The Australian market has recently reached new heights, with the ASX 200 breaking through the 9,000 mark for the first time ever, driven by strong performances in Industrials and Consumer sectors. In such a vibrant market landscape, investors often look beyond established giants to explore opportunities in smaller or newer companies. Despite its vintage connotation, the term 'penny stock' continues to represent these intriguing prospects; when backed by solid financials and a clear growth trajectory, they can offer significant potential for returns. In this article, we explore three penny stocks that exhibit financial strength and could present hidden value opportunities in today's dynamic market environment.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.72 | A$128.31M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.39 | A$74.36M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.03 | A$467.17M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.28 | A$354.12M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$2.70 | A$3.08B | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.12 | A$1.05B | ✅ 4 ⚠️ 2 View Analysis > |

| Bravura Solutions (ASX:BVS) | A$2.28 | A$1.02B | ✅ 3 ⚠️ 3 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.37 | A$135.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$4.37 | A$207.36M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.86 | A$149.81M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 454 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Hot Chili (ASX:HCH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hot Chili Limited, with a market cap of A$114.52 million, operates as a mineral exploration company in Chile through its subsidiaries.

Operations: The company has not reported any revenue segments.

Market Cap: A$114.52M

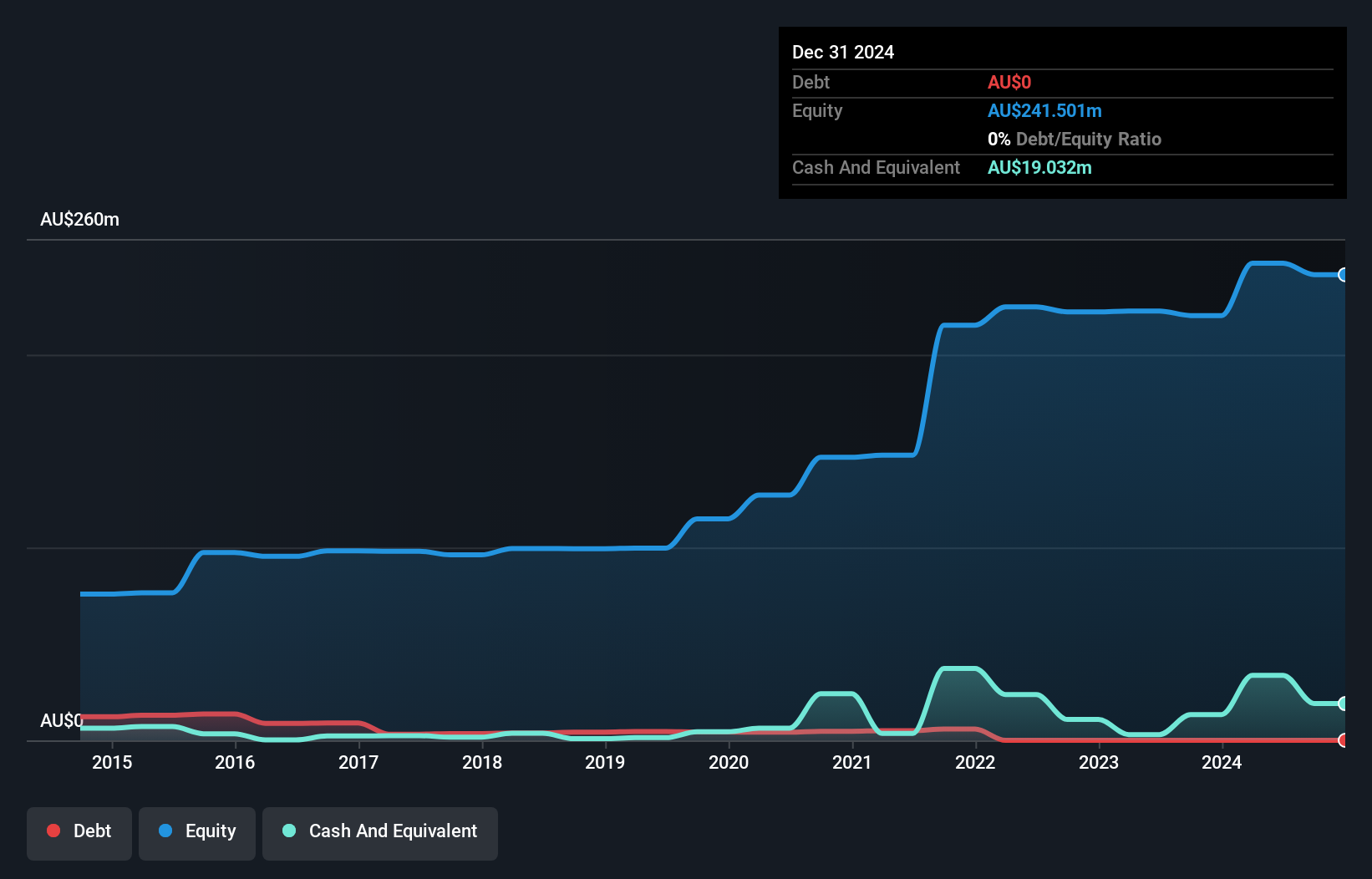

Hot Chili Limited, with a market cap of A$114.52 million, is currently pre-revenue and unprofitable. The company recently raised A$14.19 million through a follow-on equity offering to support its exploration activities in Chile's Atacama region. Recent updates highlight the potential for a district-scale porphyry cluster surrounding its La Verde discovery, supported