Verizon Communications (VZ) Launches Google Pixel 10 Preorders With Trade-In Offers

Verizon Communications (VZ) has recently launched preorders for the new Google Pixel 10 series, which is available on its 5G network, and this event aligns with the company's share price move of 6% over the past month. This product launch comes at a time when the broader market has faced declines, with the S&P 500 index down for several consecutive days. While the general market sentiment has been bearish, the excitement around Verizon’s new product offerings, along with strategic partnerships like the expansion with Staples, might have positively influenced investor confidence in the company.

Verizon Communications has 1 possible red flag we think you should know about.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

The recent launch of the Google Pixel 10 series by Verizon Communications may bolster investor sentiment by highlighting the company's commitment to expanding its 5G offerings and strategic partnerships. This could potentially enhance revenue and earnings forecasts as excitement around new product offerings tends to boost subscriber numbers and service adoption. Despite a challenging broader market environment, Verizon's stock has shown resilience with a 6% increase over the past month, possibly reflecting investor optimism about these developments.

Over the longer term, Verizon shares have delivered a total return of 26.57% over the past three years, which includes both price appreciation and dividends, showcasing the company's capacity to provide value to its shareholders. However, when assessing its recent performance over the past year, Verizon underperformed compared to the US Telecom industry, which posted a return of 25.5%. This contrast might suggest that while the company has achieved substantial returns over a more extended period, it faces competitive pressures impacting its performance in the shorter term.

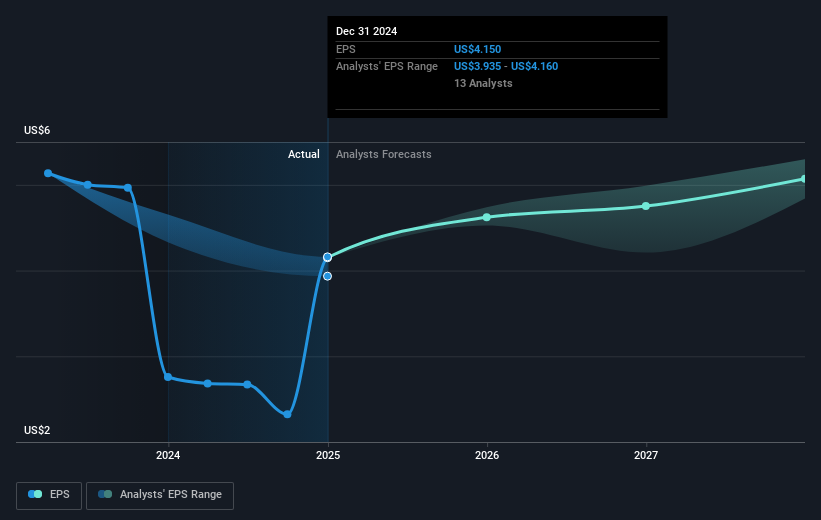

With a current share price of approximately US$45.06, Verizon shares are trading at a discount compared to the consensus analyst price target of US$48.74, indicating potential upside according to these forecasts. Analysts predict a modest revenue growth rate of 1.8% annually over the next few years, with profit margins expected to increase slightly. The excitement around Verizon’s strategic moves, such as the Pixel 10 launch and network enhancements, could positively influence these forecasts by potentially driving increased service adoption and higher average revenue per user.

The valuation report we've compiled suggests that Verizon Communications' current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10