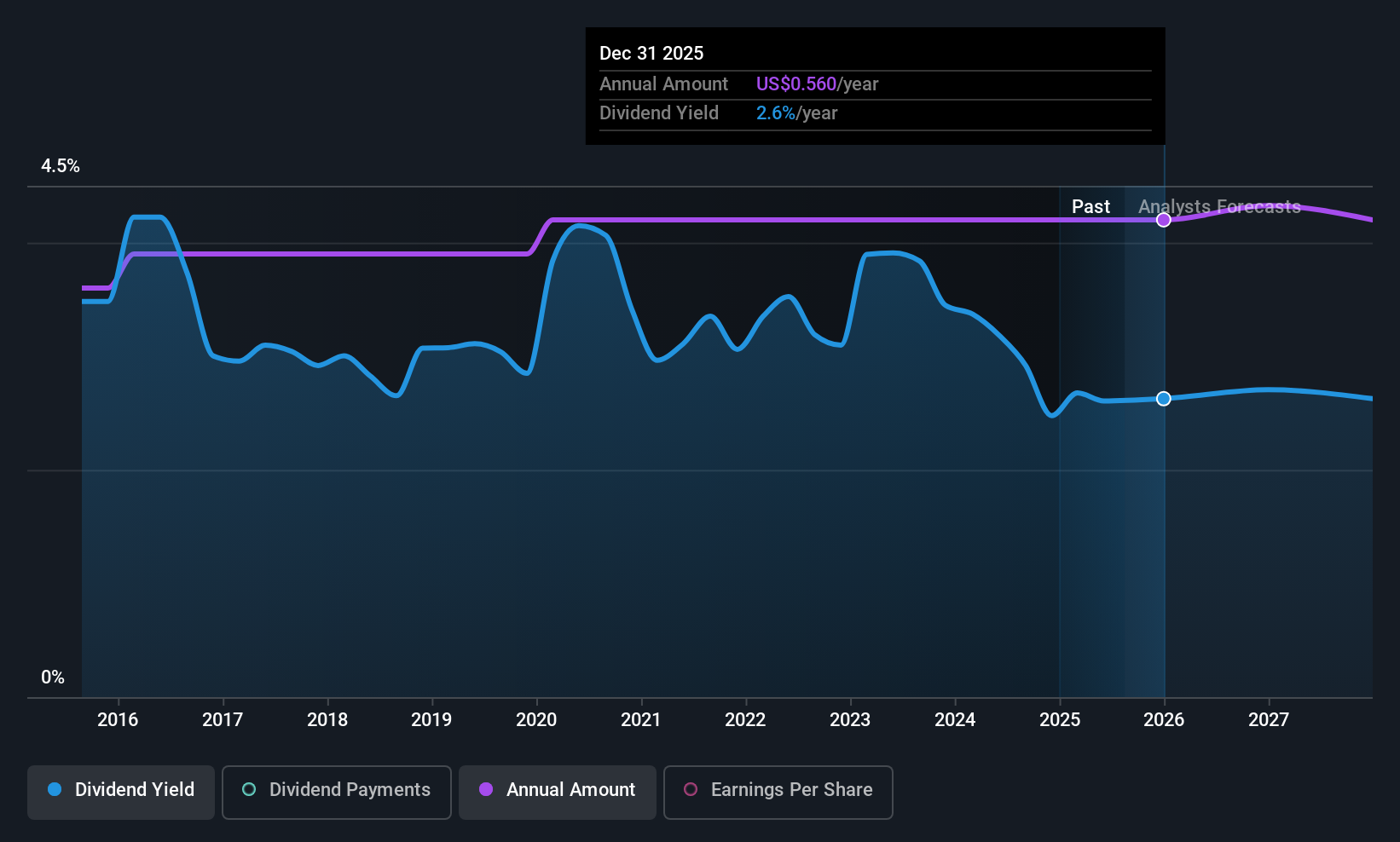

The board of Old National Bancorp (NASDAQ:ONB) has announced that it will pay a dividend of $0.14 per share on the 15th of September. This means that the annual payment will be 2.6% of the current stock price, which is in line with the average for the industry.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

Old National Bancorp's Payment Expected To Have Solid Earnings Coverage

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible.

Old National Bancorp has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Past distributions do not necessarily guarantee future ones, but Old National Bancorp's payout ratio of 33% is a good sign as this means that earnings decently cover dividends.

The next 3 years are set to see EPS grow by 77.7%. Analysts forecast the future payout ratio could be 20% over the same time horizon, which is a number we think the company can maintain.

See our latest analysis for Old National Bancorp

Old National Bancorp Has A Solid Track Record

The company has an extended history of paying stable dividends. The annual payment during the last 10 years was $0.44 in 2015, and the most recent fiscal year payment was $0.56. This implies that the company grew its distributions at a yearly rate of about 2.4% over that duration. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth May Be Hard To Achieve

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, Old National Bancorp has only grown its earnings per share at 4.1% per annum over the past five years. Earnings growth is slow, but on the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

We should note that Old National Bancorp has issued stock equal to 23% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

We Really Like Old National Bancorp's Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for Old National Bancorp that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10