As global markets navigate a landscape marked by steady inflation and mixed economic signals, Asian equities have shown resilience, with China's recent rally highlighting the region's potential for growth. In this context, dividend stocks in Asia can offer investors a way to enhance their income streams while potentially benefiting from the region's dynamic market environment.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Torigoe (TSE:2009) | 4.45% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.75% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.88% | ★★★★★★ |

| NCD (TSE:4783) | 4.57% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.96% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.13% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| Daicel (TSE:4202) | 4.39% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

Click here to see the full list of 1031 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

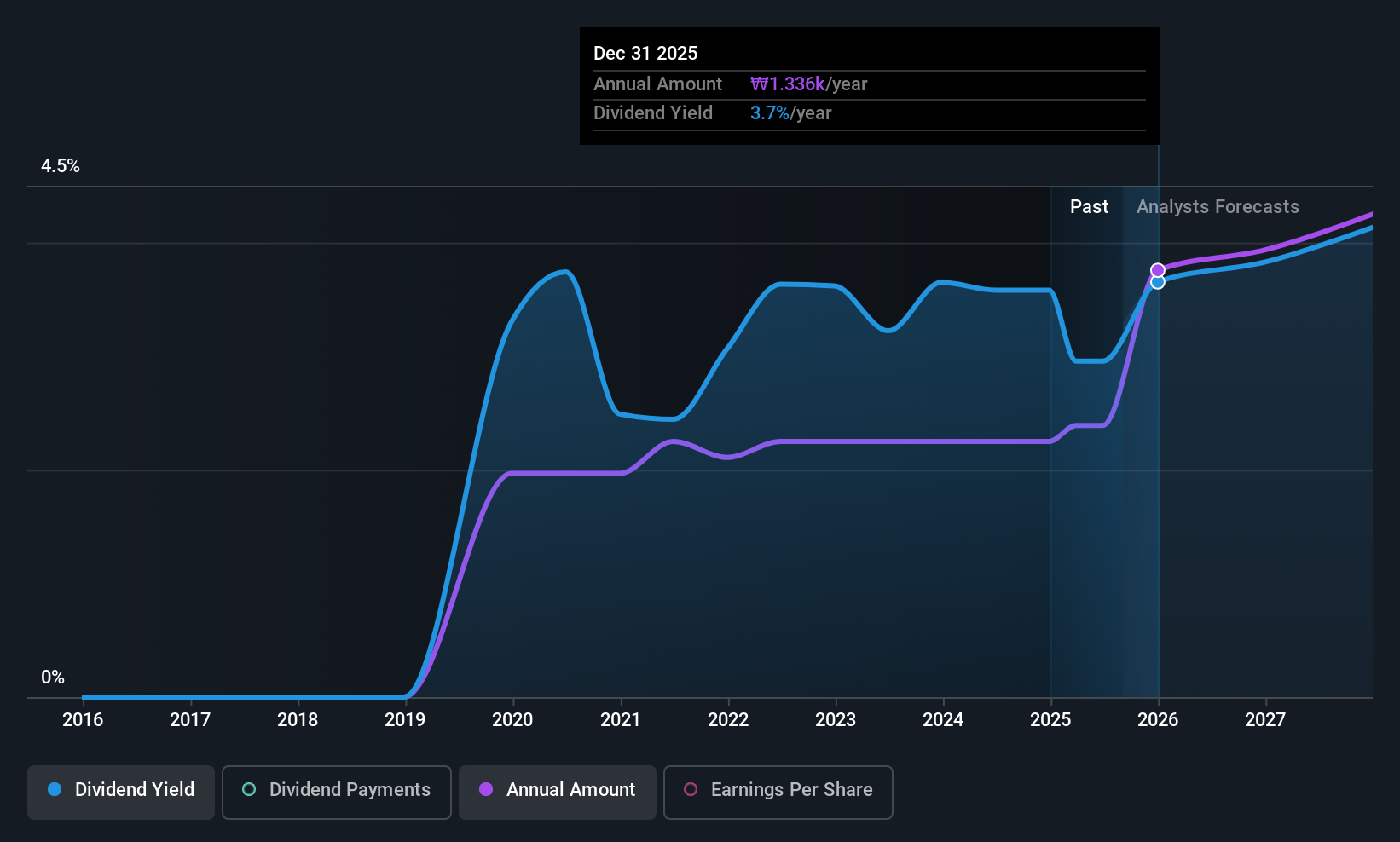

SNT Motiv (KOSE:A064960)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SNT Motiv Co., Ltd. produces, develops, and sells products for the defense and automotive industries in South Korea and internationally, with a market cap of ₩886.63 billion.

Operations: SNT Motiv Co., Ltd. generates revenue from its operations in the defense and automotive sectors, both domestically and internationally.

Dividend Yield: 3.9%

SNT Motiv's dividend payments, though in the top 25% of the KR market, are relatively new and have been paid for only six years. The payouts have been volatile with drops over 20%, raising concerns about reliability. However, dividends are well-covered by earnings and cash flows with payout ratios of 48% and 59.6%, respectively. Despite these concerns, SNT Motiv trades at a significant discount to its estimated fair value, potentially offering value to investors.

