High Growth Tech Stocks in the US Market to Watch

As the U.S. market experiences fluctuations with the Dow retreating from record highs and investors keenly watching Nvidia's earnings amidst broader economic signals, tech stocks remain a focal point for many due to their potential for rapid growth and innovation. In such a dynamic environment, identifying high-growth tech stocks involves looking at companies that demonstrate strong fundamentals, adaptability to market changes, and robust prospects in emerging technologies like AI.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.87% | 25.66% | ★★★★★☆ |

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| Palantir Technologies | 25.25% | 31.57% | ★★★★★★ |

| Workday | 11.49% | 29.77% | ★★★★★☆ |

| Circle Internet Group | 27.36% | 78.79% | ★★★★★☆ |

| OS Therapies | 57.14% | 70.11% | ★★★★★☆ |

| RenovoRx | 65.52% | 68.83% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Gorilla Technology Group | 27.68% | 129.58% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.88% | 74.81% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Dynavax Technologies (DVAX)

Simply Wall St Growth Rating: ★★★★☆☆

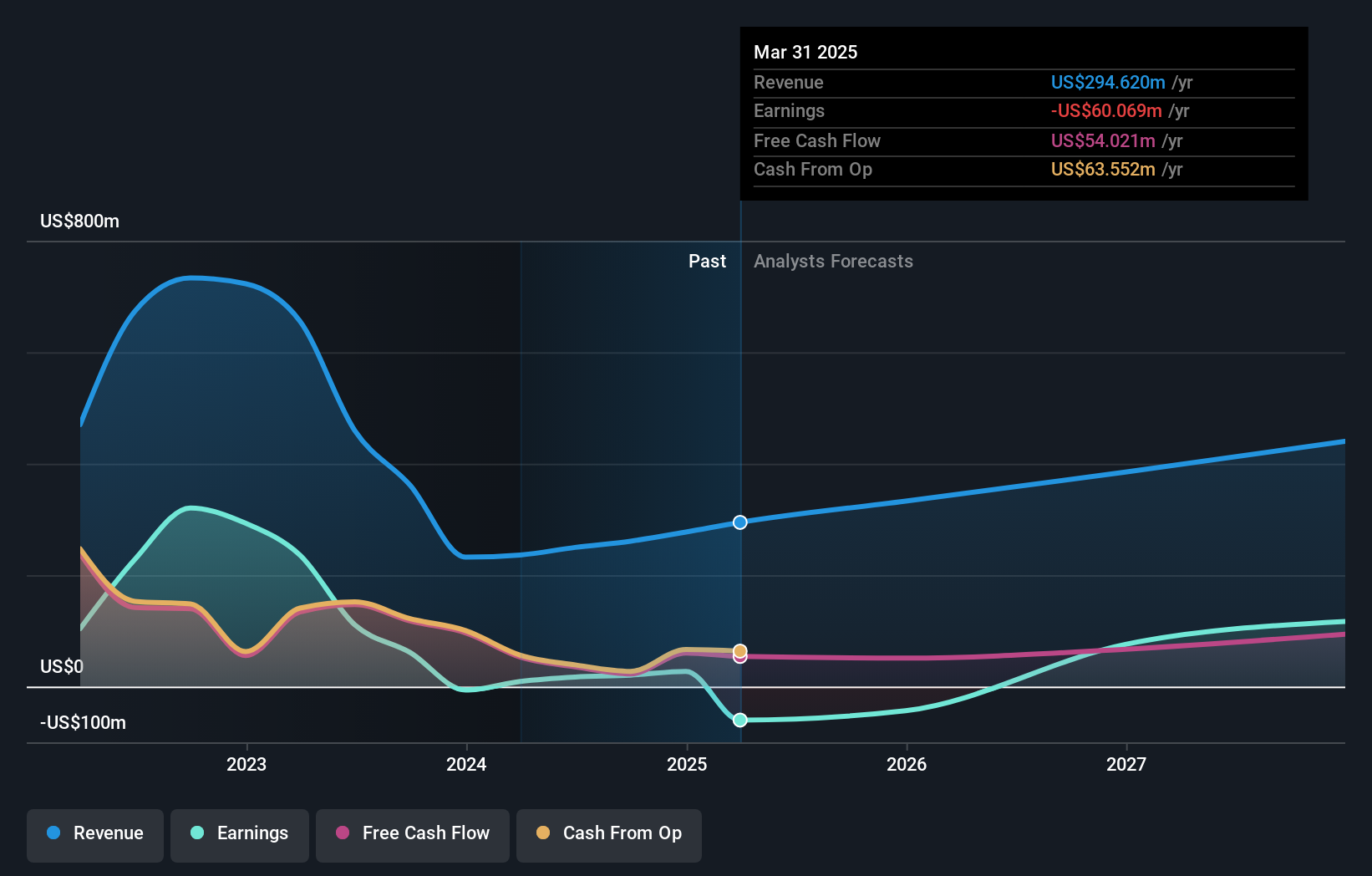

Overview: Dynavax Technologies Corporation is a commercial-stage biopharmaceutical company that develops and commercializes vaccines both in the United States and internationally, with a market cap of approximately $1.23 billion.