by promising geophysical and geochemical data. Despite having no revenue streams yet, Hot Chili's short-term assets significantly exceed both short- and long-term liabilities, providing some financial stability as it continues exploration efforts. The management team has an average tenure of 4.8 years, indicating experience within the company.

- Get an in-depth perspective on Hot Chili's performance by reading our balance sheet health report here.

- Evaluate Hot Chili's prospects by accessing our earnings growth report.

Kogan.com (ASX:KGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kogan.com Ltd is an online retailer operating in Australia with a market capitalization of A$405.20 million.

Operations: The company's revenue is derived from its operations in Australia, with A$309.36 million from the Kogan Parent and A$9.96 million from Mighty Ape, as well as in New Zealand, where it generates A$40.02 million from the Kogan Parent and A$124.88 million from Mighty Ape.

Market Cap: A$405.2M

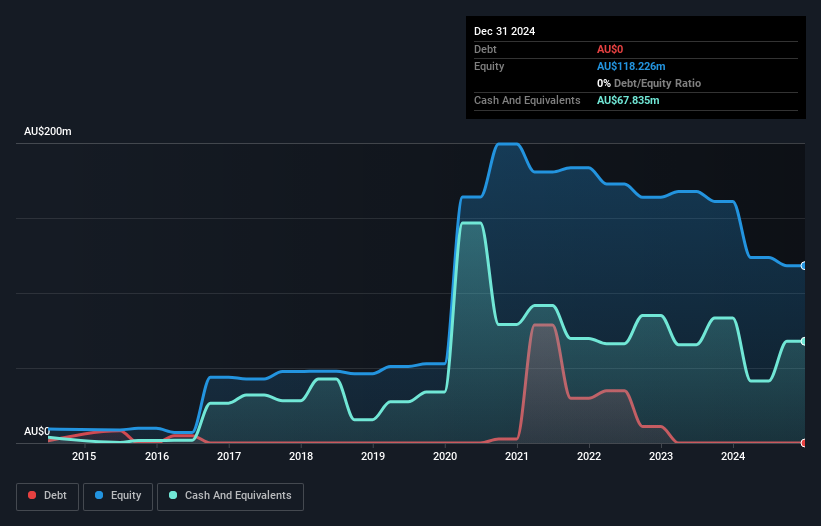

Kogan.com, with a market cap of A$405.20 million, has seen its earnings decline by 33% annually over the past five years and experienced a significant drop in profit margins from 1.4% to 0.4% last year. Despite these challenges, the company is debt-free and trades at a substantial discount to estimated fair value. Its seasoned management team averages eight years of tenure, providing stability amidst executive changes like the recent appointment of Belinda Cleminson as Company Secretary. Kogan's short-term assets exceed liabilities, offering some financial resilience as it navigates volatile market conditions in online retailing.

- Navigate through the intricacies of Kogan.com with our comprehensive balance sheet health report here.

- Assess Kogan.com's future earnings estimates with our detailed growth reports.

Lindian Resources (ASX:LIN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lindian Resources Limited, with a market cap of A$284.02 million, is involved in the exploration of mineral properties across Tanzania, Guinea, Malawi, and Australia.

Operations: Currently, there are no specific revenue segments reported for the company.

