EQT Holdings And 2 Other Undiscovered Gems With Strong Fundamentals

As the Australian market hovers around the 9,000-point mark on the ASX 200, investors are contemplating their next moves amidst a backdrop of cautious optimism and global economic events. In this environment, identifying stocks with strong fundamentals becomes crucial for navigating potential profit-taking scenarios and broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Lycopodium | 0.97% | 16.20% | 28.63% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Click here to see the full list of 50 stocks from our ASX Undiscovered Gems With Strong Fundamentals screener.

Here we highlight a subset of our preferred stocks from the screener.

EQT Holdings (ASX:EQT)

Simply Wall St Value Rating: ★★★★★☆

Overview: EQT Holdings Limited, with a market cap of A$855.92 million, operates in Australia offering philanthropic, trustee, and investment services through its subsidiaries.

Operations: EQT Holdings generates revenue primarily from Trustee & Wealth Services, excluding Superannuation Trustee Services, amounting to A$102.18 million, and Corporate & Superannuation Trustee Services at A$79.99 million.

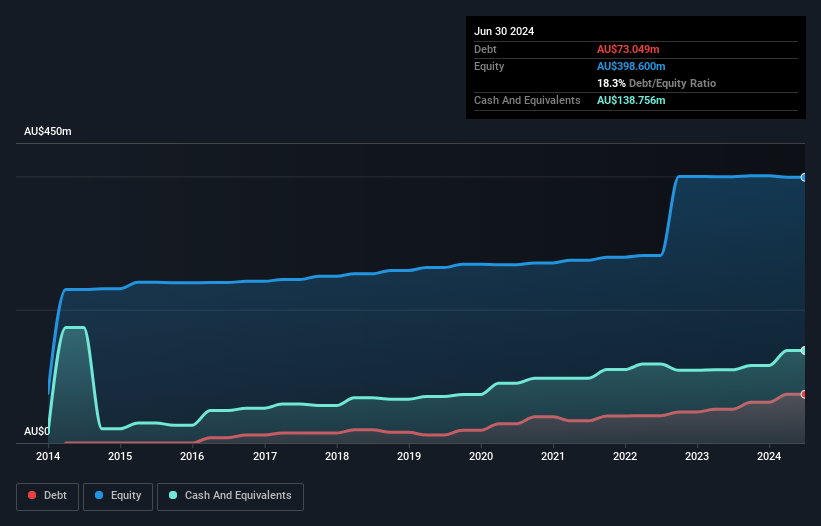

EQT Holdings, a promising player in the Australian market, has seen its net income rise to A$33.22 million from A$20.7 million over the past year, reflecting robust earnings growth of 19.7%. The company has a strong cash position with more cash than total debt and maintains high-quality earnings. Its EBIT covers interest payments 10.8 times over, indicating solid financial health. However, while EQT's projected annual revenue growth is pegged at 5.7%, transformation costs could impact future margins and profitability forecasts remain cautious due to potential outsourcing risks affecting dividend prospects and overall earnings predictability.

- EQT Holdings' strategic technology integrations could significantly enhance operational efficiencies. Click here to explore the full narrative on EQT Holdings.

Peet (ASX:PPC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Peet Limited is an Australian company that specializes in acquiring, developing, and marketing residential land, with a market capitalization of A$800.55 million.

Operations: Peet Limited generates revenue primarily through its Company Owned Projects, contributing A$313.24 million, followed by Funds Management and Joint Arrangements at A$56.39 million and A$51.88 million respectively.

