Estée Lauder Companies, Inc. (NYSE:EL) reported in-line earnings for the fourth quarter on Wednesday.

The company reported adjusted earnings per share of 9 cents, which is in line with the street view. Quarterly sales of $3.41 billion (down 12% year over year) outpaced the analyst consensus estimate of $3.397 billion.

Based on current information and net of planned mitigation actions, Estée Laude expects tariff-related headwinds to impact fiscal 2026 profitability by approximately $100 million.

"Despite continued volatility in the external environment, we embarked on fiscal 2026 with signs of momentum and confidence in our outlook to deliver organic sales growth this year after three years of declines and to begin rebuilding operating profitability in pursuit of a solid double-digit adjusted operating margin over the next few years," said CEO Stéphane de La Faverie.

The company has provided its financial outlook for fiscal year 2026, projecting EPS to range between $1.90 and $2.10, well above the analyst consensus estimate of $1.48. The company expects sales to reach between $14.613 billion and $15.042 billion, surpassing the analyst forecast of $14.321 billion.

Estée Lauder shares rose 1.7% to trade at $88.08 on Thursday.

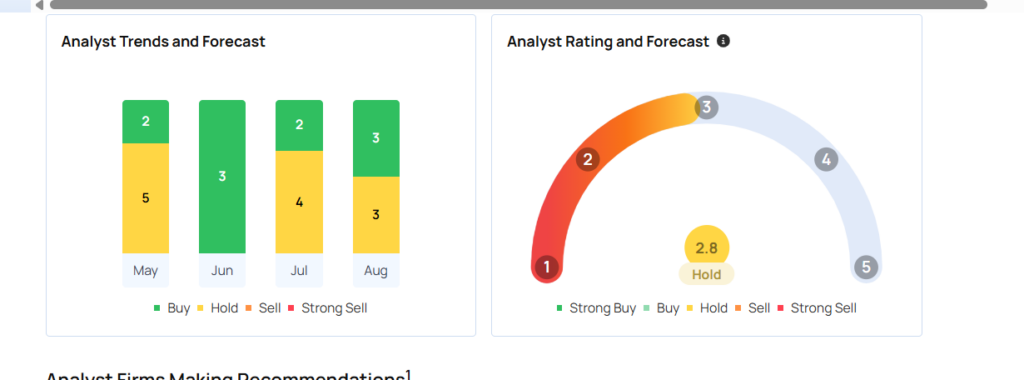

These analysts made changes to their price targets on Estée Lauder following earnings announcement.

- RBC Capital analyst Nik Modi maintained Estee Lauder with an Outperform rating and raised the price target from $90 to $107.

- JP Morgan analyst Andrea Teixeira maintained the stock with an Overweight rating and cut the price target from $101 to $99.

Considering buying EL stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks You May Want To Dump In Q3

Photo via Shutterstock