ARS Pharmaceuticals And 2 Other Growth Stocks With Strong Insider Ownership

As the U.S. markets experience a downturn with major indices like the S&P 500 and Nasdaq Composite posting losses, investors are keenly focused on Federal Reserve Chair Jerome Powell's upcoming speech for insights into future interest rate policies. In such uncertain times, stocks with strong insider ownership may offer a measure of confidence to investors, as they often indicate that those closest to the company have significant skin in the game and believe in its long-term growth potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Prairie Operating (PROP) | 30.4% | 86.3% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hippo Holdings (HIPO) | 12.9% | 41.2% |

| Hesai Group (HSAI) | 21.3% | 41.5% |

| FTC Solar (FTCI) | 23.2% | 63.1% |

| Credo Technology Group Holding (CRDO) | 11.5% | 36.4% |

| Cloudflare (NET) | 10.6% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.5% |

| Astera Labs (ALAB) | 12.3% | 37.1% |

Click here to see the full list of 194 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Let's dive into some prime choices out of the screener.

ARS Pharmaceuticals (SPRY)

Simply Wall St Growth Rating: ★★★★★☆

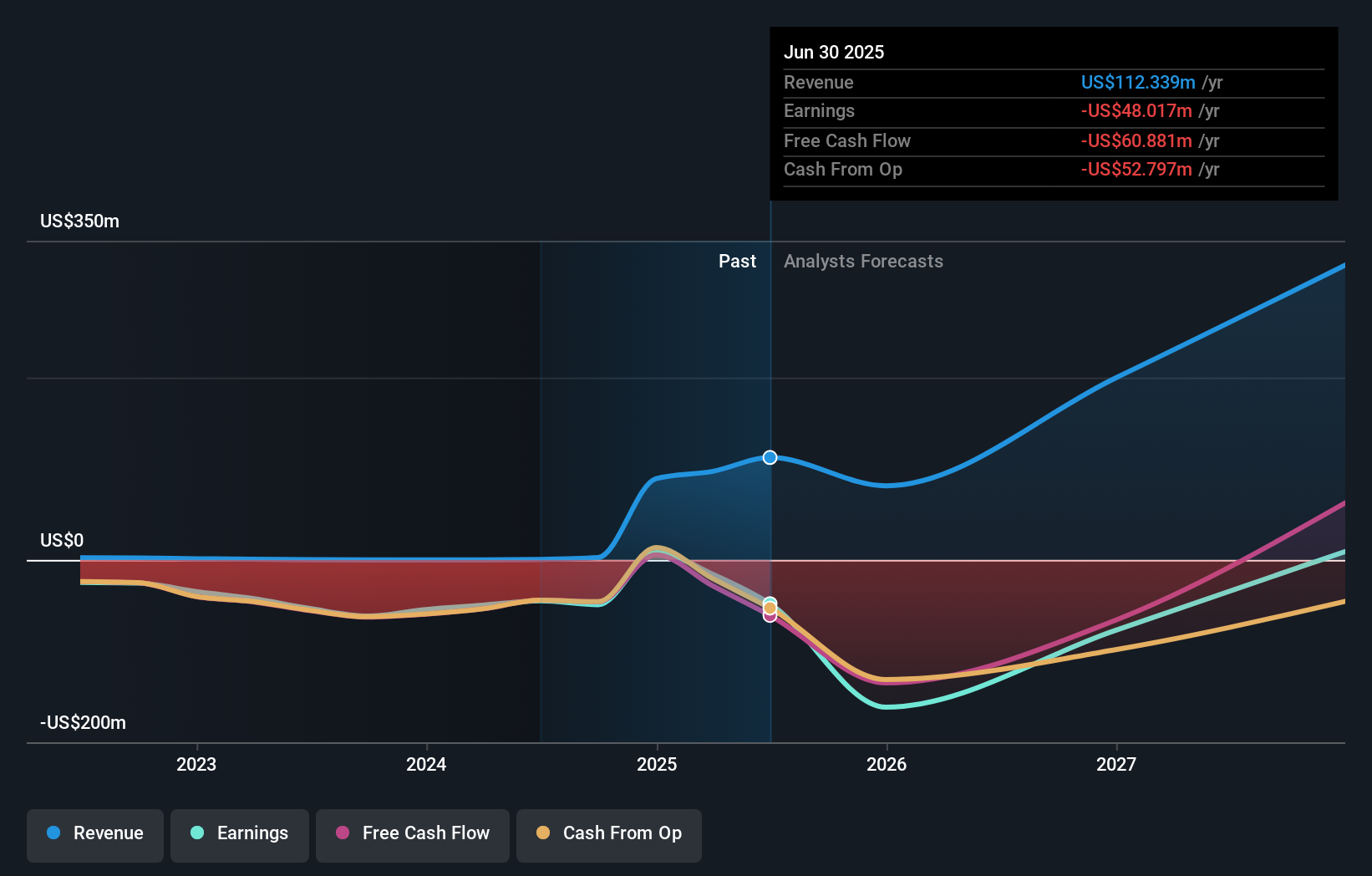

Overview: ARS Pharmaceuticals, Inc. is a biopharmaceutical company focused on developing and commercializing treatments for severe allergic reactions, with a market cap of approximately $1.44 billion.

Operations: The company's revenue segment consists solely of its pharmaceuticals division, generating $112.34 million.

Insider Ownership: 13.9%

Revenue Growth Forecast: 42.2% p.a.

ARS Pharmaceuticals recently reported a significant revenue increase to US$15.72 million for Q2 2025, though net losses widened to US$44.88 million. The company achieved a milestone with the U.K. approval of its needle-free adrenaline spray, EURneffy, addressing a crucial need in allergy treatment. Despite being dropped from several indices, ARS is expected to outpace market growth with projected annual revenue growth of 42.2% and profitability within three years.

- Click to explore a detailed breakdown of our findings in ARS Pharmaceuticals' earnings growth report.

- The analysis detailed in our ARS Pharmaceuticals valuation report hints at an deflated share price compared to its estimated value.