- Click here and access our complete dividend analysis report to understand the dynamics of SNT Motiv.

- Insights from our recent valuation report point to the potential overvaluation of SNT Motiv shares in the market.

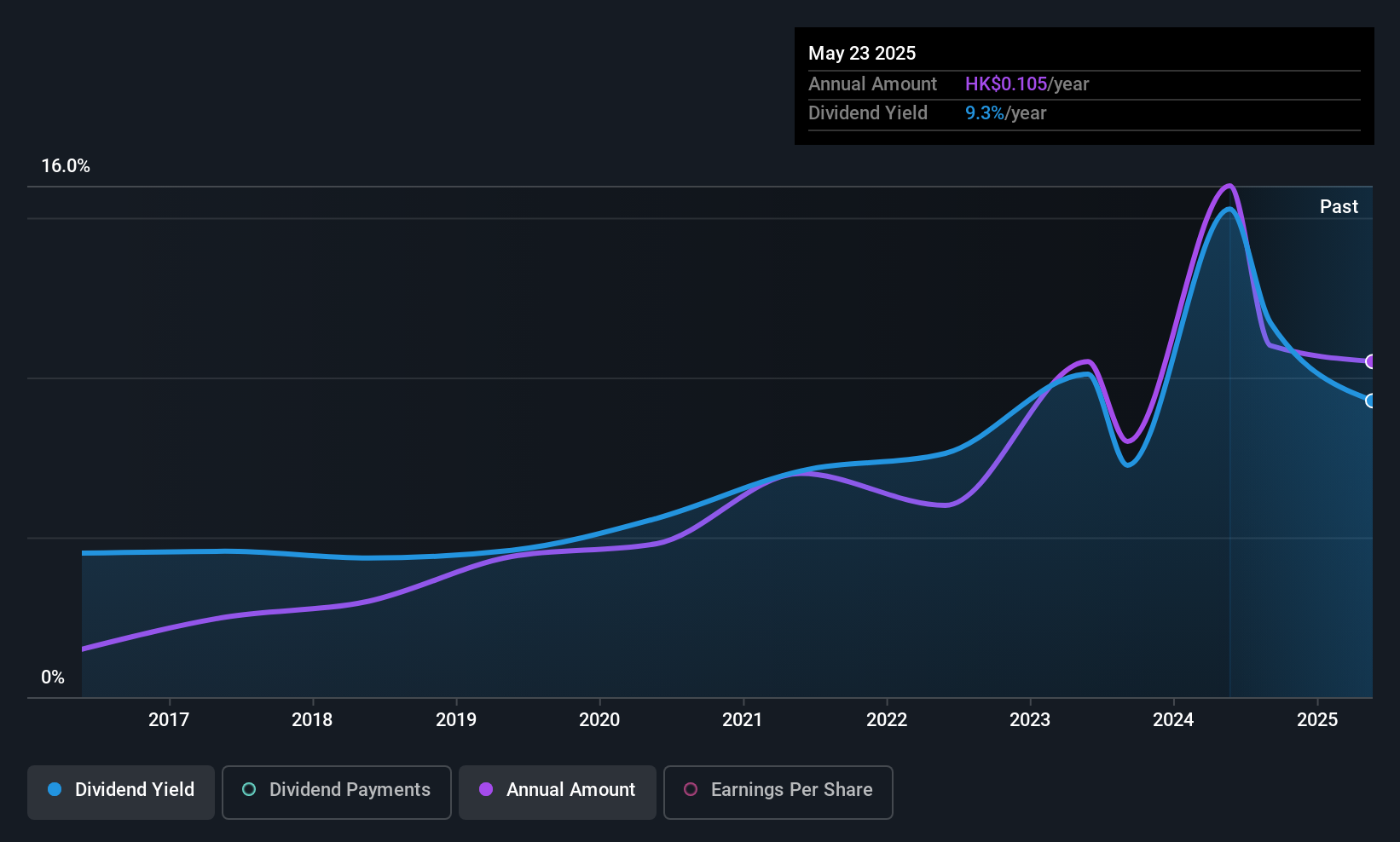

Build King Holdings (SEHK:240)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Build King Holdings Limited is an investment holding company involved in building construction and civil engineering projects in Hong Kong and the People's Republic of China, with a market cap of HK$1.63 billion.

Operations: Build King Holdings Limited generates revenue primarily through its construction work segment, which accounted for HK$14.80 billion.

Dividend Yield: 8%

Build King Holdings' dividend yield ranks in the top 25% of Hong Kong's market, supported by low payout ratios of 30.8% for earnings and 31% for cash flows, indicating good coverage. Despite a volatile dividend history with annual drops over 20%, recent increases suggest potential stability. The company reported a net income rise to HK$178.56 million for H1 2025, reinforcing its financial health. Trading significantly below estimated fair value may present an attractive opportunity for investors seeking dividends.

