Asian Stocks Trading Below Estimated Value In August 2025

As global markets navigate a period of potential monetary easing and fluctuating economic indicators, Asian stock markets are capturing attention with their own unique dynamics. In this environment, identifying undervalued stocks becomes crucial, as investors seek opportunities that offer solid fundamentals and resilience amid shifting market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimicron Technology (TWSE:3037) | NT$140.00 | NT$276.48 | 49.4% |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1197.00 | ¥2342.43 | 48.9% |

| Q & M Dental Group (Singapore) (SGX:QC7) | SGD0.485 | SGD0.97 | 49.8% |

| MEC (TSE:4971) | ¥3055.00 | ¥6058.21 | 49.6% |

| Kolmar Korea (KOSE:A161890) | ₩79200.00 | ₩157604.22 | 49.7% |

| KeePer Technical Laboratory (TSE:6036) | ¥3465.00 | ¥6839.23 | 49.3% |

| Hangzhou Zhongtai Cryogenic Technology (SZSE:300435) | CN¥17.56 | CN¥34.86 | 49.6% |

| Cosmax (KOSE:A192820) | ₩216000.00 | ₩423197.83 | 49% |

| Chifeng Jilong Gold MiningLtd (SHSE:600988) | CN¥25.30 | CN¥50.46 | 49.9% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.57 | ₱7.10 | 49.7% |

Click here to see the full list of 275 stocks from our Undervalued Asian Stocks Based On Cash Flows screener.

We're going to check out a few of the best picks from our screener tool.

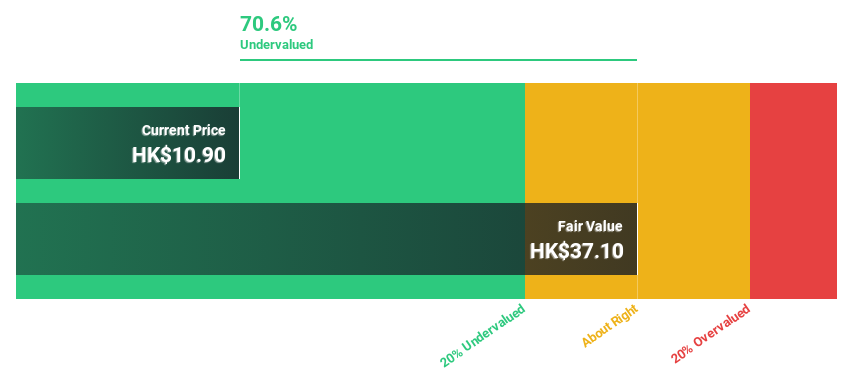

Kingdee International Software Group (SEHK:268)

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning business, with a market capitalization of approximately HK$58.45 billion.

Operations: Kingdee International Software Group Company Limited generates revenue primarily through its enterprise resource planning business.

Estimated Discount To Fair Value: 29.3%

Kingdee International Software Group's recent earnings report shows a narrowing net loss, with sales increasing to CNY 3.19 billion for the first half of 2025. The stock is trading at HK$16.47, below its estimated fair value of HK$23.28, presenting potential undervaluation based on discounted cash flow analysis. Despite a low forecasted return on equity and slower revenue growth compared to industry benchmarks, it is expected to achieve profitability within three years.

- Our expertly prepared growth report on Kingdee International Software Group implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Kingdee International Software Group's balance sheet by reading our health report here.

