Equifax (EFX) Declares US$0.50 Dividend Despite Recent Market Dip

Equifax (EFX) recently announced a quarterly dividend of $0.50 per share, set to be paid on September 15, 2025. This declaration comes amid a weekly share price decline of 1.95%, consistent with broader market trends where the S&P 500 also fell for five consecutive days. As investors anticipate Federal Reserve Chair Jerome Powell's speech, market volatility has been prevalent. While the dividend announcement reflects stability in Equifax's commitment to shareholder returns, it aligns with general sector pressures, as seen in market-wide declines driven by investor caution and economic uncertainties.

We've spotted 1 warning sign for Equifax you should be aware of.

Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

The recent dividend announcement of US$0.50 per share is expected to strengthen Equifax's long-term shareholder returns, contributing to the company's total return of 59.27% over the past five years. This figure provides a solid context for the company's performance, despite a recent dip in share price. Over the last year, Equifax underperformed the US Professional Services industry, which saw a 3.6% increase compared to Equifax's smaller return. The dividend reflects an ongoing commitment to shareholders and could stabilize sentiment amid broader market fluctuations driven by economic uncertainties, aligning with the company's strategies for organic growth and margin improvement.

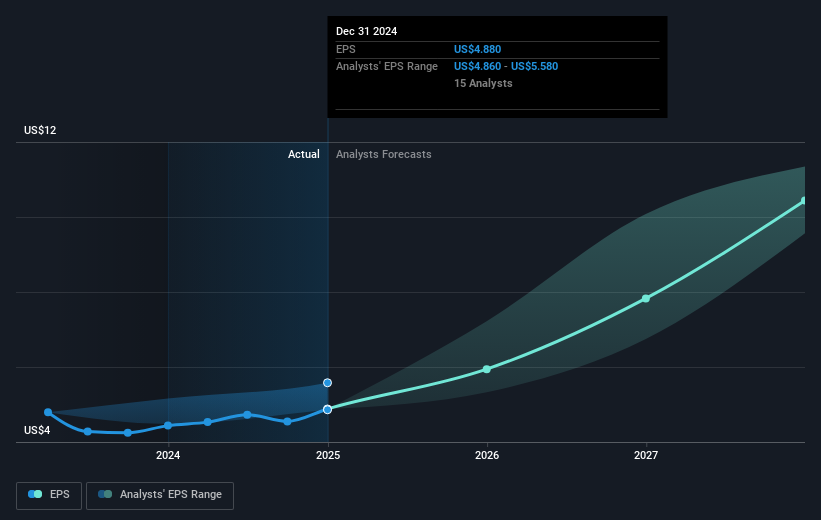

Equifax's share price is currently US$248.35, presenting a 12.95% discount to the consensus analyst price target of US$280.50. This gap indicates potential for upside if the company's growth projections materialize. Analysts forecast revenue growth at 8.8% annually, slightly below the market average of 9.2%, and earnings to increase significantly over the next three years. The dividend and market trends suggest the company is in a position to weather temporary market setbacks while focusing on long-term profitability. Investors should consider these dynamics as Equifax aims to meet and potentially exceed future earnings projections, with particular attention to how ongoing economic conditions might affect these forecasts.

Assess Equifax's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10