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

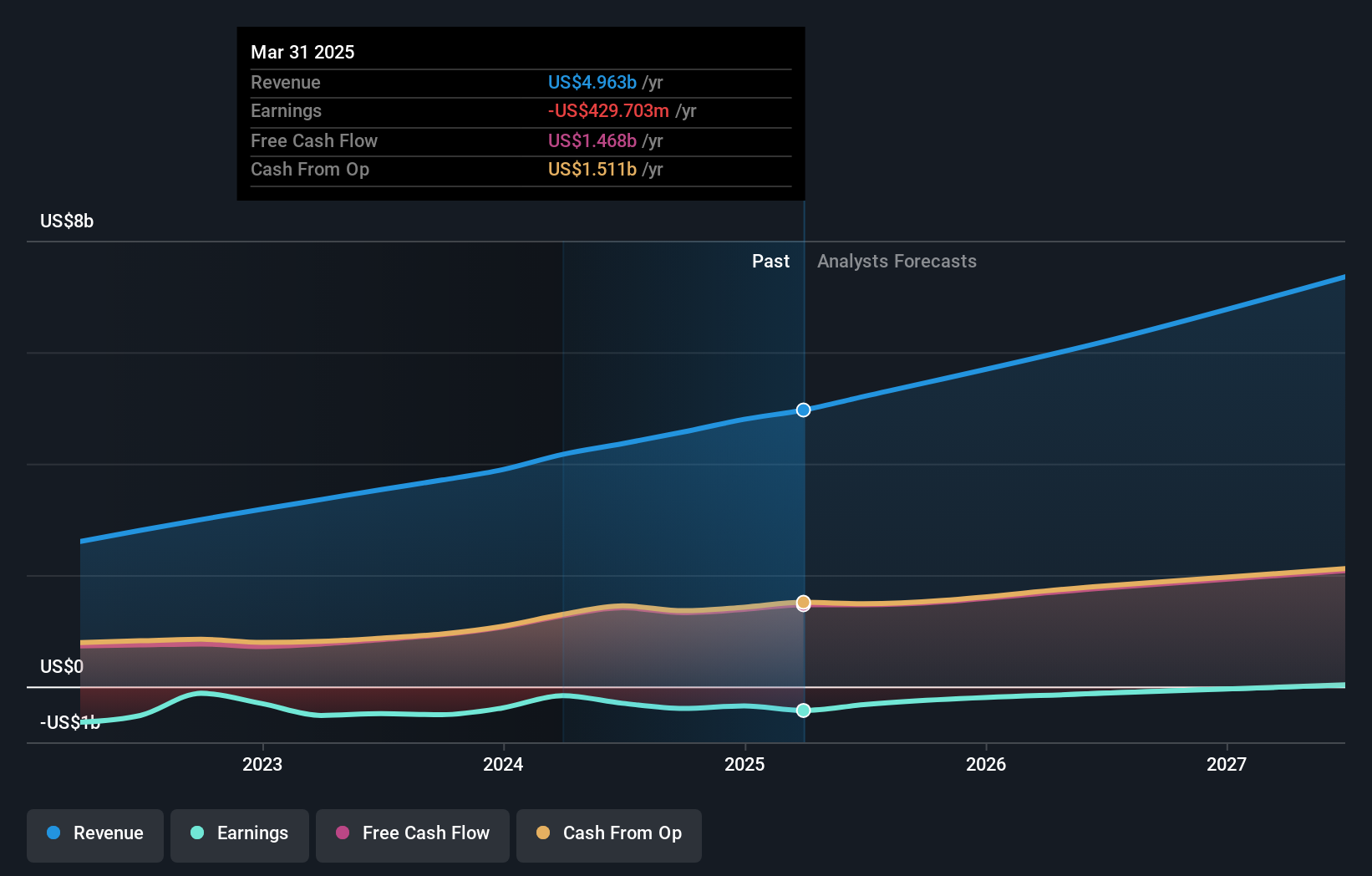

Overview: Atlassian Corporation offers collaboration software designed to enhance productivity across teams globally, with a market cap of approximately $43.69 billion.

Operations: The company's revenue is primarily generated from its Software & Programming segment, which amounts to $5.22 billion.

Insider Ownership: 37.2%

Revenue Growth Forecast: 14.7% p.a.

Atlassian's growth trajectory is underscored by its substantial insider ownership, though recent months have seen significant insider selling. The company reported a revenue increase to US$5.22 billion for the year ending June 2025, with a reduced net loss of US$256.69 million. Atlassian's partnership with Google Cloud aims to enhance AI capabilities and cloud transformation, potentially driving future growth. Despite trading below fair value estimates, Atlassian forecasts robust revenue and profit growth in the coming years.

- Click here to discover the nuances of Atlassian with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Atlassian is priced lower than what may be justified by its financials.

Workiva (WK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Workiva Inc. provides cloud-based reporting solutions across the Americas and internationally, with a market cap of approximately $4.28 billion.

Operations: The company generates revenue primarily from its data processing segment, amounting to $806.98 million.

Insider Ownership: 10.6%

Revenue Growth Forecast: 15% p.a.

Workiva's growth potential is supported by insider ownership, though recent months have seen significant insider selling. The company reported a revenue increase to US$215.19 million for Q2 2025, with a net loss of US$19.4 million. Workiva is expected to become profitable within three years, with revenue forecasted to grow faster than the US market at 15% annually. Despite trading below fair value estimates, Workiva anticipates continued revenue growth and has completed a share buyback program worth US$50.11 million.

- Get an in-depth perspective on Workiva's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Workiva is trading behind its estimated value.

Taking Advantage

- Explore the 194 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10