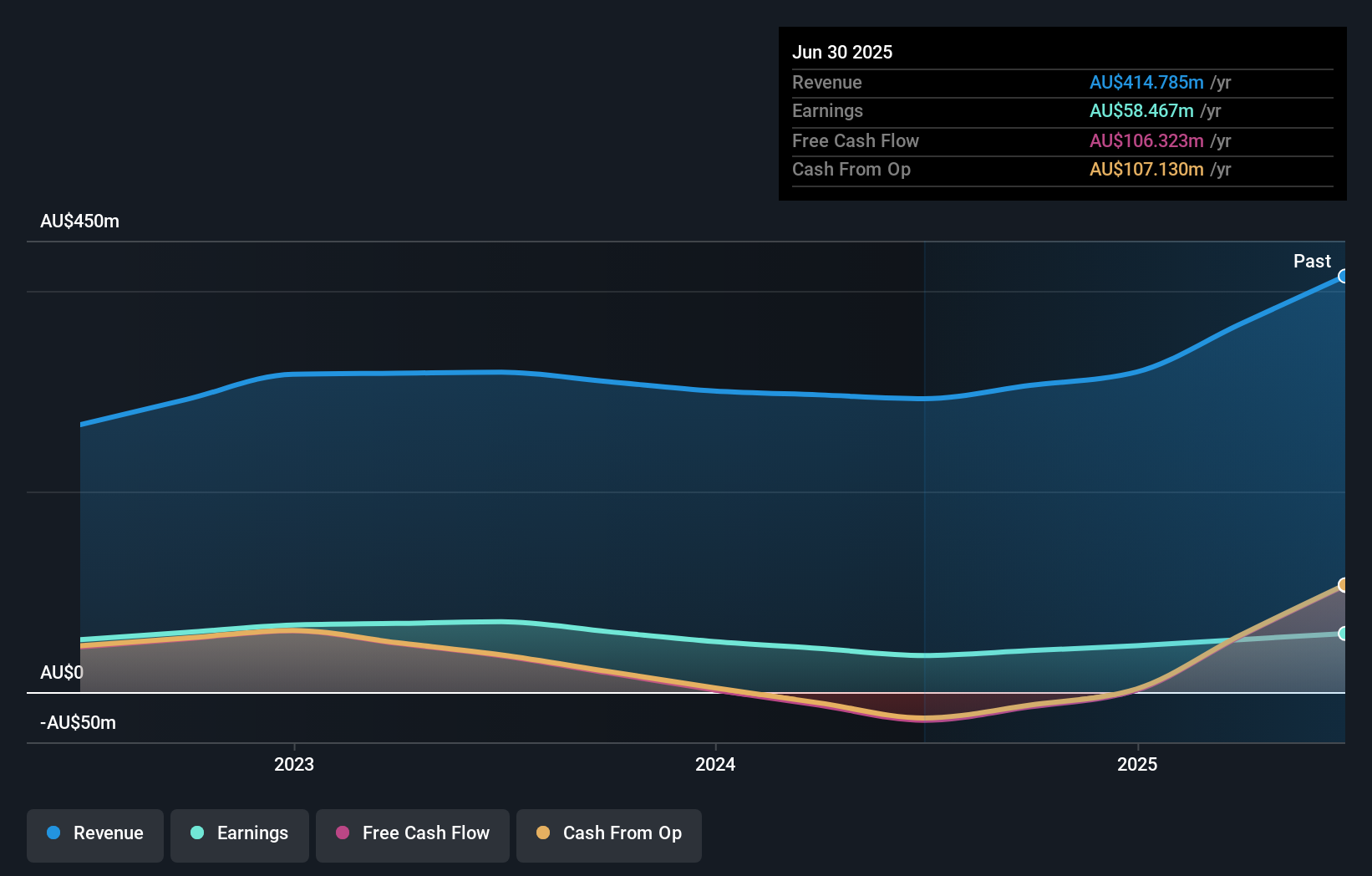

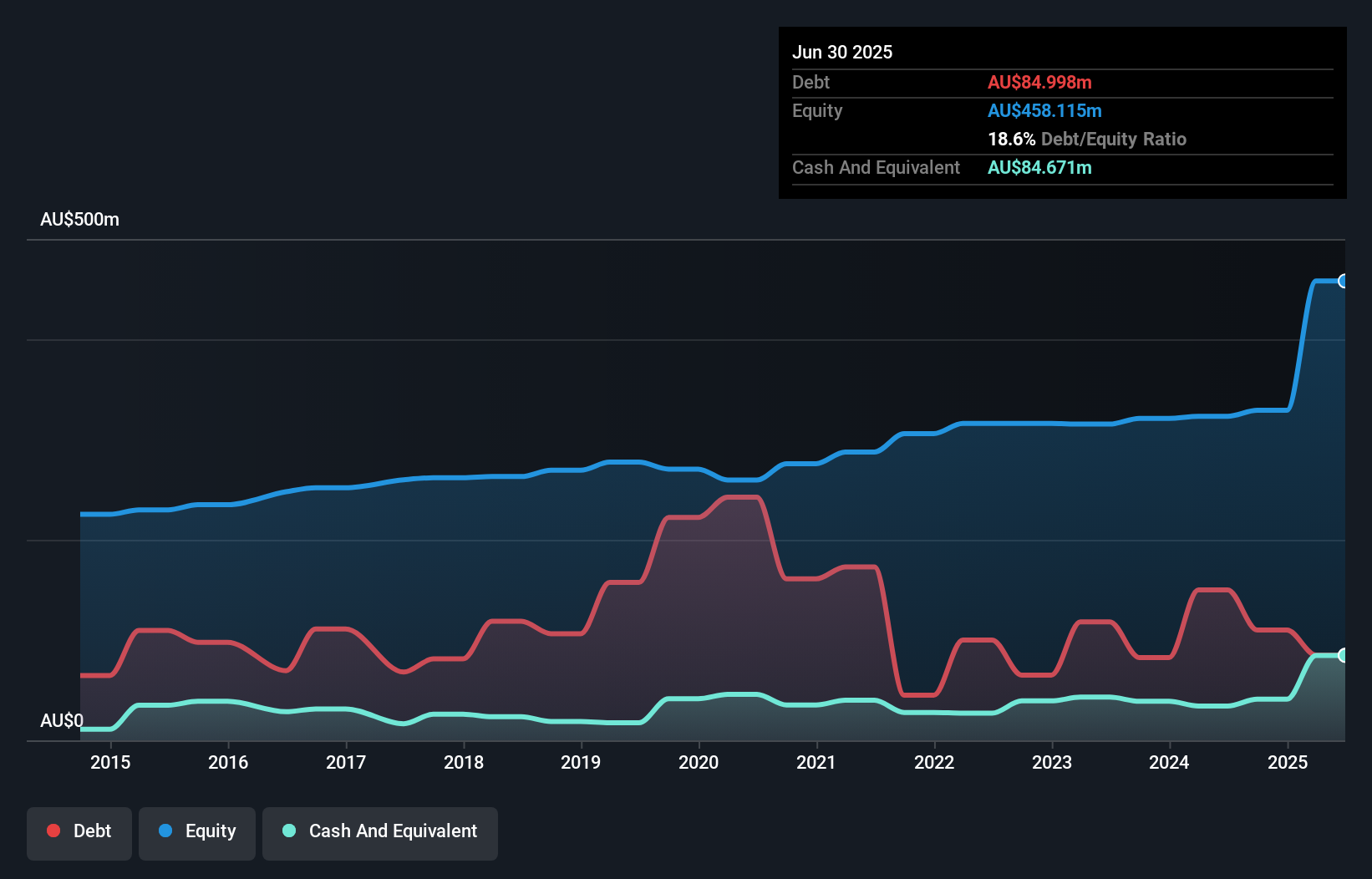

Peet, a notable player in the Australian property sector, has shown robust financial performance with earnings up by 60% over the past year, surpassing industry growth of 14.2%. The company reported sales of A$414.79 million and net income of A$58.47 million for FY25. Despite a high net debt to equity ratio at 45.8%, Peet's interest payments are well covered with an EBIT coverage of 10.7 times, indicating sound financial health. Recent strategic reviews led by Goldman Sachs aim to leverage Peet’s asset base and capitalize on favorable market conditions for sustained growth in FY26 and beyond.

- Click here and access our complete health analysis report to understand the dynamics of Peet.

Gain insights into Peet's past trends and performance with our Past report.

Ridley (ASX:RIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Ridley Corporation Limited is an Australian company that, along with its subsidiaries, provides animal nutrition solutions both domestically and internationally, with a market capitalization of approximately A$1.14 billion.

Operations: Ridley's revenue primarily comes from its Bulk Stockfeeds segment, generating A$909.17 million, and the Packaged/Ingredients segment, contributing A$425.83 million.

Ridley's strategic moves in the pet food and prawn sectors, including the acquisition of OMP, are set to boost earnings. Sales for FY 2025 reached A$1.30 billion, up from A$1.26 billion last year, with net income rising to A$43.32 million from A$39.85 million. Earnings per share improved slightly to A$0.135 from A$0.126 a year ago, reflecting stable growth despite challenges like rising finance costs due to acquisitions and interest rates. The company is also eyeing new revenue streams through NovacqPro's global commercialization and potential Southeast Asia expansions while managing risks such as avian influenza impacts on revenue stability.

- Ridley's strategic acquisitions and market expansion in pet food and prawns aim to enhance earnings. Click here to explore the full narrative on Ridley's growth strategy.

Summing It All Up

- Delve into our full catalog of 50 ASX Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10