Operations: The company generates revenue primarily from the discovery, development, and commercialization of novel vaccines, amounting to $316.27 million.

Dynavax Technologies has recently showcased robust growth and strategic advancements, particularly in its innovative vaccine development. The company's recent positive trial results for its novel shingles vaccine candidate, Z-1018, against the industry standard Shingrix, underscore a promising trajectory in vaccine efficacy and tolerability. Financially, Dynavax raised its 2025 revenue guidance to between $315 million and $325 million following strong first-half performance. This upward revision aligns with a significant 29.64% increase in Q2 revenue year-over-year, highlighting effective execution despite broader market challenges. Moreover, the firm's strategic decisions are set against a backdrop of increased R&D investments aimed at bolstering its competitive edge in the high-stakes biotech sector.

- Unlock comprehensive insights into our analysis of Dynavax Technologies stock in this health report.

Review our historical performance report to gain insights into Dynavax Technologies''s past performance.

Exelixis (EXEL)

Simply Wall St Growth Rating: ★★★★☆☆

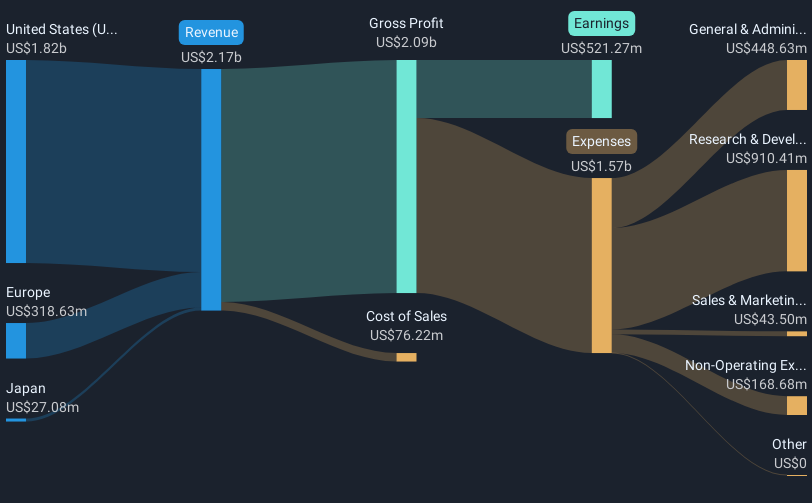

Overview: Exelixis, Inc. is an oncology company dedicated to discovering, developing, and commercializing new medicines for challenging cancer treatments in the United States, with a market cap of approximately $10.40 billion.

Operations: Exelixis focuses on the biotechnology segment, generating approximately $2.23 billion in revenue from its cancer treatment medicines.

Exelixis has demonstrated resilience with a 72.1% earnings growth over the past year, surpassing its industry's average. Despite a recent dip in quarterly revenue to $568.26 million from $637.18 million, the company maintains a robust forecast with annual revenues expected between $2.25 billion and $2.35 billion for 2025, underpinned by strategic share repurchases totaling $500 million this year alone. Innovatively, Exelixis's zanzalintinib shows promising clinical outcomes in colorectal cancer trials, potentially enhancing its portfolio and market position within oncology therapeutics—a sector marked by high stakes and rapid innovation cycles.

- Delve into the full analysis health report here for a deeper understanding of Exelixis.

Understand Exelixis' track record by examining our Past report.

