Undervalued Small Caps With Insider Buying Across Regions

As the United States market grapples with a tech sector slump and investors await insights from Federal Reserve Chair Jerome Powell, small-cap stocks present an intriguing opportunity amidst broader market volatility. In this environment, identifying potentially undervalued small-cap companies with insider buying can offer a unique perspective on resilience and growth potential in various regions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First United | 9.5x | 2.8x | 46.27% | ★★★★★☆ |

| Angel Oak Mortgage REIT | 6.4x | 4.1x | 32.42% | ★★★★★☆ |

| PCB Bancorp | 10.1x | 3.0x | 32.00% | ★★★★☆☆ |

| Southside Bancshares | 10.6x | 3.6x | 37.32% | ★★★★☆☆ |

| S&T Bancorp | 11.0x | 3.7x | 40.10% | ★★★★☆☆ |

| Tilray Brands | NA | 1.4x | 11.64% | ★★★★☆☆ |

| Lindblad Expeditions Holdings | NA | 1.1x | 11.41% | ★★★★☆☆ |

| Shore Bancshares | 9.9x | 2.6x | -73.92% | ★★★☆☆☆ |

| Citizens Community Bancorp | 12.6x | 2.7x | 20.29% | ★★★☆☆☆ |

| Farmland Partners | 7.1x | 8.7x | -43.69% | ★★★☆☆☆ |

Click here to see the full list of 82 stocks from our Undervalued US Small Caps With Insider Buying screener.

Underneath we present a selection of stocks filtered out by our screen.