- Click here to discover the nuances of Build King Holdings with our detailed analytical dividend report.

- Our valuation report here indicates Build King Holdings may be undervalued.

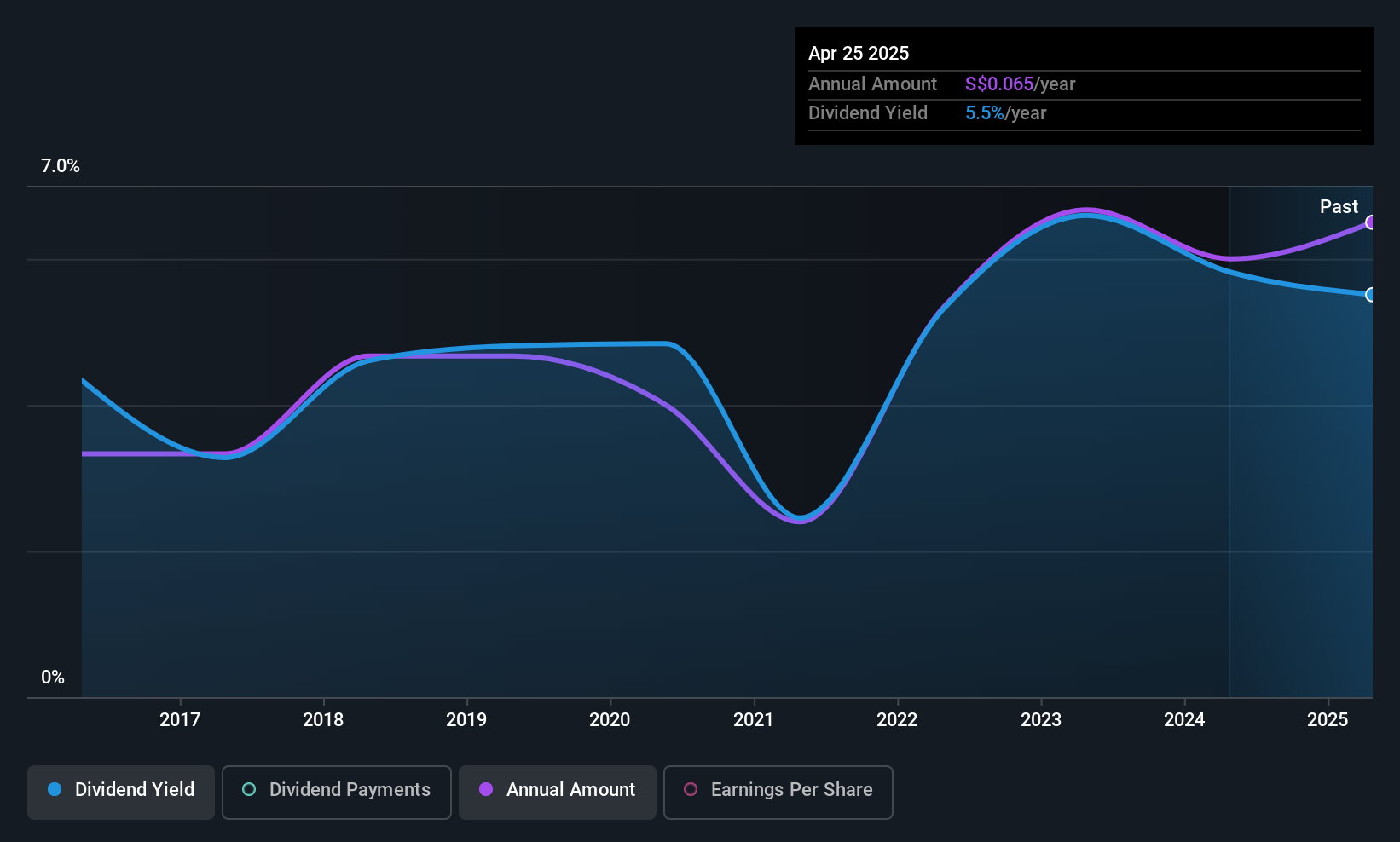

Sing Investments & Finance (SGX:S35)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sing Investments & Finance Limited offers financial products and services to individuals and corporations in Singapore, with a market cap of SGD342.84 million.

Operations: Sing Investments & Finance Limited generates revenue of SGD79.15 million from its financing business and related nominee services.

Dividend Yield: 4.5%

Sing Investments & Finance's recent earnings report shows net income growth to S$21.7 million for H1 2025, reflecting robust financial performance. Despite a history of volatile dividends, with over 20% annual drops at times, the company's dividends have increased over the past decade. With a low payout ratio of 36.6% and cash payout ratio of 14.6%, dividend payments are well covered by earnings and cash flows, though the yield is lower than top-tier dividend payers in Singapore.

- Get an in-depth perspective on Sing Investments & Finance's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Sing Investments & Finance's share price might be too pessimistic.

Make It Happen

- Delve into our full catalog of 1031 Top Asian Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Build King Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com