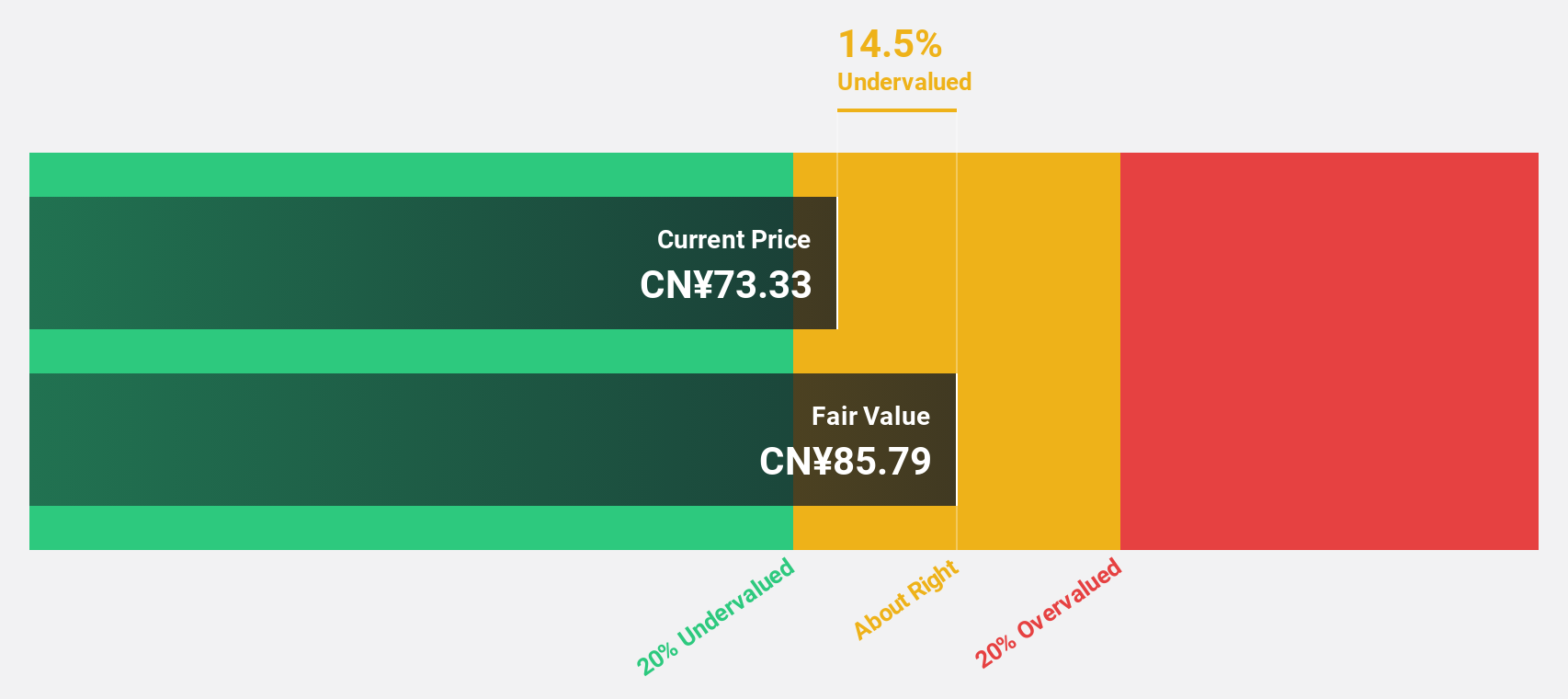

Nanya New Material TechnologyLtd (SHSE:688519)

Overview: Nanya New Material Technology Co., Ltd specializes in the manufacturing, designing, developing, and selling of composite materials with a market cap of CN¥17.22 billion.

Operations: Nanya New Material Technology Co., Ltd's revenue is generated through the manufacturing, design, development, and sale of composite materials.

Estimated Discount To Fair Value: 11.1%

Nanya New Material Technology Ltd. reported significant revenue growth for the first half of 2025, with sales reaching CN¥2.31 billion, up from CN¥1.61 billion a year earlier. Despite volatility in its share price, the stock trades at CN¥76.31, slightly below its estimated fair value of CN¥85.82 based on discounted cash flow analysis. Earnings are forecast to grow significantly at 67% annually over the next three years, though return on equity is expected to remain modest at 16.3%.

- In light of our recent growth report, it seems possible that Nanya New Material TechnologyLtd's financial performance will exceed current levels.

- Click here to discover the nuances of Nanya New Material TechnologyLtd with our detailed financial health report.

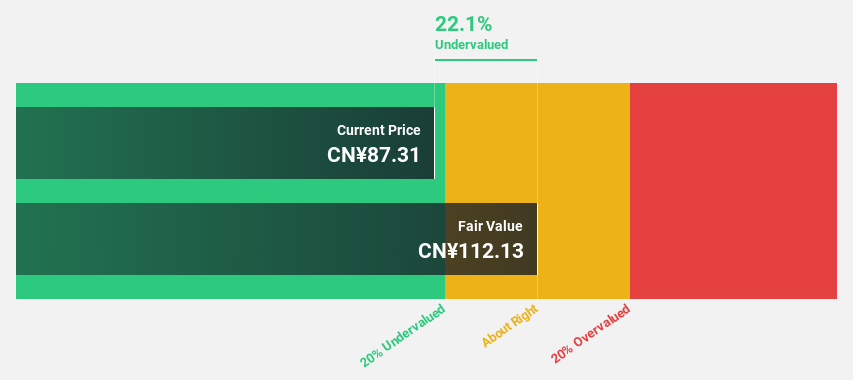

Shanghai Allist Pharmaceuticals (SHSE:688578)

Overview: Shanghai Allist Pharmaceuticals Co., Ltd. is a pharmaceutical company focused on the research and development of tumor-targeted drugs in China, with a market capitalization of CN¥42.20 billion.

Operations: The company generates revenue of CN¥3.91 billion from the research and development of drugs.

Estimated Discount To Fair Value: 33.1%

Shanghai Allist Pharmaceuticals is trading at CN¥93.78, significantly below its estimated fair value of CN¥140.21, indicating it is undervalued based on discounted cash flow analysis. The company has experienced robust earnings growth of 67.6% over the past year and is expected to continue growing at 18.79% annually, albeit slower than the Chinese market average of 25.2%. Revenue growth is projected at 20.1% per year, surpassing market expectations in China.

- Insights from our recent growth report point to a promising forecast for Shanghai Allist Pharmaceuticals' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Shanghai Allist Pharmaceuticals.

Key Takeaways

- Navigate through the entire inventory of 275 Undervalued Asian Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingdee International Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10