Market Cap: A$284.02M

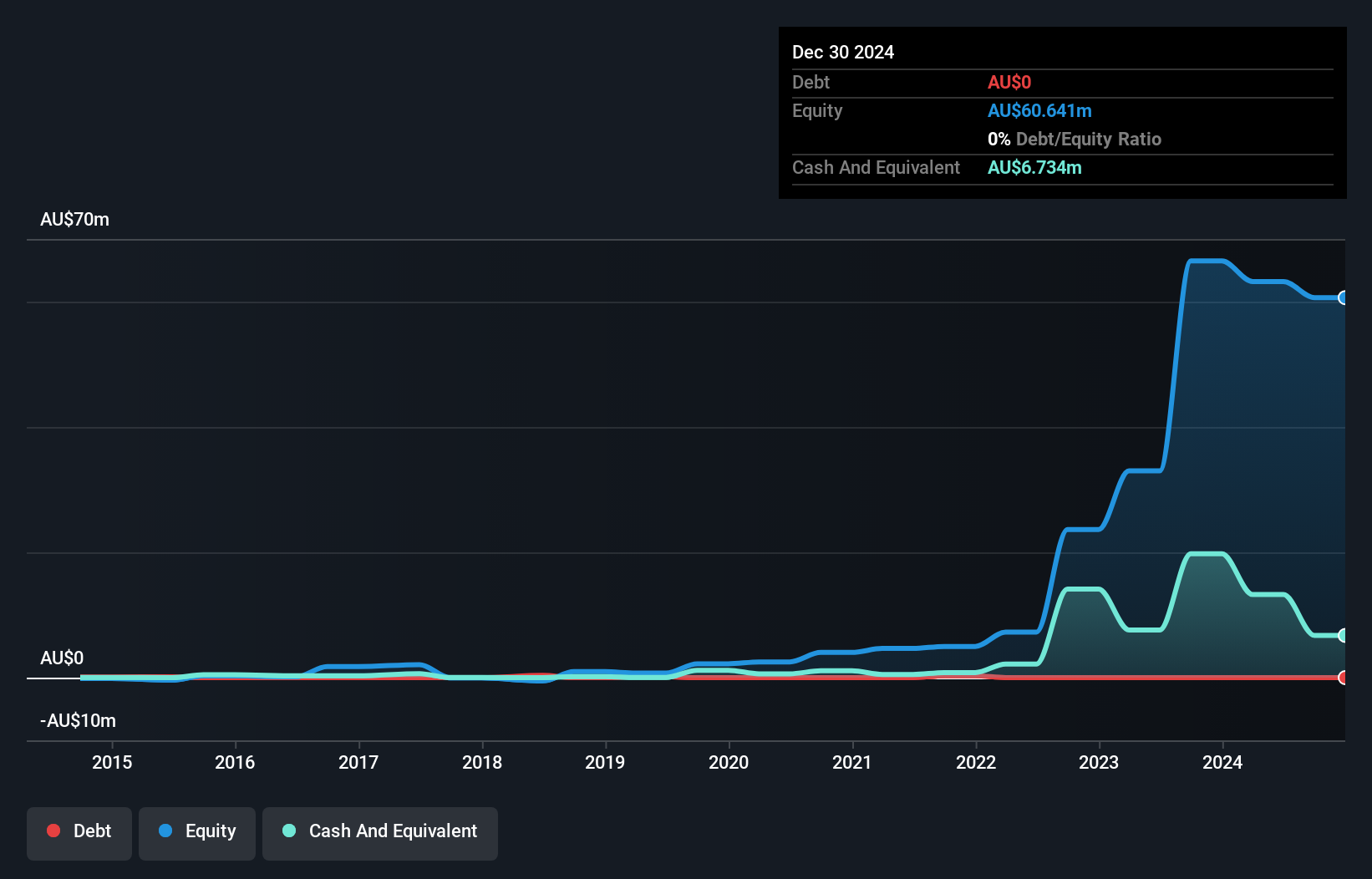

Lindian Resources, with a market cap of A$284.02 million, remains pre-revenue and unprofitable, facing increased losses over the past five years. The company recently raised A$91.5 million through a follow-on equity offering, bolstering its cash runway amid short-term asset coverage challenges for long-term liabilities. Despite high share price volatility and an inexperienced management team, Lindian is progressing with its Kangankunde Rare Earths Project in Malawi. Key developments include advancing infrastructure projects like haul roads and a solar farm to support sustainable operations as it prepares to award critical contracts for the next development phase.

- Jump into the full analysis health report here for a deeper understanding of Lindian Resources.

- Assess Lindian Resources' previous results with our detailed historical performance reports.

Summing It All Up

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 451 more companies for you to explore.Click here to unveil our expertly curated list of 454 ASX Penny Stocks.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com