By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, the China Success Finance Group Holdings Limited (HKG:3623) share price is up 56% in the last three years, clearly besting the market return of around 35% (not including dividends).

The past week has proven to be lucrative for China Success Finance Group Holdings investors, so let's see if fundamentals drove the company's three-year performance.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

China Success Finance Group Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years China Success Finance Group Holdings saw its revenue shrink by 22% per year. The revenue growth might be lacking but the share price has gained 16% each year in that time. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

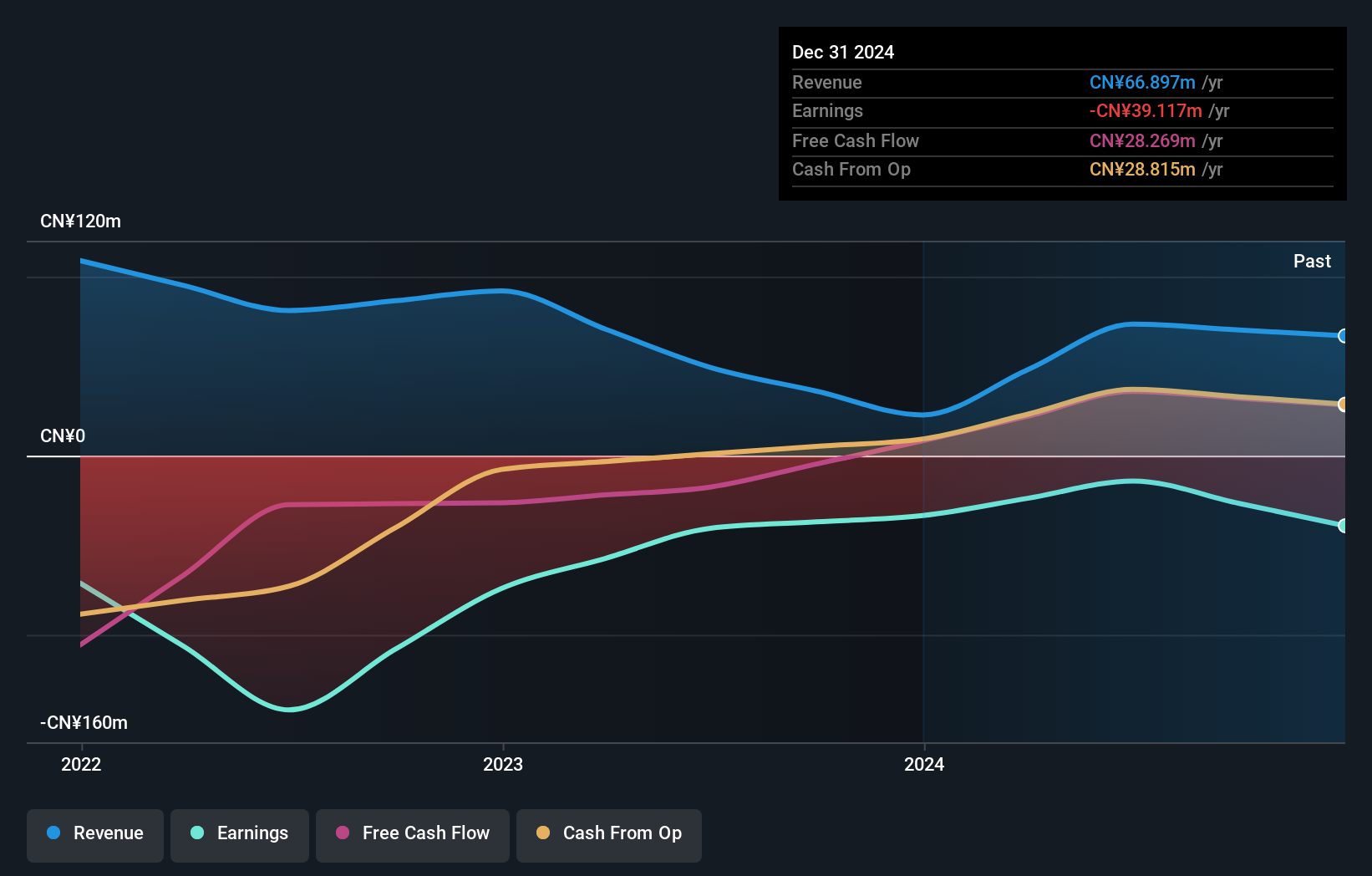

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

China Success Finance Group Holdings' TSR for the year was broadly in line with the market average, at 52%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 3%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. You could get a better understanding of China Success Finance Group Holdings' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.