The TJX Companies, Inc. Just Beat Earnings Expectations: Here's What Analysts Think Will Happen Next

Investors in The TJX Companies, Inc. (NYSE:TJX) had a good week, as its shares rose 3.4% to close at US$138 following the release of its quarterly results. TJX Companies reported US$14b in revenue, roughly in line with analyst forecasts, although statutory earnings per share (EPS) of US$1.10 beat expectations, being 8.5% higher than what the analysts expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

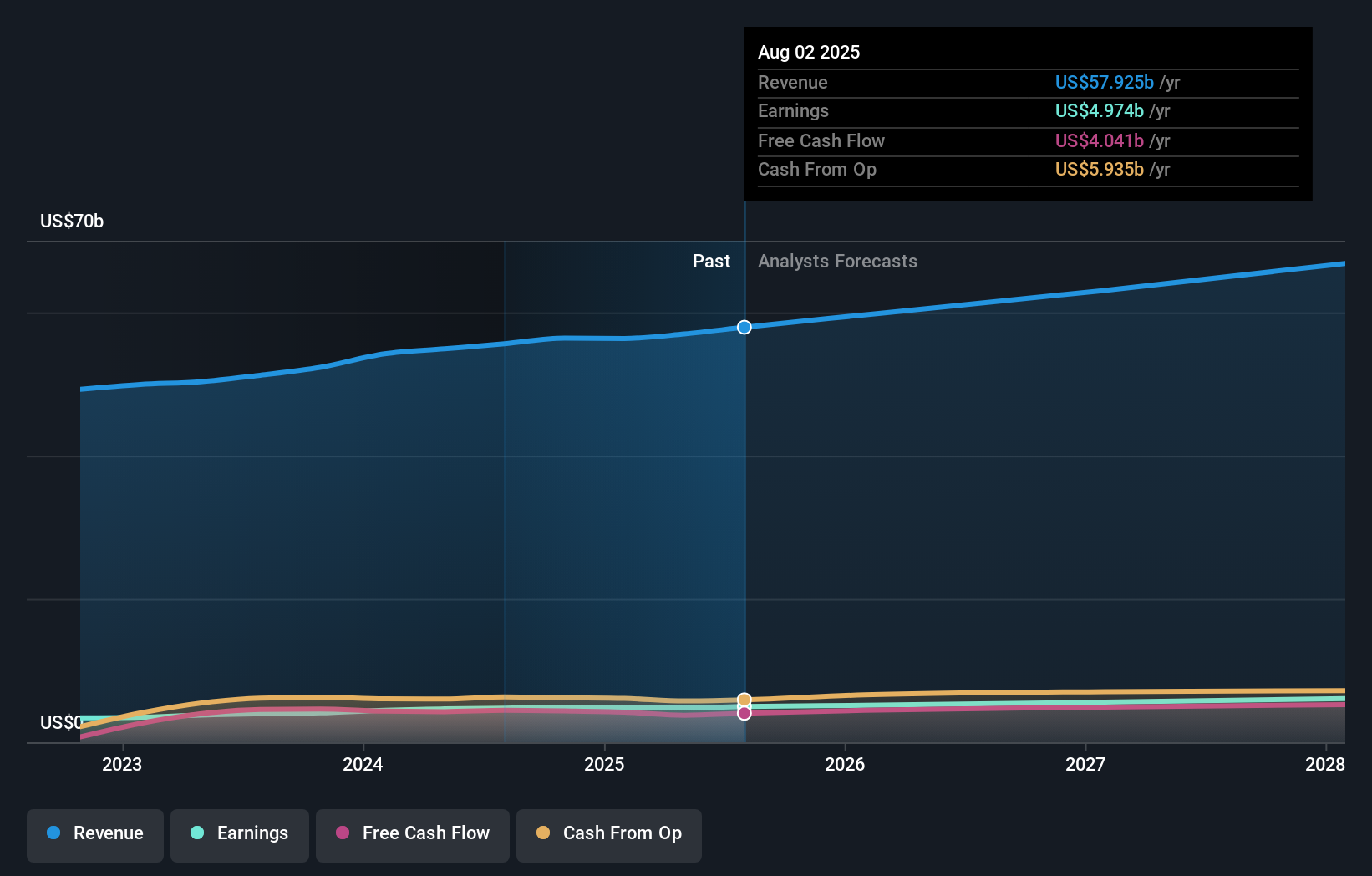

Following the latest results, TJX Companies' 17 analysts are now forecasting revenues of US$59.7b in 2026. This would be a reasonable 3.0% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to increase 3.1% to US$4.60. Before this earnings report, the analysts had been forecasting revenues of US$59.2b and earnings per share (EPS) of US$4.50 in 2026. So the consensus seems to have become somewhat more optimistic on TJX Companies' earnings potential following these results.

See our latest analysis for TJX Companies

There's been no major changes to the consensus price target of US$149, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock's valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values TJX Companies at US$172 per share, while the most bearish prices it at US$88.00. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await TJX Companies shareholders.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's pretty clear that there is an expectation that TJX Companies' revenue growth will slow down substantially, with revenues to the end of 2026 expected to display 6.0% growth on an annualised basis. This is compared to a historical growth rate of 10.0% over the past five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 5.6% annually. Factoring in the forecast slowdown in growth, it looks like TJX Companies is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around TJX Companies' earnings potential next year. Happily, there were no real changes to revenue forecasts, with the business still expected to grow in line with the overall industry. The consensus price target held steady at US$149, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple TJX Companies analysts - going out to 2028, and you can see them free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

Valuation is complex, but we're here to simplify it.

Discover if TJX Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10