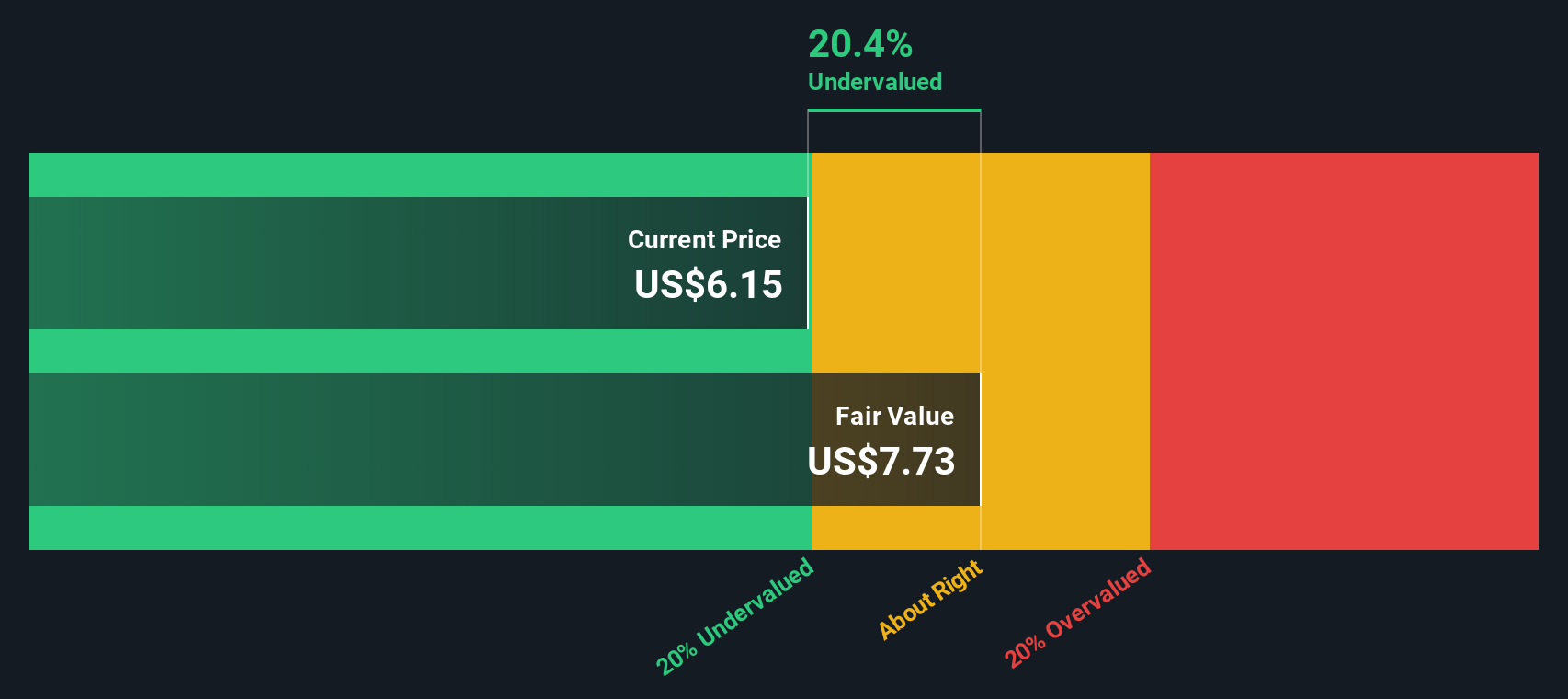

Sigma Lithium (SGML)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sigma Lithium is engaged in the exploration and development of lithium deposits, focusing on sustainable extraction practices, with a market cap of approximately $3.75 billion.

Operations: Sigma Lithium's financial data indicates that the company has experienced fluctuating net income margins, with recent figures showing a net loss. Despite generating revenue from its metals and mining segment, the company has faced challenges in achieving profitability, as evidenced by a gross profit margin of 4.96% in the latest period. Operating expenses and non-operating expenses have contributed to its negative net income.

PE: -13.9x

Sigma Lithium, a small company in the lithium sector, has seen insider confidence with recent share purchases. Despite volatile share prices and earnings declining by 23.2% annually over five years, production is on track to hit 270,000 tonnes in 2025. Recent quarterly results showed a net loss of US$18.86 million on sales of US$16.89 million but highlighted increased lithium oxide concentrate output from the previous year. New CFO Felipe Peres brings decades of industry experience to navigate these challenges and opportunities ahead.

- Delve into the full analysis valuation report here for a deeper understanding of Sigma Lithium.

Examine Sigma Lithium's past performance report to understand how it has performed in the past.