Phreesia (PHR)

Simply Wall St Growth Rating: ★★★★☆☆

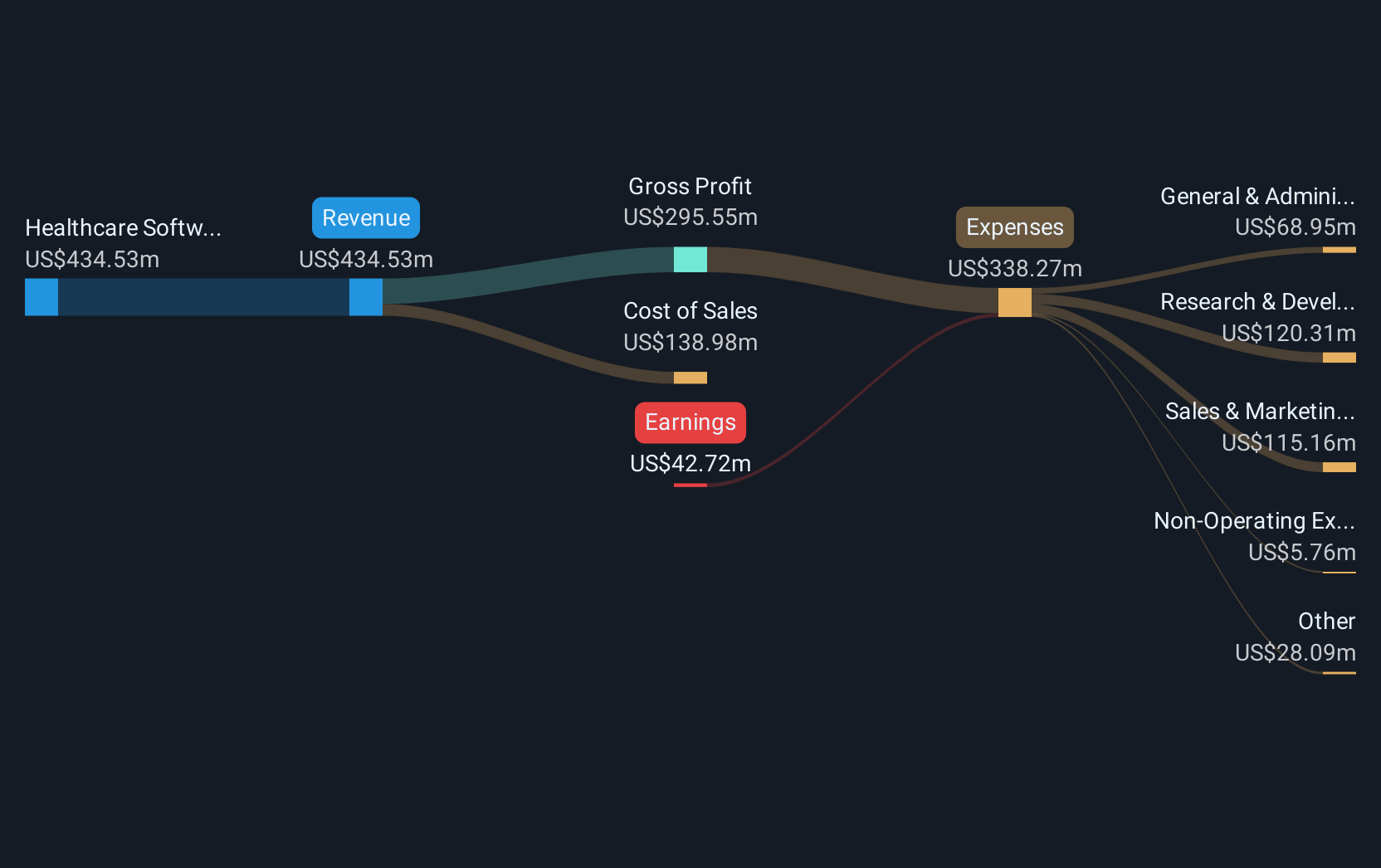

Overview: Phreesia, Inc. offers a comprehensive SaaS-based software and payment platform tailored for the healthcare sector across the United States and Canada, with a market cap of approximately $1.81 billion.

Operations: Phreesia generates revenue primarily from its healthcare software segment, which accounted for $434.53 million. The company's business model focuses on providing integrated solutions to the healthcare industry in North America, leveraging its SaaS-based platform to enhance operational efficiency and patient engagement.

Phreesia, despite not being profitable yet, is on a path to profitability within the next three years, supported by an impressive expected annual earnings growth of 70.88%. This growth trajectory is bolstered by strategic collaborations such as the recent partnership with Sesame Workshop, which leverages Phreesia's digital intake platform to deliver educational content at pediatric healthcare visits. This initiative not only enhances client engagement but also positions Phreesia at the intersection of healthcare and digital innovation. Moreover, with a revenue growth forecast of 10.5% per year—surpassing the US market average—Phreesia is making significant strides in capturing market share while investing in future capabilities.

- Take a closer look at Phreesia's potential here in our health report.

Assess Phreesia's past performance with our detailed historical performance reports.

Where To Now?

- Unlock our comprehensive list of 67 US High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10