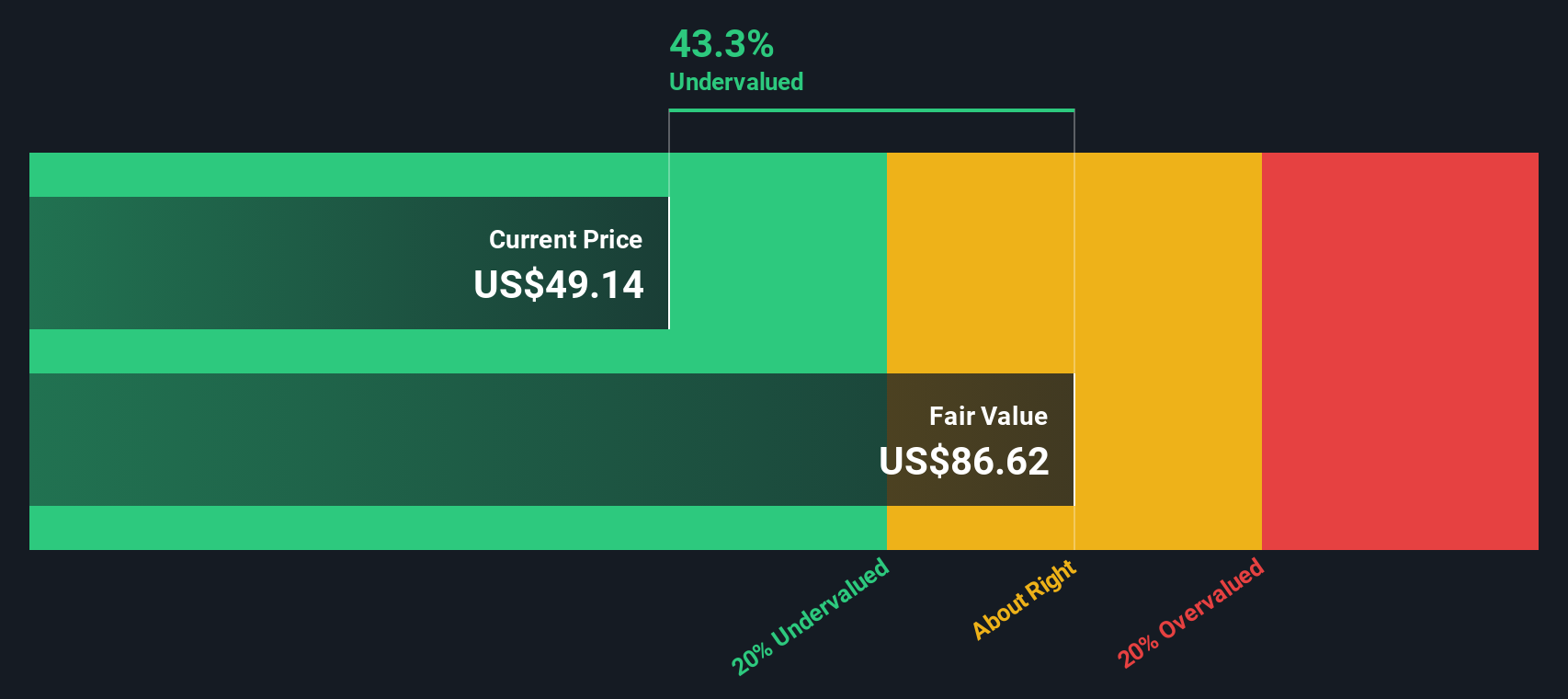

Mercantile Bank (MBWM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mercantile Bank operates as a financial institution providing banking products and services, along with investment securities, with a market capitalization of approximately $0.53 billion.

Operations: The company generates revenue primarily from banking products, services, and investment securities, totaling $228.38 million. Operating expenses are a significant cost component, with general and administrative expenses accounting for the majority at $108.36 million in the latest period. The net income margin has shown variability over time, reaching 35.64% recently.

PE: 9.5x

Mercantile Bank, a company within the smaller cap category, demonstrates potential value through its financial performance and strategic actions. Recently, they reported an increase in net interest income to US$49.48 million for Q2 2025 from US$47.07 million the previous year, with net income rising to US$22.62 million from US$18.79 million. The company completed a share buyback of 420,292 shares for US$13.18 million under a program announced in May 2021, enhancing shareholder value despite not repurchasing any shares recently. Additionally, insider confidence is evident as executives have shown commitment by maintaining their positions amidst these developments. With earnings projected to grow at 8.54% annually and recent inclusion in the Russell 2000 Dynamic Index as of June 28, Mercantile Bank's trajectory suggests room for growth while highlighting its undervalued status among peers.

- Take a closer look at Mercantile Bank's potential here in our valuation report.

Gain insights into Mercantile Bank's past trends and performance with our Past report.

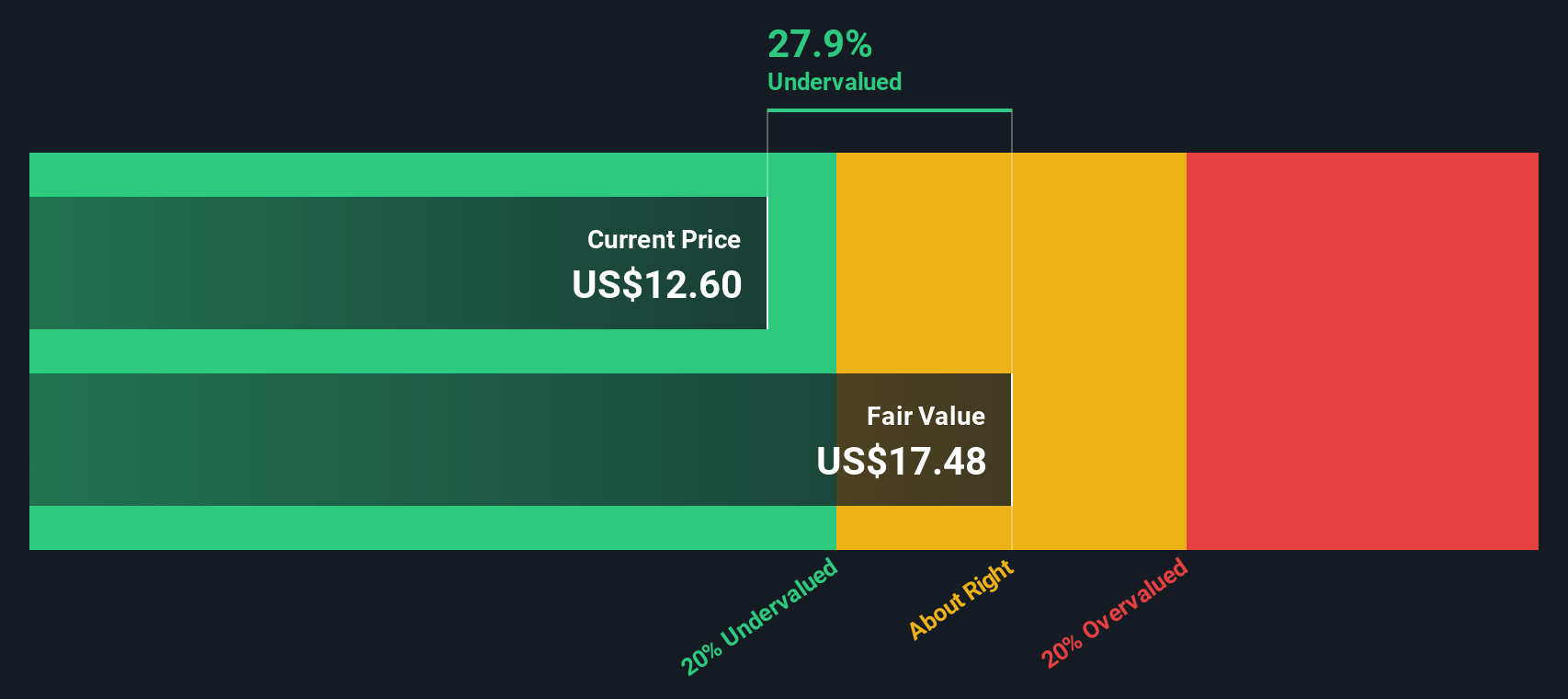

Whitestone REIT (WSR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Whitestone REIT is a real estate investment trust focused on owning and operating community-centered commercial properties, with a market cap of approximately $0.53 billion.

Operations: Whitestone REIT generates revenue primarily from its commercial real estate operations, with a recent quarterly revenue of $155.37 million. The company's gross profit margin has shown variability, reaching 70.19% in the latest period. Operating expenses and non-operating expenses are significant cost components, including general and administrative expenses which were $20.82 million in the most recent quarter.

PE: 18.8x

Whitestone REIT, a smaller player in the U.S. market, has seen insider confidence with recent share purchases. Despite being dropped from the Russell 2000 Dynamic Index in June 2025, Whitestone reported Q2 net income of US$5.05 million, nearly doubling from last year. The acquisition of a prime retail center in Fort Worth strengthens its Texas footprint and potential for growth. However, earnings are forecasted to decline by 2.6% annually over the next three years due to reliance on external borrowing and large one-off items impacting financial results.

- Click here to discover the nuances of Whitestone REIT with our detailed analytical valuation report.

Explore historical data to track Whitestone REIT's performance over time in our Past section.

Turning Ideas Into Actions

- Embark on your investment journey to our 82 Undervalued US Small Caps With Insider Buying selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10